Before we kick off this review I must disclose a bit of an interest. I’m a big fan of IG, in my mind, they are the default broker. When we review brokers, we tend to ask the question “why would you trade here rather than at IG?” So, in my updated 2024 IG review, I compare IG Index to other brokers, tell you what I like about them, who they are best for and show you their trading platform with some live trades in a video demo.

- Overview

- Richard's Review

- Awards

- Video Demo

- Facts & Figures

- Customer Reviews

IG Review

Name: IG

Description: Founded in 1974 as Investors Gold Index, then IG Index, now just “IG” is one of the world’s largest margin trading brokers. IG offer CFDs, FX and Spread Betting (in the UK) alongside share trading and prime brokerage to over 313,000 active clients and offers 17,000 tradable markets. IG also recently introduced physical share dealing and smart portfolios for longer-term investors.

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Is IG a good trading platform?

Yes, IG provides an excellent all-round trading and investing brokerage service. IG pioneered online trading and financial spread betting for private clients and remains not only one of the largest online trading platforms, but also one of the best. IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Pros

- Vast range of markets

- Excellent liquidity & DMA equities

- Listed on the London Stock Exchange

Cons

- Customer service can be slow

- No DMA futures trading

- Still charges inactivity fee

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.7Ratings Explained

- Pricing: Industry leading spreads and with DMA you can get inside the bid/offer.

- Market Access: Best around for spread betting and CFD trading.

- Platform & Apps: Loads of added value, signals and execution features.

- Customer Service: IG is very big, but still managed to score well here.

- Research & Analysis: Superb, news, analysis, social feeds, plus free premium subscriptions for active clients..

Richard’s IG Review

I’ve had an account with IG for about 20 years and I remember their first online trading platform when it was just basically a messaging system through to the dealing desk. Amazingly enough, it turns out that I was also in the same class (at two different schools over about five years) as the founder’s daughter, but of course, didn’t know that back then.

When I was interning on the NYMEX and IPE trading floors in London and New York as a ticket checking clerk, I’d tap away on IG on my Ericsson R380 trying to emulate the bigger boys in the pit.

IG were my first trading account and along with Trading Places (my dog is even called Winthorpe #notobsessed) I hold them fully accountable for the path my so-called career has taken.

IG Index

Stuart Wheeler, the founder, basically invented financial spread betting in the attic of a Chelsea townhouse in 1974. It was first called Investors Gold Index, then IG Index and then just IG. As the product range grows, the name shortens. As is the fashion these days with II, HL & IBKR.

If you read his biography (Winning Against the Odds, My Life in Gambling and Politics), you can tell that IG was founded for the love of the business. That business being gambling and investing. It’s a great read, very witty, lots of indescrete gossip, some “slightly dated” views, but overall a great insight into how and why the business started.

Ethos

This brings me to my first point. One of the things that makes IG stand out, is really the fact that it is IG. I’m a big believer that there are two types of financial business. One that is set up to extract money from customers because they spot a gap in the market. And the second, that does it because they are good at it and want to be the best.

I hope that’s what we at the Good Money Guide do and I hope that that’s what IG still do. I certainly gathered from my interview with the now IG CEO, June Felix, that their position is still to very much be on the clients side. In that, they believe it’s better to try and help a client win and give them a good service, so they are still doing business with you in twenty years, rather than the churn and burn quick-fire approach.

Quality Service

This was most evident I think during the big bonus push of around seven years ago. This was basically a time when the trading industry became uber-competitive and brokers were offering big bonuses, sometimes up to £5,000 to new clients to sign up. The catch of course was that you had to generate more than that in trading commission before you could withdraw it or use it. IG’s stance on that was, “No, that’s not for us” clients trade with us because of what our service offers” and didn’t get into the murky business of incentives. Interestingly enough, the FCA banned new account bonuses because it all got a bit out of hand as the more unscrupulous platforms were running too heavy B-books.

No B-Book

One draw for big clients is that whilst IG does internalise orders, they have Symmetrical exposure limits. So they don’t take a view on the markets. This means two things, first, IG are not betting against you with a B-Book. And second if you are a big trader, because of their liquidity there may actually be bigger volume on IG’s bid and offer than there is in the underlying market. You get positive slippage, so if you place a limit order and the market suddenly moves in your favour you get filled at a better price than your limit.

Spread Betting & CFD Trading

With IG you can trade CFDs or spread bet 24 hours on major indices, forex and commodities markets, there are extended hours on global equities, where some fairly significant volume goes through, particularly on US equities when company announcements are made after the main market shuts. IG is one of the few brokers to allow trading during the weekend, so you can still take a view or limit your exposure if something big comes out politically.

IPO Grey Market

One feature that is now unique to IG (lots of other brokers used to do it) is the “grey market”, where they will make you a price in unquoted stocks that are due to come to market. You essentially take a bet on what the market cap will be of a company when it lists. Or, you can just apply for shares in the IPO through PrimaryBid, who will deliver them to your IG account.

International Presence

IG also have this nice nack of looking at a region and finding specific products for them. It’s actually quite interesting how each country has a specific way it likes to trade the markets. The UK for example, is the only country that benefits from financial spread betting, the rest of the world trades on margin with CFDs. Of course, with the exception of the Americans, who trade on margin by taking out a loan to buy stock (from their broker) or trade options, which are much more popular on equities. Japan has knockouts and Europe has barrier options and Turbos Warrants.

Options Trading

Talking of options, IG has one of the widest ranges of index, forex, and commodities options and if you want to trade options on stocks, you can, although you have to do it over the phone in the UK, you’ll be able to do it online soon they say. If you have a professional account you can still trade binary options with IG, which are now called Digital 100s. I’m actually a big fan of binary options as they give you the ability to take a short-term limited risk bet on how the market is going to move. Unfortunately, as with bonuses they were abused by off-shore hoodlums and banned for retail traders.

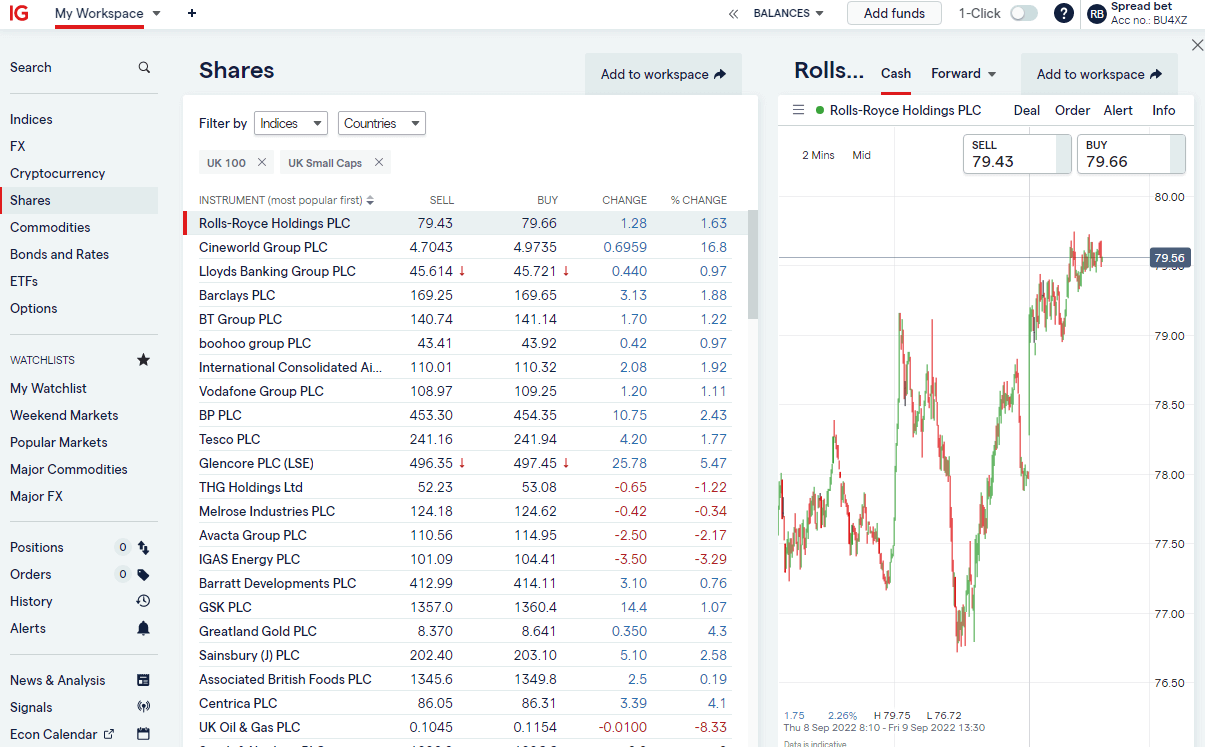

Trading Platform

IG’s trading platform has gone through many iterations in the 20 years or so I’ve used them. Their first online platform was just really a live price feed with a messenger box, that put you through to the dealers, who would manually execute trades for you. Now, of course, it’s all DIY online, but still with phone support if you need it.

Something IG is very keen to push, is their added value. The platform tries to integrate as much as possible. IGTV, is based on the platform analytics of what people are trading and they create programs around what markets and assets traders are looking for information on. The news and analysis comes from Thomas Reuters, with snapshot videos and a series of IG market commentary videos.

High Net Worth Accounts

If you are a high volume traders you can also trade DMA, with ProRealTime and you can get level 2 pricing and trade directly on the exchange order book. This can be done on the IG trading app or by downloading the L2 dealer software. There is a cost of course, but if you do a few trades that is rebated back. Brokers have to pay the exchanges for providing level 2 data to their clients, so the charge is there to dissuade everyone signing up without trading. If you are really clever and have developed your own trading algorithm, you can plug that into IG’s platform too. Or MT4/MT5 which they also offer, if you’re into that sort of thing.

IG Community

There is a fairly active forum in the IG community, it’s not as quite as “social media feed” as some copy trading platforms, but there are a few thousand users chatting away and the IG staff get involved. As with other brokers, there is Autochartist, but they add value there, by having a “copy to order” function where you can execute the signal, but also add the stop and limit. You can then tinker with the pricing by moving the lines on the chart. On charting, IG are implementing logarithmic charting, one of their most requested features from traders.

Sticky Clients

A problem all brokers are desperate to address though is people losing money. It’s always been the case and previously was always anecdotally noted that only around 20% of people made money. The IG founder, even mentions this in his book, prior to it being a regulatory requirement to display in all marketing and on websites what percentage of clients lose money when trading spread betting and CFDs. A few brokers have implemented post-trade analytics, to help their clients try and win more. IG’s Trade Analytics tool does just that. It’s sole purpose is to try and help traders win more by getting a better understanding of where they profit and lose in the markets. It’s been developed in-house by IG, based on their analytics and to provide clarity.

James Perry IG’s Client Experience Manager told me “We desperately want our clients to win as the more they win, the longer they are going to be a client, and the more they are going to trade” as they make their money from commissions, financing and spreads, “as soon as they lose, they feel disenfranchise, sad and reduce trading volumes”.

I know this to be true from my own trading, when you’re on a winning run you trade more, when you can’t call the market right so step away until another day.

Investing, Share Dealing & Smart Portfolios

IG also, offer longer-term investing products, where you can buy and hold stocks, ETFs and funds in a stocks and shares ISA, or IG Smart Portfolio. They have a trading academy so they can learn through video and interactive courses. IG can see from their analytics that clients that use these, do become better traders. Along with their recent acquisition of DAILY FX (for $40m) they also offer live webinars to provide analysis and trading strategy.

Overall, if you are going to trade, I would be surprised if you didn’t have an account with IG.

IG Awards

IG won best spread betting broker in our most recent 2023 awards and has won in the past:- 2023: Best Spread Betting Broker

- 2022: Best Spread Betting Broker

- 2021: Best Trading Platform

- 2020: Best Spread Betting Broker & Best Professional Trading Account, Best All-Round Trading Platform

- 2019: Best Forex Broker & Best Overall Broker

- 2018: Best Spread Betting Broker & Best Overall Broker

@good_money_guide Looking for the top spread betting broker? Check out the winners of the 2023 Good Money Guide Award for Best Spread Betting Broker IG. #IG #goodmoneyguide #goodmoneyguideawards #trading #betting #spreadbetting #stocks ♬ original sound – Good Money Guide

IG Video Review

In this video, we test the IG trading platform and highlight some of the key added-value trading tools.

IG Facts & Figures

IG Total Markets | 17,000 |

| ➡️Forex Pairs | 51 |

| ➡️Commodities | 38 |

| ➡️Indices | 34 |

| ➡️UK Stocks | 3925 |

| ➡️US Stocks | 6352 |

| ➡️ETFs | Over 2000 |

IG Key Info | |

| 👉Number Active Clients | Over 313,000 |

| 💰Minimum Deposit | 250 |

| ❔Inactivity Fee | Yes – £12 per month |

| 📅 Founded | 1974 |

| ℹ️ Public Company | ✔️ |

| 🏢 Head Office | London, UK |

IG Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ✔️ |

IG Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1.2 |

| ➡️DJIA | 2.4 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.4 |

| ➡️EURUSD | 0.6 |

| ➡️GBPUSD | 0.9 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.3 |

| ➡️Crude Oil | 0.28 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | 0.1% |

IG Customer Reviews

Tell us what you think:

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG FAQs:

IG has over 313,000 clients worldwide and is one of the latest online trading platforms globally

IG’s share dealing account is one of the cheapest of all the major stock brokers in the UK. You can buy UK shares from £3 per trade and there is no commission for buying US stocks.

Yes, you can trade gold on IG, through ETFs, CFD or spread bets. In fact, IG started off being called Investors Gold Index with a focus on making gold markets.

Yes, IG’s trading platform is ranked by us as one of the best in the UK. IG’s trading platform is specifically good for high volume traders that require deep liquidity.

Yes, IG offers around 51 forex pairs to trade and you can also invest in currencies by buying FX rate tracking ETFs.

- Further reading: Compare the best forex brokers here

IG Index was the previous full name of Investors Gold Index before they shortened it to IG. IG Index, was the pioneer of the spread betting industry.

IG Markets has the same spreads as IG Index. The difference is that IG Index offers spread betting to UK customers where as IG Markets offers CFD trading globally (except in America) to retail and professional traders.

IG offers spread betting, CFDs, forex and investing accounts through IG Markets.

IG was founded and is still based in London. Their current offices are in the heart of the City of London. IG’s London address is: Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA

Yes, IG offers a share dealing ISA where you can pick your own shares and also a Smart Portfolio ISA where you buy into a pre-made portfolio that contains a diverse range of investments and is ranked by risk.

- Further reading: Compare stocks and share ISA accounts

IG’s client sentiment shows how many traders are long or short in a market. It can be used as either a leading or contrarian indicator depending on whether or not you agree with crowd investing mentality.

IG is one of the most competitively priced trading platforms. IG spread sin major markets are often marketing leading. For example, they offer some of the tightest spreads for GBPUSD trading. They are also one of the cheapest brokers for holding positions overnight.

Further reading: Overnight Financing Explained: What is it and is it important?

Yes, In the UK IG Group and IG Markets is regulated by the FCA so if they go bust your money (up to £85k) is protected by the FSCS. However, your money is not safe from you making bad investment decisions or picking a bad trader to copy trade.

No. There are no withdrawal fees for taking money out of your IG account.

No, you do not have to pay tax on profits if you are spread betting or have a stocks and shares ISA account with IG. However, if you have a CFD or share dealing account, you will have to pay tax.

Yes. IG will charge you a monthly inactive fee of £12 if you do not use your account for two years. Once your account balance reaches zero you will no longer have to pay this fee.

Yes IG does have a SIPP account where you can invest in individual shares or their Smart Portfolios. IG partner with Options UK Personal Pensions LLP who are an independent pension administration company providing specialist pension services and products to the UK market. The trustee of the IG SIPP is MK SIPP Trustees UK Ltd.

- Further reading: Compare stocks and shares ISAs and SIPP providers

IG’s level-2 dealer is a trading platform that lets you trade with direct market access. Unlike normal IG spread betting and CFD accounts you are charged commission post-trade as you can work orders inside the market bid/offer spread.

- Further reading: Compare DMA trading platforms here

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.