In this guide, we will explain what stocks and shares ISAs are, how they work, who they are for, their pros and cons and how you can use them to profit from tax-free investing.

How does a stocks and shares ISA work?

Stocks and shares ISA accounts work in the same way as a general investing account, except a certain portion of your profits are tax-free. They are an excellent way to start investing, particularly as they are often free to open.

Stocks & Shares ISAs are available to UK residents aged 18 and over. For those under the age of 18, the Junior ISA is available. You can own multiple Stocks & Shares ISAs, however, you can only contribute to one per tax year.

The maximum amount that can be paid into a Stocks & Shares ISA per tax year is currently £20,000. This is the annual ISA allowance. The annual allowance covers all types of ISAs meaning that if you own different types of ISAs, you can only invest a total of £20,000 across them in any one tax year.

To invest in a stocks and shares ISA follow these steps:

- Decide if you want to pick your own investments or have a professional do it for you.

- If you want to do it yourself choose a DIY ISA like Hargreaves Lansdown

- If you want someone else to do it for you pick a managed ISA like Wealthify

- Or use our comparison table of stocks and shares ISA providers to compare fees and market access

- Once you have picked your platform, deposit funds. This can be a one-off deposit initially

- Set up recurring investments, to help grow your savings and investments

- Check in regularly to check performance and fees. Sometimes it may be cheaper to switch providers or adjust your risk level.

Stocks and shares ISA rules & allowances

The rules for investing with your Stocks & Shares ISA allowance are as follows:

- You can open an account if you are a UK resident aged 18 and over.

- You can invest a maximum of £20,000 per tax year. This is the maximum you can invest across all your ISA accounts per tax year. So, for example, if you invest £5,000 in a Cash ISA during the year, you can only invest £15,000 in a Stocks & Shares ISA.

- You can have as many Stocks & Shares ISAs as you want but you can only contribute to one per tax year.

- You can withdraw your money from a Stocks & Shares ISA at any time.

- If you withdraw money from your ISA and pay it back into the account in the same tax year, it will count towards your ISA allowance. This rule does not apply to ‘flexible’ Stocks & Shares ISAs.

Investment ISAs Explained

In this video interview, we discuss with industry expert Rebecca O’Keefe from Interactive Investor everything you need to know about investing in a stocks and shares ISA.

How many stocks and shares ISAs can you have?

You can only open and contribute to one stock and share ISA every year. As this is due to their tax benefits the year for ISAs runs from the 6th April 2023 to the 5th April 2024. ISa providers always advertise switching and new customer ISA offers around March, so that is a good time to open a new ISA. Opening an ISA as early as possible in the tax year also means that your money can be invested longer.

However, overall you can have as many stocks and shares ISAs as you like if you open a new one each year. For instance, one year you could put your ISA allowance into a managed ISA account like Weathify, if you don’t have time to manage your investors. Another year you could open one with Interactive Investor if you felt like this was the year to pick your own shares. Or, if you think the stock market is going to perform badly, you could put your ISA allowance into an interest paying account with a cash ISA with Raisin.

If you wanted a mixture of your allowance in cash and the stock market you are allowed to open both a cash ISA and a stocks and shares ISA in the same year. But you can’t contribute more than £20,000 overall to get the tax benefits. So you could put £10k in cash and £10k in the stock market.

So, for example, if you have already invested £10,000 in a Cash ISA during the tax year, you’ll only be able to invest £10,000 in your Stocks & Shares ISA. The tax year runs from 6 April to 5 April. After the 5th April ISA deadline, you receive a new £20,000 allowance.

If you have more than £20,000 to invest, you can either invest it in another type of account such as a general investment account or a SIPP, or wait until the next tax year to invest it in your ISA.

If you have a substantial amount of savings to invest, you may want to consider making a large upfront contribution into your ISA to make use of your ISA allowance.

By contrast, if you have a lower level of savings but a high level of income, you may want to consider making larger regular contributions into your ISA.

How do you invest with a stocks and shares ISA?

You can either pick your own shares or have a professional do it for you. I will cover the difference between the two type in the next section, plus who they are appropriate for. But when you invest in a stocks and shares ISA, you still have to decide what you want to invest in.

A stocks and shares ISAs let you invest your money in a wide range of investments, including:

- Shares in companies listed on the UK stock market

- Corporate and government bonds – compare bond brokers

- Exchange-traded funds – compare ETF brokers

- Investment trusts

- Funds (OEICs or ‘open-ended investment companies’) – compare fund platforms

- Overseas shares and corporate bonds that are listed on a recognised stock exchange

If you don’t want to decide what to invest in you can buy into a prebuilt portfolio from a robo-advisor.

You can also invest your money in ethical investments and most managed ISA accounts have ethical portfolios and self-select ISA providers publish a list of ethical funds to make the task of identifying them easier.

There are also limits, for example, you cannot use an investment ISA to trade derivatives.

Types of stocks and shares ISA

The two main types of investment ISA:

- Self-select stocks & shares ISA (pick your own investments/DIY)

- Managed investment ISA (investment experts managed your portfolio)

Self-select stocks & shares ISA

A self-selected investment ISA puts you in complete control of choosing your investments, monitoring their performance and managing your portfolio.

ISA providers like Hargreaves Lansdown, Interactive Investor and AJ Bell cater to DIY investors. Through them, you can invest in a wide range of individual shares, bonds and funds that you pick yourself. However, even though these DIY platforms cannot offer advice, they do provide some tools investors need to manage their own portfolios, like stock screeners, best buy lists and regular market commentary. If you want advice on what to buy and sell through a DIY ISA platform Bestinvest do offer paid-for advice services, where they will provide recommendations on what to buy and sell for your portfolio.

- Related guide: How to research funds for DIY investing.

The main advantage of using a DIY platform is that you’re likely to have more choice in terms of investment options. Typically, these kinds of platforms offer access to a wide range of shares, funds, ETFs, and bonds. They are often considerably cheaper than managed accounts. For instance, even one of the most expensive DIY ISAs, Hargreaves Lansdown charges 0.45% a year, whereas, one of the cheapest managed ISAs, Wealthify charges 0.6%

Who are DIY ISAs suitbale for?

- Investors that are interested in the financial makets and want to pick their own investments

- Experienced investors or those prepared to take on a higher level of risk

- Those who have time to manage their money.

Managed investment ISAs

With a managed investment ISA, a team of experts will make all of the decisions about where your money is invested. Providers like Wealthify, Moneyfarm and Nutmeg have a range of “ready-made” investment portfolios which they run on investors’ behalf. These are made up of a selection of bonds, shares and funds across different regions and risk levels. They are designed to provide relatively consistent returns, however, they are still ultimately linked to the overall economy and stock market performance.

With these managed ISA platforms you can slightly adjust the risk you would like to take by filling in the platform’s suitibility questionnaire. This will determine if the product is suitable for you based on how much risk you are prepared to take.

Managed platforms are generally more suited to beginner investors. With a managed platform, you don’t have to worry about choosing your own investments as the provider will do that for you.

Managed ISA products are well suited to those who don’t have the time to manage their own investments. With managed products, you can get set up in minutes and you don’t need to spend time researching investment opportunities.

The main advantage of using a managed platform is that it’s generally easier to construct an investment portfolio. Often, you can set up a portfolio within minutes. On the downside, you’re likely to have less investment options to choose from.

Who are managed ISA suitable for?

- Beginner investors and those who do not want to manage their own portfolios.

- Those who don’t have the time to manage their own investments.

- Those who want slightly less risk

Advantages of stocks and shares ISA accounts

The advantages of investing within a Stocks and Shares ISA include:

- Tax efficiency. Within this type of ISA, all investment gains and income are completely tax-free. This is a valuable benefit. Over the long term, you could potentially save tens or even hundreds of thousands in tax by investing within a Stocks & Shares ISA.

- High returns, at least potentially. Through a Stocks & Shares ISA, you can gain access to a wide range of investments including shares, funds, investment trusts, ETFs, bonds, and more. Over the long term, these kinds of assets tend to generate much higher returns than cash savings. UK shares, for example, have returned around 5% per year in real terms (above inflation) over the long run, according to the Barclays Equity Gilt study.

- Flexibility. Stocks & Shares ISAs are generally very flexible. With this type of ISA, you can build an investment portfolio that matches your own financial goals and risk tolerance. You can also access your money at any time.

Disadvantages of stocks and shares ISA investing

Stocks & Shares ISAs do have some disadvantages. Investors should be aware that:

- There are ISA contribution limits. You can only invest a maximum of £20,000 per tax year within this type of ISA. If you are looking to invest more than this, you will have to invest the excess capital in another type of investment account such as a general investment account or Self-Invested Personal Pension (SIPP). The annual ISA allowance cannot be rolled forward.

- You can lose money. A Stocks & Shares ISA doesn’t have a fixed return. Instead, its overall performance depends on how well the underlying investments perform. While assets such as shares, funds, and ETFs tend to generate strong returns over the long term, they can generate negative returns at times. So, there’s always the chance that your Stocks & Shares ISA could fall in value.

- There are fees to invest. Some fees that ISA providers charge include annual custody charges, trading commissions, FX fees on international investments, and exit fees. Fees and charges need to be considered carefully when comparing platforms as they can have a large negative impact on your investment returns over time.

- Withdrawals can impact your ISA allowance. In most cases, if you withdraw money and then put it back into the ISA in the same tax year, it will count towards your annual allowance. Some ISAs, however, do allow you to take money out and pay it back into the account in the same tax year without affecting your annual ISA allowance. These are known as ‘flexible ISAs.’

- There is no tax relief on contributions into a Stocks & Shares ISA.

- You cannot have a joint ISA account. Meaning your ISA only be in your name and only your money can be used to invest in it.

Stocks and shares ISA fees

One of the most confusing aspects of investment ISAs is the plethora of fees and charges levied by providers. The main fees associated with stocks and shares ISAs are:

- Account fee – an annual fee for a provider to hold your ISA account

- Dealing fee – a commission charged every time you buy and sell something in your ISA

- Exit fees – the cost of transferring out your ISA

Account fees

If you’re investing through an online platform or fund supermarket, the first fee to look out for is the “platform” or “custody” fee. This will either be a flat fee, which tends to be more cost-effective for very large sums of money, or a percentage of the value of your shares/funds.

You can compare account fees in our stocks and shares comparison table.

The more expensive a platform, the more added value it should offer.

For instance, AJ Bell charges 0.25% for their ISA, but you have to pick your own investments. Whereas, Wealthify charge 0.6%, but they pick your investments for you.

Dealing fees

Other fees to compare are the fees for buying and selling investments – these can range from £0 to over £15. If you hold funds, you’ll also pay an annual management charge to the fund manager, and if you’ve opened your account via a financial adviser there will be advice fees to pay.

Comparing the various fees will help you to determine whether your current ISA provider is overcharging you. Providers sometimes change their charging structures so it’s important to make sure it is still as cost-effective as when you first opened your account, by checking your account on a regular basis.

Exit fees

It is possible to transfer your ISA from one provider to another, but you might have to pay exit fees in order to do so. If you’re happy with your investments you can request an “in specie” transfer, which is when all your investments are moved to your new provider. A cash transfer – when your investments are sold and the proceeds passed to the new provider – tends to be quicker but your money will be out of the market, meaning you could miss out on any share price gains.

Are Stocks & Shares ISAs better than cash ISAs?

Stocks and shares ISAs can potentially perform better than cash ISAs and make you more money. However, they come with more risk.

Cash ISAs are safer because you’re not exposed to investment risk, your money is invested in an interest-paying account. However, even though interest rates on cash ISAs are high at the moment (you can get up to 6% with Hargraves Lansdown Active Savings, they are still lower than inflation rates. This means that the interest you earn on your savings will be lower than how much more expensive it is to live. So your money can be eroded over time.

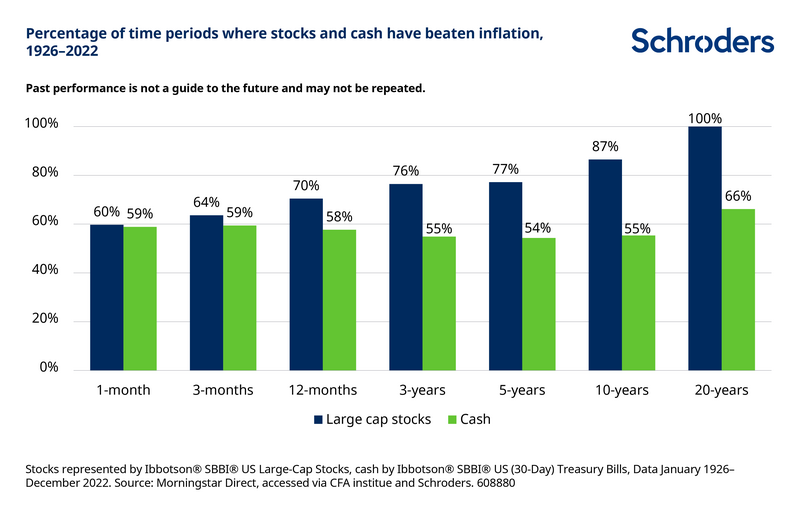

You can see in this chart from Schroders, that generally investing in shares outperforms investing in cash most of the time.

However, the highest interest-paying cash ISAs usually lock your money away for a set period of time, meaning you can’t access it if you need it. With a stocks and shares ISA you can access your savings faster.

Cash ISAs are good if you are prepared to accept lower returns but in exchange for having the security of knowing that your deposit will not decrease in value.

So you can make more money with a stocks and shares ISA if you’re willing to take on more risk,. However, investing in stocks and shares with an investment ISA may mean you are exposed to more volatility in the short and medium term but could earn larger returns in the long term.

- Related guide: Advantages and disadvantages of Investment ISAs vs cash ISAs

You should not invest money that you are likely to need in the short term in a Stocks & Shares ISA. In the short term, ISA investments can fluctuate in value meaning that you may not get back what you invested if you withdraw your money soon after depositing it. Investments within a Stocks & Shares ISA should be viewed as long-term investments.

Withdrawals from stocks and shares ISAs

A key advantage of Stocks & Shares ISAs is that they allow you to withdraw your money at any time. Generally speaking, it’s usually quite easy to access money that has been saved in an ISA although you may have to sell your investments first and this can take a few days.

When can you withdraw money from a stocks and shares ISA?

You can withdraw money from stocks and shares ISA anytime, as long as you have sold or liquidated your investments.

However, think before you take money out as with most stocks & shares ISAs, if you withdraw money and then put it back into the ISA in the same tax year, it will count towards your annual allowance.

Those looking to make regular withdrawals from their Stocks & Shares ISA may want to consider a ‘flexible ISA.’ This type of ISA enables you to withdraw money and then put it back into the ISA in the same tax year without impacting your ISA allowance. Most providers do not offer flexible Stocks & Shares ISAs. CMC Invest however does offer customers a flexible ISA product..

Can you transfer your ISA instead of withdrawing cash?

Yes. Transferring old stocks & shares ISAs into a new account can be a smart move. When your accounts are consolidated, it’s easier to manage your money.

Generally speaking, transferring an old ISA to a new account is a straightforward process. Usually, it’s simply a matter of applying for a transfer with your new provider. They will contact the old provider and begin the transfer. Once the transfer is complete, you can invest the money in your new ISA. Usually, the process is completed within a few weeks.

Those wishing to transfer an ISA should be aware of the following:

- Transfers can be made as cash or stock.

- Transferring an ISA does not count towards your ISA allowance.

- You can transfer an ISA as many times as you like.

- Some providers charge exit fees (sometimes per stock transferred). It’s worth checking this before you execute a transfer.

- You cannot transfer your ISA to an ISA owned by someone else.

If you wish to execute a partial transfer, you should speak to your providers to see if this is possible. Not all ISA providers allow partial transfers.

You do not need to transfer a Junior ISA into an adult Stocks & Shares ISA. This should be done automatically by the provider.

Regulation & Protection of Stocks & Shares ISAs

Stocks and Shares ISAs are heavily regulated and the Government has ensured that funds are protected in a platform that manages your ISA goes into financial difficulty.

Investments held in stocks and shares ISA are covered up to £85,000 if the platform or broker enters default.

Investments held in a stocks and shares ISA are covered up to £85,000 if the platform or broker enters default.

You aren’t covered for any losses you make as a result of your investments performing poorly.

Industry experts told us

"A Stocks & Shares ISA allows investors to save up to £20,000 free from tax on income and capital gain with the flexibility to withdraw money whenever it is needed. Investors also have the freedom to choose which investments to include in their ISA, whether shares, funds, investment trusts and bonds."Stocks & Shares ISA FAQs

Stocks & Shares ISAs have been around in their current form since 2008. Before this, they were known as ‘Maxi ISAs.’ Prior to 1999, they were known as ‘Personal Equity Plans’ (PEPs).

You can invest your stocks and shares ISA money into shares, investment trusts, open-ended investment companies (OEICs), unit trusts, government bonds and corporate bonds.

Be careful, if you are worried read our guide on how to spot investment ISA scams

Self-select ISAs give you complete control over choosing your investments, monitoring their performance and rebalancing your portfolio.

Unless you invest through a managed ISA, where experts choose and monitor your portfolio, you have sole responsibility for your ISA making money.

ISA investments such as shares, funds, ETFs, and investment trusts are constantly fluctuating in value. So, it’s not unusual to see the value of your ISA fall in the short term. Stocks & Shares ISA investments should be viewed as long-term investments (5+ years). History shows that, over the long term, assets such as shares, funds, and ETFs tend to provide healthy, inflation-beating returns.

Yes. Most Stocks & Shares ISAs are suited to long-term investing. The best ISAs for long-term investing, however, are those that offer the combination of a wide range of investment options and competitive fees. Over the long term, fees can have a large negative impact on investment returns so it’s important to find a provider that offers low fees.

Yes. Nutmeg won our award for the best investment ISA to help buy a house with their Lifetime ISA. The main advantage of Nutmeg’s Lifetime ISA is that you can build an investment portfolio very easily. When you sign up to Nutmeg, they ask about your goals and risk appetite. They then use this information to build a portfolio for you. One downside to Nutmeg’s Lifetime ISA is that investment options are quite limited.

A Lifetime ISA is a tax-efficient investment account designed to help people save for retirement or purchase their first home. It is open to those aged 18-39. The annual allowance is £4,000.

The main advantage of the Lifetime ISA is that contributions into the account come with a 25% bonus while you’re under the age of 50. The disadvantage of this ISA is that there are penalties for withdrawing money before you turn 60 or buy your first property. You can compare all Lifetime Investment ISAs here.

You can access your money in an ISA anytime, whereas a SIPP is for retirement and can only be accessed after 55.

ISAs and SIPPs both have their advantages and disadvantages. The main advantage of investing in an ISA is the flexibility you have – you can access your money at any time. One disadvantage is that you can only invest £20,000 per tax year.

The main advantage of investing in a SIPP is that you receive tax relief on your contributions. This is essentially a bonus from the government for saving for retirement. One disadvantage of a SIPP, however, is that you cannot access your money until age 55 and then you can only withdraw 25% tax-free.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.