Trading Accounts Compared & Reviewed

We have ranked, compared and reviewed some of the best trading accounts in the UK that are regulated by the FCA. There are many different ways to speculate on the market and all come with different features and benefits. Our guides can help you choose a broker that offers the right way for you to trade.

Trading Platforms

Trading platforms let you speculate with leverage on the price of stocks, commodities, indices, fixed income and foreign exchange by going long or short via futures, options, CFDs or spread betting.

Compare Trading PlatformsTrading Apps

Trading apps are mobile versions of a broker’s online trading platform that let you monitor positions and trade on the move, an essential part of trading.Compare Trading AppsCFD Trading

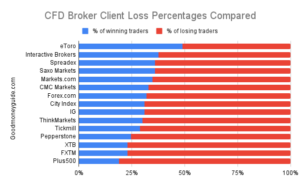

Trade the global markets through CFDs (contracts for difference) through UK-based FCA regulated CFD brokers.

Compare CFD BrokersFinancial Spread Betting

Unique to the UK, speculate through financial spread betting and pay no capital gains tax on trading profits.

Compare Spread Betting BrokersFutures Trading

Trade the global markets through on-exchange futures from FCA-regulated brokers.

Compare Futures BrokersOptions Trading

Options brokers allow traders to buy and sell options on stocks, indices, commodities and foreign exchange.

Compare Options BrokersDMA Brokers

Direct Market Access (DMA) accounts enable investors to place ordres directly on the exchange order books to get the best possible execution price.

Compare DMA BrokersForex Trading

Forex brokers let you speculate on the price of currency pairs going up or down with leverage through spot FX, CFDs and financial spread betting. Compare Forex BrokersIndices Trading

Index brokers provide access to indices markets such as the FTSE, DAX, and S&P for the purposes of trading, speculation, and hedging. Compare Index BrokersMT4 Brokers

MT4 brokers provide the MetaTrade4 (MT4) platform so that its clients can speculate on financial markets.Compare MT4 BrokersCommodities Trading

Commodities brokers enable traders and investors to speculate on the price of commodities markets such as gold, oil, and corn through financial products like futures, options, CFDs, financial spread betting and ETFsCompare Commodities BrokersCryptocurrency Trading

Use our comparison table of Cryptocurrency accounts to compare costs and the different ways to buy and sell cryptocurrenciesCompare Crypto BrokersProfessional Trading

Professional trading accounts offer higher leverage and lower margin on trading products such as CFDs or spread betting.

Compare Professional Trading AccountsPrime Brokers

Prime brokers provide an all-in-one trading and investing account for institutional traders and hedge funds.

Compare Prime Brokers