My original Robinhood review back in 2020 was titled “Robinhood Gold: More Like The Sheriff of Nottingham’s Silver”. Because a. you couldn’t get Robinhood in the UK and b. because, whilst I think the name is great for marketing it’s fairly disingenuous. But, Robinhood launched today in the UK and as I just wanted Dumb Money on the plane back from America, I was really keen to try them out. Mainly because the founders Vlad Tenev & Baiju Bhatt got such an almighty bashing in the film I wanted to see if what they’ve created was truly disruptive.

- Overview

- Richard's Review

- Customer Reviews

Robinhood UK Review

Name: Robinhood

Description: Robinhood is a zero-commission trading app launched in 2013 that lets UK investors buy and sell around 6,000 US shares 24 hours a day with as little as $1 through fractional shares.

Is Robinhood good for UK investors?

If you just want to invest a little bit of money in US shares then Robinhood is a good choice to get started. It’s very simple to use and you can trade 24 hours with zero commission and custody fees. However, it’s not really up to scratch for more advanced or active investors.

Pros

- Zero commission trading

- Very good exchange rates

- Slick app

- 24 hours investing

Cons

- Only US stocks

- No SIPPs or ISA

- No options trading

-

Pricing

(4.5)

-

Market Access

(2)

-

App & Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

3.5Ratings Explained

- Pricing: Cheap GBPUSD fx rates of 0.03% and no commission.

- Market Access: US stocks only and no pension or ISA accounts.

- Platform & Apps: Very slick app, but basic execution orders.

- Customer Service: App only, no phone number or chat online.

- Research & Analysis: Limited to some technical indicators and news.

Expert Review

I knew I should have joined the waiting list because I’m itching to trade on Robinhood. I hate waiting lists, they are clearly just marketing gimmicks to create the mystic of demand. But I’m regretting not joining now because it’s just taken me 10 minutes to sign up with Robinhood, and after taking pictures of my passport, digging up a payslip and snapping selfies I now have to wait for what I can only assume is a terrified compliance department to approve my account before I can trade. Update: I’ve now been waiting two days.

The app

In the meantime, I’ll tell you about the app. I’ll start with the first massive disappointment. You can’t trade options. I mean really, what’s the point in another app that only lets you invest in US stocks? It won’t get very far, just like Public tried and almost immediately pulled out of the UK when despite spending a huge amount on adverts on the Tube probably didn’t sign up any customers. Incidentally, Robinhood put a green statue of a guy with a bow and arrow in a train station, that at least got people on LinkedIn chatting about them.

But, if you want to trade with a US broker in the UK, you want the full-on Yankee experience. When my children drag me into an American Candy shop on every high street I don’t want Rowntree Liquorice allsorts. I want a tooth-shattering cardboard rectangle of dried corn syrup. Show me the money Robinhood, give me the options I crave. Maybe I’ll put in a call and ask you for them directly, but you don’t have a phone number. Not even a premium rate number. Strike two.

Options

I was an options broker for ten years and I think they are great, but we don’t do options trading en masse in the UK because we have CFDs and financial spread betting for margin trading. But in America, if you want to trade on leverage you have to do it on an exchange, so there is huge liquidity for equity options, that you just don’t get on smaller stocks in the UK.

Our analyst just wrote a great piece on Roblox shares and I wanted to buy some puts to test the Robinhood app. But I can’t, so instead maybe I’ll just short the stock with potentially unlimited losses, rather than taking a limited risk position.

The good

There are some good features to the app though. You’ve got news from all the usual sources. I really like the stock screeners, that give you 52 week highs and lows (but not relative) and you can see at a glance, what is hot and what stocks are moving fast. And obviously, it’s really simple to use.

Plus, many of their stocks are tradable 24 hours, which is great for UK investors, as I (to paraphrase) “do my trading after breakfast” and having to wait for the US to open is a bit of pain. Most apps let you place “market on open orders” or set limits, but seeing a price and just clicking buy makes the whole thing a lot easier.

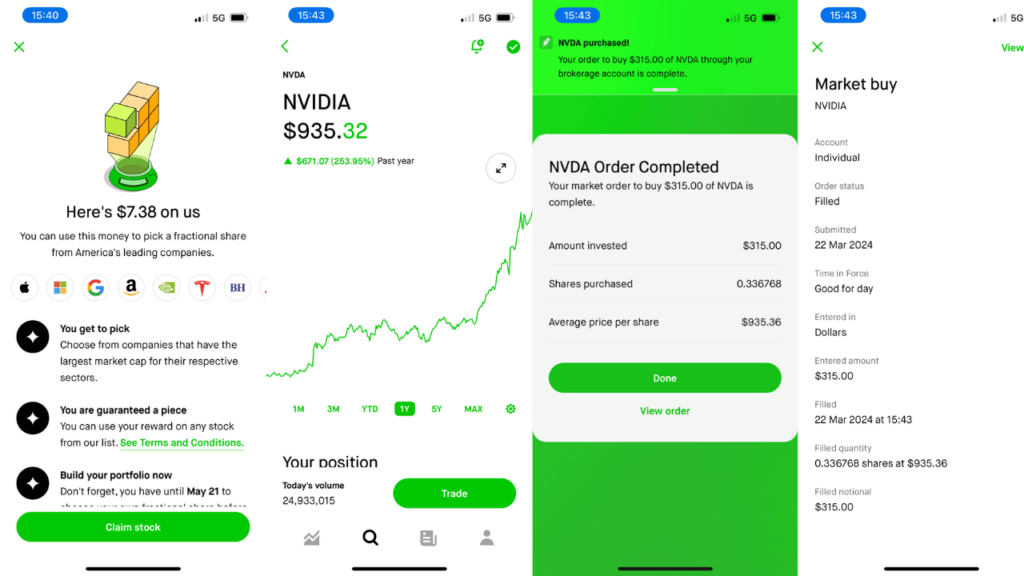

So, as I can’t trade options I’m just going to do what (probably) everyone else is going to do on Robinhood which is kick the tyres and light the fires by chucking a few greenbacks in and buy some Nvidia shares.

Update: After three days, my account has now been approved. For some reason that was not explained to me beforehand, I have been given some free shares. but have now lost interest. I have indeed bought some Nvidia shares (screenshots below), and will just leave them there until Robinhood, give us a little bit more…

Democratising investing?

Robinhood started off with grand claims of democratising investing, but it has slipped into the murky world of actually trying to make money.

I don’t actually think that investing needs that much democratising anyway. In fact, all trading was expensive 20 years ago because there was less competition and online trading platforms were in their infancy. Then, technology caught up and as with every industry fees reduced naturally. When I was a student, I opened a Selftrade account and was able to buy shares for about £5. I was probably investing a few hundred pounds in small-cap stocks in the hope that some would rise significantly in value in the short term. Some did, some didn’t, but I don’t remember commission being a significant factor. It was more the bid/offer spread that was irksom.

Is it really free?

Yes it is to you, the investor. Yes, Robinhood UK is just an introducer to Robinhood in the US where all sorts of evil (aka PFOF (payment for order flow)) takes place. But to be honest, if you are a typical Robinhood customer you shouldn’t really care, because the pricing difference will be fairly inconsequential, and it is certainly cheaper than if you were to pay commission and custody fees on your trades.

It was only a matter of time before people started offing investing for free. We have seen a lot of commission-free accounts spring up over the years including Freertade, Trading212, IG and even Interactive Brokers launching IBKR Lite offering fractional shares.

In my life I do not believe there has ever been a point when someone with £100 to invest has been unable to do so.

There is a great fashion for fintech firms to say they are democratising something, but in reality, they are doing nothing more than looking for a savvy way to market an existing product. Which is access to the stock market. It has never been difficult to access the stock market or invest your money for the future.

There is however a growing trend in pushing new inexperienced investors towards products that they are not suitable for.

Investing or trading?

I think the blame for this can squarely be put on social media scammers like and the Gamestop saga introducing their followers to brokers through dodgy lifestyle campaigns. It has been particularly prevalent in cryptocurrency derivatives (which the FCA has banned). But also on the providers because margin trade is a higher margin product than investing. Therefore, the modus operandi is generally let’s get a load of accounts open by advertising free investing and then upsell them to margin trading.

I personally think margin trading is great, it’s just that it’s very difficult to win at unless you really know what you are doing. Just look at the risk warning rates from UK CFD brokers.

Trading on margin is for experienced and professional investors. It is something that very people understand, and it it’s certainly something that should be avoided by the vast majority of retail traders, of whom I suspect make up the vast majority of Robinhood’s US client base.

Just because you can do something, it doesn’t mean you should.

As Polonius said, “a lender nor a borrower be” and for fear of losing a pound of flesh I shan’t quote Shylock.

Robinhood offering margin trading is not so much stealing from the rich to give to the poor. Rather, stealing from the rich and then lending to the poor at 5%. So I suppose it’s a good thing that you can’t trade options or derivatives with Robinhood in the UK.

Overall, for such a delayed launch Robinhood’s UK app feels a bit rushed, but it’s certainly one to watch.

Robinhood Customer Reviews

Tell us what you think:

Robinhood Alternatives

| US Stock Buying Platform | US Commission | FX Rate | ISA | SIPP | GMG Rating | More Info |

|---|---|---|---|---|---|---|

| £11.95 | 1% – 0.25% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £3.99 | 1.5% – 0.25% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| 0.5 cents per share | 0.02% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £3.50 – £5 | 0.50% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| 20 cents per share | 0.5% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £8 | 0.5% | ✔️ | ❌ | Visit Broker Capital at risk |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.