Ocado’s share price (LON:OCDO) got off to a good start, but has really let investors down over the past two years. Ocado is a rare breed in the UK stock market. The company started out as an online retailer and has now pivoted into a retail technology company. Rare because it is a hybrid company; part retail, part technology.

Is Ocado a good investment in the long term?

Investors eyeing to buy Ocado need not rush into the stock as uncertainty still stalks the market. The company is progressing in the right direction but for this effort to translate into shareholder returns, some patience is required.

Prior to the pandemic, many thought Ocado’s days as a darling of the stock market were numbered. Its share price had stalled for a year and the company is struggling with the new direction. But covid-19 injected a new lease of life to the online retailer. Repeated lockdowns prevented physical shopping and shoppers turned en masse to online purchases. Ergo, Ocado’s share almost tripled in 2020. At its peak, it was valued at more than £20 billion, above that of Tesco at that time.

However, the company has seen a massive slide in its share price since that post-pandemic high. In just over 18 months, Ocado’s shares lost a staggering 86 percent (£29 to £4).

After such a bruising decline, many wonder if Ocado will ever return to its highs again. Note that even at current prices, the company is worth £5.6 billion. Not exactly a small company.

Positive points about the Ocado share price include:

- its proprietary ‘Ocado Smart Platform’, which the company is leveraging through multiple international partnerships with other retailers,

- Ocado Retail, where the company may profit when better times return and shoppers have more money in their pockets.

The downside risks of buying Ocado shares now are:

- the whole stock market is bearish. Most stocks are being marked down heavily, especially those loss-making ones.

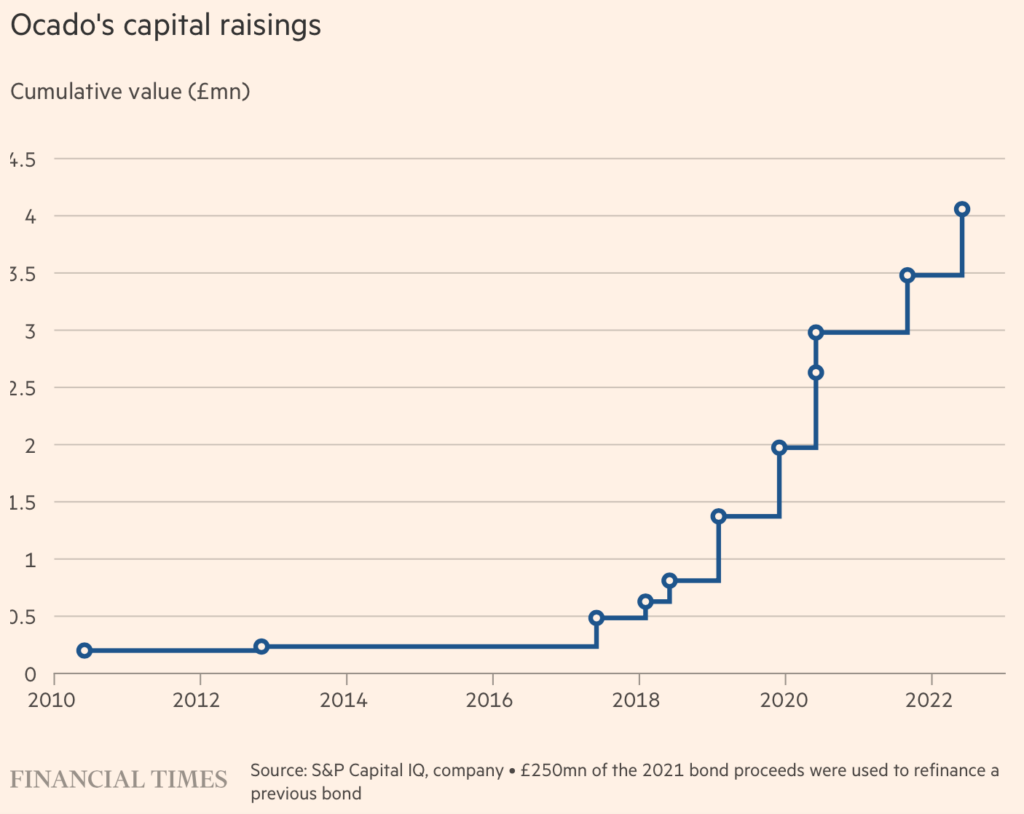

- Ocado needs capital to further its business – equity investments that may take a long time to generate profits.

Source: Financial Times

When is the best time to buy Ocado shares?

As with most other tech stocks, the best times to buy tech stocks are either they are really beaten down (down 99%, for example) or when they have completed a long base and are rising rapidly in prices.

For Ocado, its shares are still in a long-term downtrend. Prices did rebound sharply earlier this month, but many chartists will point out that this could be just a ‘bear market rally’.

Therefore, the best time to buy Ocado’s shares may still lie ahead.

Is the Ocado share price overvalued or undervalued at the moment?

Over- or under-valued? The answer to this depends on when you ask it.

If you wonder about this in early summer, the answer is likely to be ‘overvalued’. Then Ocado’s share prices was sliding nonstop; and the market sentiment towards loss-making consumer tech stocks was bearish. Ocado’s H1 revenue was £1.2 billion and lost about £200 million.

But now, the answer is potentially more positive. Ocado’s share price has rebounded from its summer lows, signalling that the stock may start to build a technical floor at around 500p.

Still, the current market conditions are dominated by investor sentiment and macro data. One week bullish, next week bearish. And if you stop to think about this: How can a company be worth twice as much in a matter of days? It makes not much sense really. The market are changing too rapidly for us to say for sure about Ocado’s valuation.

Why has Ocado’s share price risen recently?

Ocado’s share price was locked in a severe and persistent decline prior to the November 1 RNS.

In that RNS, Ocado revealed that it was developing a new partnership with one of the largest supermarkets in South Korea, Lotte Shopping. The Asian supermarket has annual sales of about £9.5 billion. So unexpected was this RNS that shorters (traders who bet on price falls) scrambled for the exit; investors cheered.

As a result, Ocado’s share price surged 38% that day on one of the highest volume session of the year. Soon after, prices nearly doubled from the pre-RNS price to 900p.

While a consolidation is now underway, the recent rally has broken the downward progression.

What is Ocado’s share price prediction?

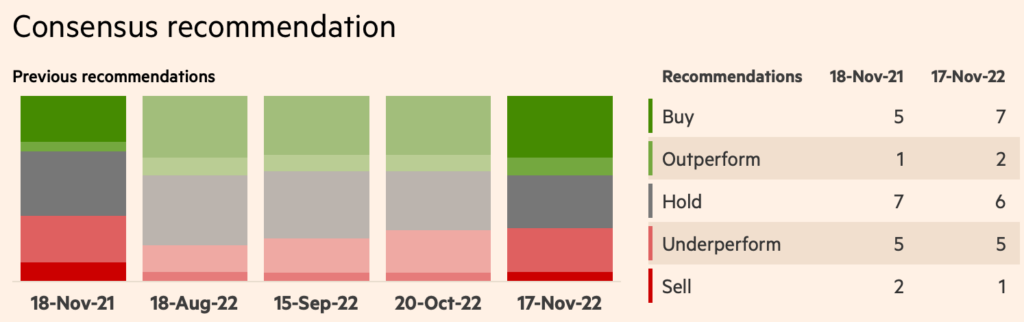

Ocado is a polarising stock. A few analysts are sticking with their ‘Buy’ recommendations on the automated grocer, while a good number is also bearish on the stock (11 out of 21 on ‘Hold’ or ‘Underperform’). The median price target is around 730p.

So what’s the overall Street verdict? Trend-wise, the negative camp is winning at the moment – as revealed by Ocado’s persistent price slide. That said, the bears can be whipsawed by sudden positive news, like the 39% price spike on November 1 when the company revealed a new partnership.

Although the stock is negative, one have to tread carefully in this price range because of the potential of a base formation.

Source: Financial Times

| Date | Broker name | New | Price at forecast | Old Ocado price target | New Ocado price target |

| 02-Nov-22 | JP Morgan Cazenove | Underweight | 650.4 | 500 | 500 |

| 18-Oct-22 | JP Morgan Cazenove | Neutral | 480.1 | 850 | 500 |

| 14-Sep-22 | Barclays | Equal-weight | 623.2 | 775 | 740 |

| 08-Aug-22 | JP Morgan Cazenove | Neutral | 891.2 | 850 | 850 |

| 25-Jul-22 | Berenberg Bank | Buy | 759.6 | 1,415.00 | 1,290.00 |

| 22-Jul-22 | Barclays | Underweight | 791.6 | 1,500.00 | 1,500.00 |

| Averages | 699.35 | 981.67 | 896.67 |

What is the live Ocado share price (LON:OCDO)?

The current LON:OCDO share price is 349p which is a change of -14.9 or -4.09% from the last closing price of 349 with 2,880,645 shares traded giving LON:OCDO a market capitalisation of £2,896,503,164. The most recent daily high has been 365.6 and daily low 341.6. The LON:OCDO share price 52 week high has been 1,017 and the 52 week low 341.6. Based on the most recent LON:OCDO share price opening of 349, the current LON:OCDO EPS (earnings per share) are 0.38 and the PE (price earnings ratio) is n/a.

How to buy Ocado Plc shares (LON:OCDO)

To buy shares in Ocado (LON:OCDO), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Ocado:

- Decide if you want to buy Ocado shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Ocado shares (LON:OCDO)?

Buying one LON:OCDO share costs 349p. However, as well as the 349p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Pricing data automatically updates every 15 minutes

Compare accounts for investing in Ocado (LON:OCDO)

- Use our comparison table of share dealing accounts to see how much it will cost to invest in Ocado shares (LON:OCDO) in the long term.

Compare accounts for trading and shorting Ocado (LON:OCDO)

- Use our comparison table of UK share trading accounts to see how much it costs to trade Ocado shares in the short term and hold LON:OCDO overnight.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.