How to buy, trade and invest in cannabis, weed or marijuana stocks and shares

So you want to buy cannabis stocks? Buying cannabis stocks is a hot topic at the moment. Not quite as much as crypto trading – but at least there is an underlying asset.

But, if you want to get involved in the wackly world of baccy stocks how do you trade and buy cannabis stocks?

Marijuana stock plays aren’t a new thing, they’ve been around for a while but mainly in the form of spivvy penny shares. You know, the type of stocks where you pays your money and takes your chance. You buy some and are either going to lose all your money or make a bucket load.

I’ll resist the temptation to use puns like, “could these stocks go sky high?” because quite frankly they’ve all been used by everyone else already.

However, we are guilty of a lit puns too, cough-cough…

Where to buy cannabis stocks?

Here is a quick rundown of the best brokers to buy cannabis stocks.

Obviously, we’re not recommending these stocks or providing investment advice here. Just highlighting where you can buy cannabis stocks. If you wanted…

Best brokers for investing and trading cannabis stocks

Cannabis stocks are becoming more readily available on platforms like IG, Saxo and eToro. Read our reviews to find out more or read on for screenshots and the risks and opportunities involved in trading marijuana.

Spread Betting on Cannabis with IG

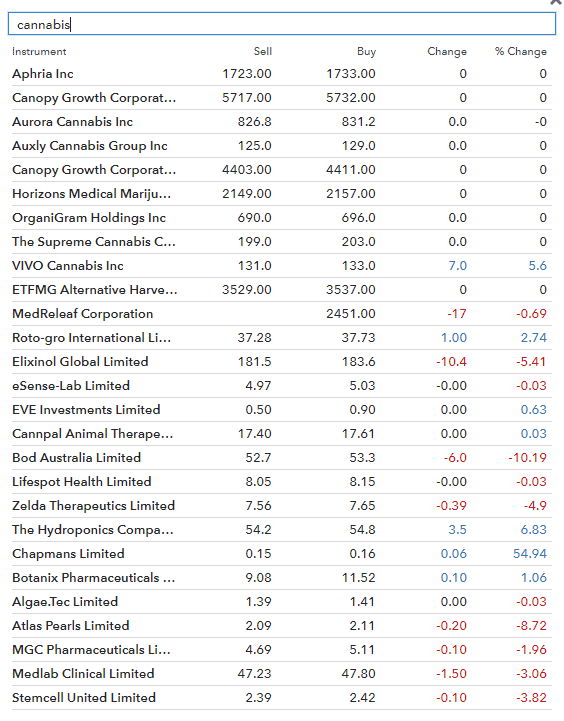

If you want to job about in individual cannabis stocks take a look at IG. A quick search on their platforms shows around 27 cannabis stocks that you can trade on CFDs or through spread betting.

Marijuana ETF investing through Saxo

If you want access to a cannabis ETF, Saxo offer Horizons Marijuana Life Sciences Index ETF which is a basket of stocks with exposure to cannabis.

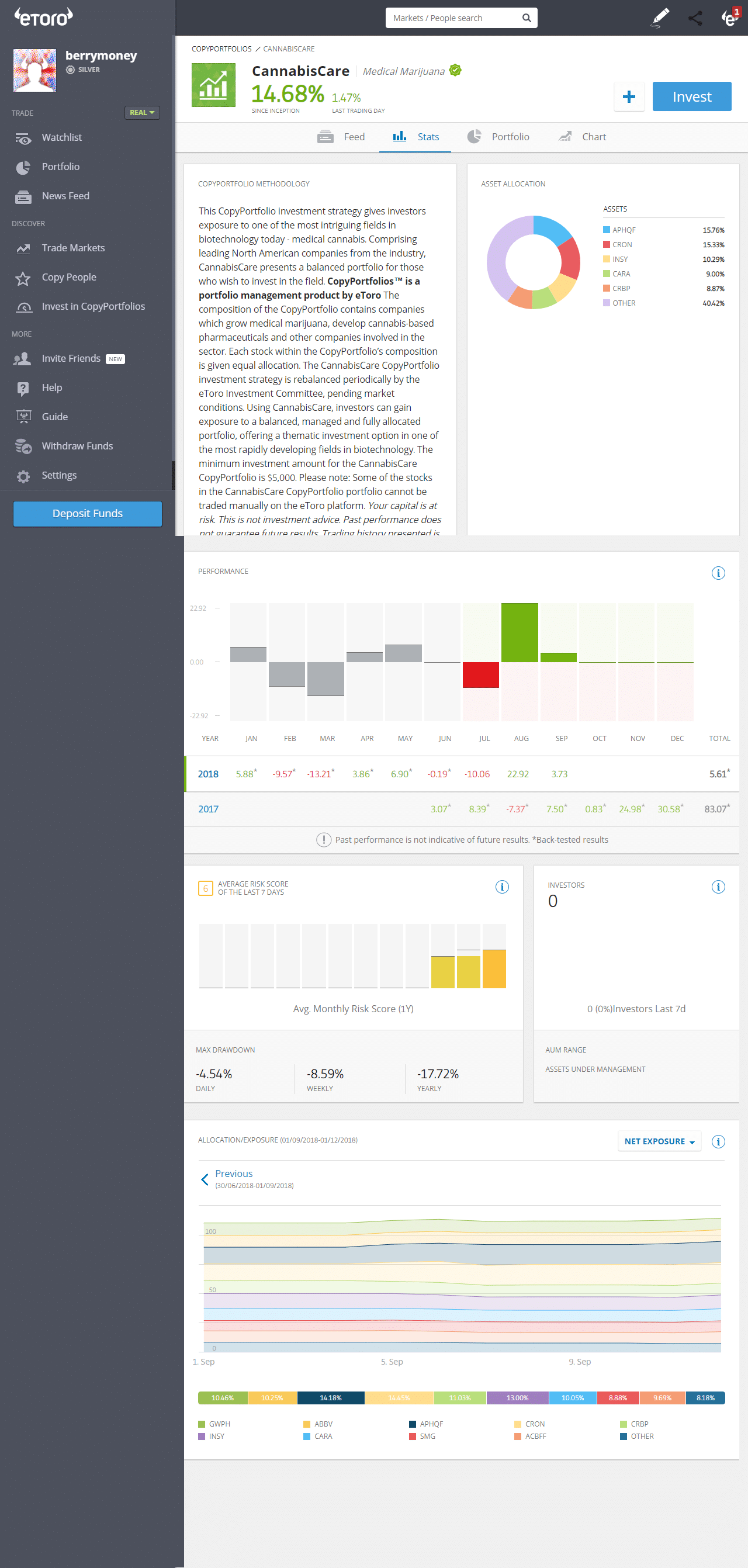

Cannabis CFD trading through eToro

Or if you are of the social trading persusasion eToro is giving investors the chance to bet on the rapidly growing medical marijuana market via it’s CannabisCare CopyPortfolio

What are the additional risks when you buy cannabis stocks?

- Firstly, most cannabis stocks are listed abroad so make sure you either hedge your currency exposure or trade in your local currency. Which you can do with spread betting for example.

- Secondly, regulation is a major factor and changes will have a significant impact on cannabis stock prices.

- Thirdly, it’s just like any other pharma stock – they are subject to high volatility

Below is a recent video from Bloomberg on “Where to Find Opportunities in Cannabis Stocks”

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.