- Fintech firm Plus 500 reported good revenue growth for FY22; shares rose 4.6%

- Strong balance sheet into FY23 (no debt, cash balance $900 million)

- Share price near all-time high; may retest psychological 2,000p

London is a premier financial city and no doubt many active trading firms are listed here. Plus 500 (LON:PLUS) is one of these vibrant trading firms that services customers globally.

A constituent member of the mid-cap FTSE 250, you may be surprised to learn that Plus500 was only formed in 2008. Its leading trading platform was so popular that the firm, headquartered in Haifa, went public in the AIM market in 2013 to expand its business. A few years later, Plus 500 was promoted into the premium segment of the London Stock Exchange. Currently, the company is valued at £1.6 billion – a fantastic achievement for a 16-year old trading firm!

What helped the firm to grow quickly? Market volatility, a boom in crypto derivatives and an industry-leading trading platform. The continuing improvement in its trading platform helped to keep and attract new customers. Just this week, the firm released an excellent trading update for 2022 – revenue last year totalled about $832 million, an increase of 15 percent.

Is Plus 500 (LON:PLUS) a good investment in the long term?

However, as an investment Plus 500 is not suitable for every investor. When the firm was a relatively young share on the public market, its stock price often exhibited high volatility – volatility that may be unacceptable to many conservative investors (see below).

In 2015, for example, prices plunged from near 800p to 200p (-80 percent) in a matter of days. Again in 2019, prices nosedived from £16 to £4 over a short time frame. That three-quarter plunge in value was caused by stricter regulation on trading activities. Right now, the stock is riding high on a bull run that started from 2019. This is Plus’s longest rally – and smoothest one too – on its chart.

But a chart can only record historical prices. It can’t predict future trends. Can Plus 500 break its 2018 highs? Can the four-year bull run extend further above £20? More importantly, will Plus500’s business continue to grow as fast as before? Nobody knows. At this point, we would be wary of chasing a rally that is rather ‘long in the tooth’ so to speak. A lull in market trading activities brought on by an equity bear market may also clip the bullish expectations here.

So, to answer the question if Plus500 is a long-term buy – the answer is generally affirmative. But I would wait for better prices to initiate long-term positions. ‘Buy low, sell low’ remains the only investment principle I would follow.

When is the best time to buy Plus 500 shares?

As exhibited by Plus 500’s chart, the best time to buy the stock is when it suffers from an episode of price decline that is quite sharp and violent. Some will call it a ‘crash’.

There were 3-4 such instances over the decade. Each decline was followed by a general price recovery. I expect this pattern to hold.

Of course, readers may point out that this pattern is only valid when the company was much smaller. Now the company is larger and so should render this pattern less relevant. This is especially true when the company is initiating share buybacks to limit any deep price drawdowns. Perhaps. Still, I would not discount a potential retreat from the previous resistance attained in 2018.

Another ‘buy point’ to watch for, though it is more relevant for traders, is when Plus500 touches new all-time highs above £20. When that happens, it means all investors are sitting on profits. This should lead to further momentum buying and higher share prices.

Is the Plus share price overvalued or undervalued at the moment?

According to Plus 500 business reports, maintaining a trading platform seems to be a cash-rich business. Plus500’s proprietary trading platform throws out more cash than what is required for its business needs. This benefits shareholders. And that’s why investors prefer Plus500’s business model to many other sectors – sectors that require higher capital investments to generate the same level of profits.

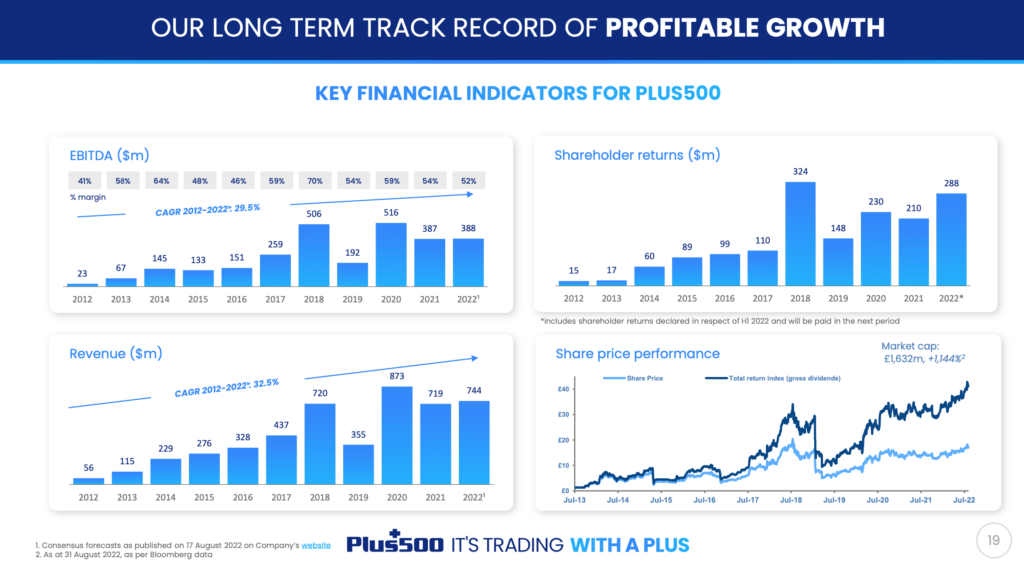

According to Plus500’s latest presentation slides, you can see Plus’s rising shareholder returns over time (see below).

In February 2022, the company initiated a $55 million share repurchase program (on top of $80 million in 2021). And in August last year, the trading firm announced another $60 million of share buyback. In total, for 2022 the firm bought back another 6.9 million of its shares for a total of $138 million.

On top of this, Plus500 shares currently pays a dividend yield 4.95% – not bad compared to many other stocks.

Therefore, one may argue that the stock is modestly ‘undervalued’ given the highly cash-generative business and ample shareholder returns.

Source: Plus500 Plc

Why has Plus500’s share price risen recently?

Plus 500 is a financial services firm that provides a trading platform for traders and investors. The stock despite the wide market jittery has been rallying into the previous high. This is due to:

- Robust business results – underpins bullish investors sentiment

- Multiple share buybacks – that support share prices over time

- Active financial trading – due to the rise and fall in many instruments, which led to numerous market opportunities for astute traders

What is the Plus500 share price forecast?

While Plus500 is worth more than £1.5 billion, its share is not as widely followed as other blue-chip companies. Only 4/5 brokers follow Plus, and three of them are issuing ‘Buy’ recommendations. This is a bullish consensus.

The median price target for Plus500 is £25 – a material increase from its current share price. Will it reach there? May be, but we would be wary of being too bullish on any stock as the overall market sentiment is quite fragile.

- Further reading – our expert review of the Plus500 trading platform.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.