The ‘Santa Rally’ describes the bullish sentiment that bubbles up at the end of a calendar year.

What produces this positive sentiment? Hard to say for exact. But reasons include the ‘feel good’ factor due to the ongoing festive season, extra monetary compensation (especially bonuses) and renewed optimism of the coming year. Psychologically, the happy mood all around induces consumers – and investors – into buying rather than selling.

To some extent, the Santa Rally also coincides partially with the ‘January Effect‘ – a calendar anomaly whereby stock prices rise in the first month of the year more frequently than all other months.

Despite this widespread festive mood, there are, of course, many factors that sap this hopefulness. In December 2008, for example, the global banking crisis dragged all asset prices lower. In recent years, Wall Street tends to exhibit positive returns during the holiday season. After all, those years were part of a secular bull market.

What dates are the Santa Rally from?

According to Yale Hirsch, the market analyst who first coined the term Santa Clause Rally back in 1972, the Santa rally starts in the last 5-10 trading days of the year. It then straddles the New Year and stretches into the first 2-5 days of the following year.

This strict definition has allowed investors to calculate the returns of the Santa rally objectively.

What have been the historic Santa rally results?

The Santa Rally, at the most fundamental level, is really a market conjecture.

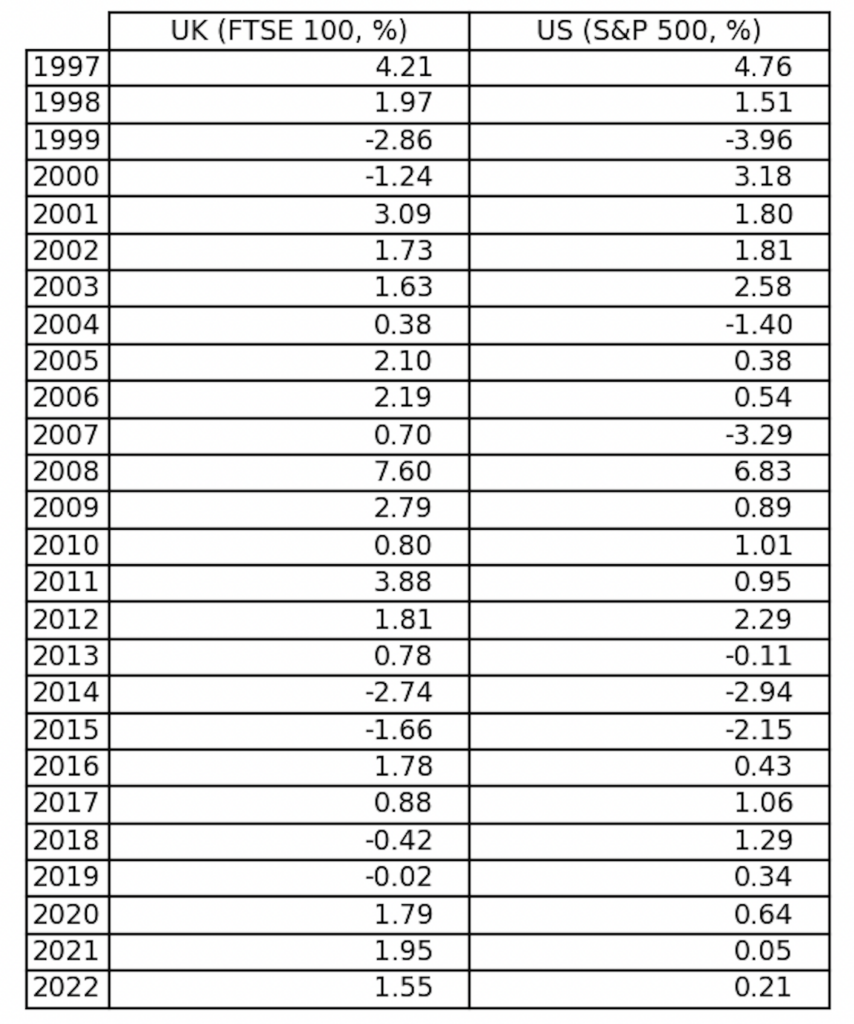

Over the years, many traders attempted to exploit this hypothesis. To see if the Santa Rally is still a relevant phenomenon these days, I analysed previous Santa Rally dates all the way back to 1997. That is, I calculated the Santa rally for the UK/US using the FTSE 100 Index (UK) and the S&P 500 Index (US) as the market proxy.

A quick glance at the table below shows the returns for the Santa period (five final trading days of the year plus the first two trading sessions of the following year). Returns are in percentages.

In recent years, the two benchmark equity indices did indeed put on a mild Santa rally. Since 2010, Footsie’s biggest Santa rally was recorded in 2011 at 3.88 percent. The lowest at -2.74 in 2014.

So, based on these historic results can we exploit the Santa rally? Perhaps. But one has to take a few considerations into account:

- Transaction costs – once fees are included are these returns still positive?

- Liquidity – is thin during the holiday seasons (Christmas to New Year). This exacerbates the pricing issue and potentially widens the bid-ask spreads

Therefore, while the Santa rally is real, chances are we may have to position a portfolio slightly earlier in the festive season rather than trading furiously through a thin market. Stock trends are ever changing and no strategy makes money all the time.

Source: Author’s calculations

Will there be a Santa rally this year?

By and large, stock prices in the States tend to rise in the latter months of the year. But economic conditions play a dominant role in determining if an equity rally will happen in any year.

Personally, I find the original definition of the Santa somewhat restrictive. This turn-of-the-year effect is already well known. In a competitive field like finance, a lucrative phenomenon like this are often taken advantage of rather quickly. Astute investors position themselves ahead of the crowd and exploit the rally to the full.

However, despite its known presence has the Santa rally been ‘arbitraged away’? Not really. Markets still tend to rise into the year because of the above-mentioned reasons. But the dates may have changed as investors positioned earlier in the year.

For 2023, however, Mark Hulbert of MarketWatch took a downbeat note, “the odds of a rally in November and December are not significantly different than at any other time.”

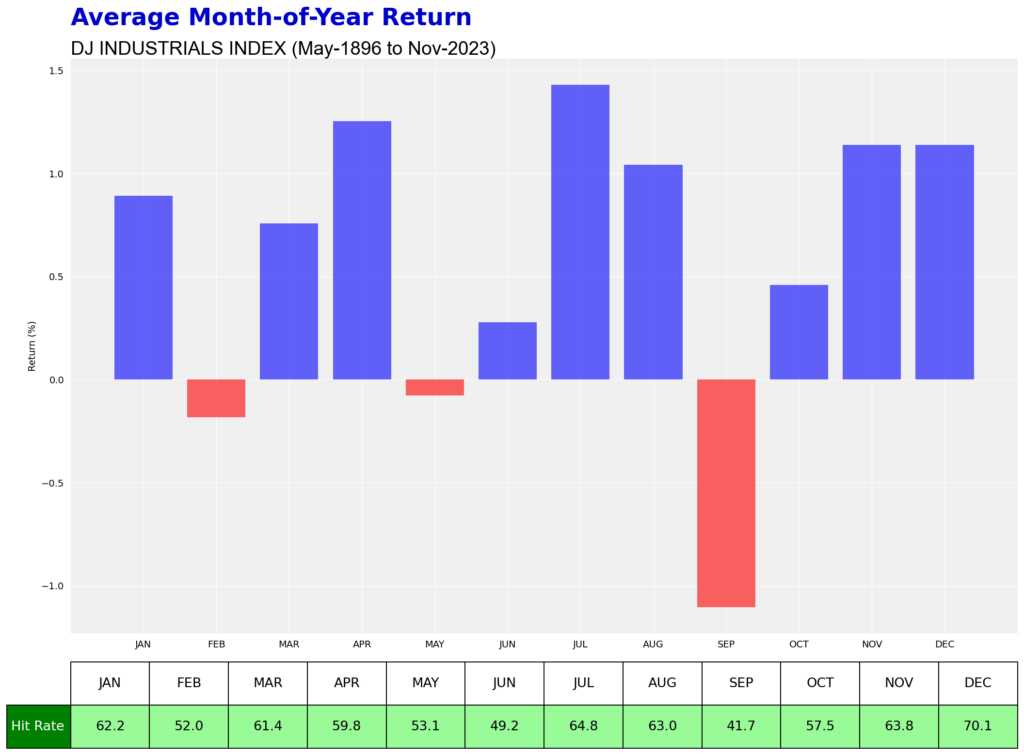

By my calculations using the Dow Jones Industrial Index (since 1896), the period spanning November-January is, statistically speaking, the most bullish time of the year. For three consecutive months the index exhibited positive returns – until the buying pressure dissipated in February due to profit-taking.

More crucially, the month December has a ‘Hit Rate’ of 70 per cent (see below). In other words, the Dow rises in the last month of the year seven times out of ten. When dealing with uncertainty, that’s not a bad predictive outcome.

Based on the above, will we see a Santa Rally this year? Perhaps it has already started.

A quick look at most US equity indices shows a strong rebound from the October lows. The market believes that the Fed has started Christmas early this year.

What are the best sectors to buy to take advantage of the Santa Rally?

This year, the macro conditions are much different to the previous cycles. Naturally, the impact on the stock market will be quite distinct too.

If the Santa Rally is happening, how should we take advantage of it? In other words, what should we buy?

The first is outperforming sectors. Right now, few industries are doing better than tech stocks. Look at the tech ETF below (as proxied by QQQ): prices are surging into multi-quarter highs in spite of the high interest rates. A breakout back to 400 later this year is a distinct possibility.

What’s causing investors to rush into the sector? Peak interest rates. As soon as the borrowing costs are expected to stop rising, smart money piled back into Big Techs (and many other speculative vehicles like Bitcoin).

Stocks like Apple (AAPL), Tesla (TSLA), Meta (formerly Facebook), Microsoft (MSFT) are still heavily owned by large institutional investors. Microsoft, in particularly, is snapping at Apple’s heels to end 2023 as the world’s most valuable company (MSFT: $2.7 trillion vs APPLE: $2.9 trillion, as of Nov 14, 2023).

Of course, during a booming Christmas season, one sector benefits too: Retail.

As a matter of fact, investors have started to accumulate more shares of traditional retailers like Walmart (WMT) and Costco (COST) – both of these stocks have risen significantly during the last few weeks. Walmart broke above its long-term highs just recently (see below).

In the UK, you should take a look at Next (UK:NXT) and Marks & Spencer (UK:MKS) – both of which did surprisingly well this year despite the lack of strong retail data.

If you do not have confidence in choosing sectors, you may buy the entire market using ETFs like S&P 500 (SPY) or FTSE 100 (ISF).

Is the Santa Rally real?

The Santa Rally is a real phenomenon in the American stock market. But is this a ‘one-way bet’ without risk?

Broad speaking, the answer is no. Every momentum trade carries risk. This year, for example, the stock rally has already started. Investors who missed the earlier (lower) entry point have to chase the market. This entails more risk because the easy part of rebound has materialised and prices may be vulnerable to corrections due to profit taking. For instance, QQQ has advanced for three consecutive weeks.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.