Plus 500, the online CFD broker has made some improvements to their trading platform.

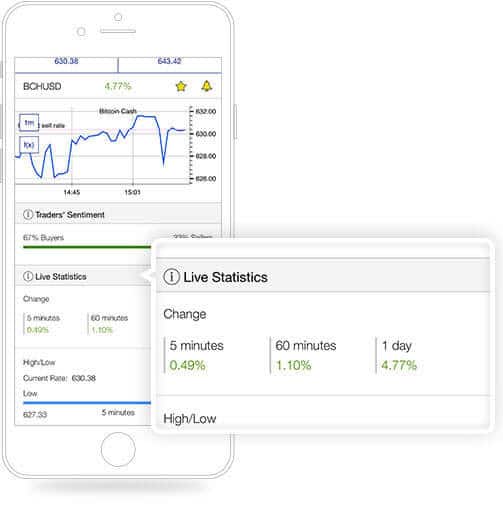

Clients can now see sentiment information about Plus 500 client positions when they bring up a dealing ticket.

Plus 500’s two main LSE listed competitors IG and CMC Markets have had this function for a long time so it’s good to see Plus 500 making improvements to their trading platform.

As well as showing client sentiment, the Plus 500 also offer alerts based on changes in sentiment on an instrument. So for example, if you wanted to be notified when Plus 500’s client net positions in Bitcoin goes down from the current status of 93% to say 75%, you will get an alert when it does.

You can also set alerts based on certain time frames for price action as well as sentiment. A useful tool to scan for stocks that are breaking up or down on the day.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.