For the last two decades, our team of industry experts has been providing industry news covering investing, trading and currency transfers.

Our four main news writers (Richard Berry, Ed Sheldon, Jackson Wong & Darren Sinden) have over 85 years of combined experience, making us an authority when it comes to market movements, company updates, interviews and more. We cover sectors such as UK shares, US stocks, commodities, indices and currency pairs.

Our finance news is a key part of the offering at Good Money Guide, and compliments our extensive guides, independent reviews and comparisons of financial providers.

We have been mentioned in publications such as Fortune.com, BusinessInsider.com, IG.com, BDaily.co.uk and FinancialReporter.co.uk.

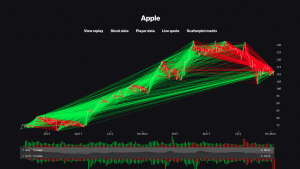

Is the best trading game of all time?

I’ve just read “The Trading Game” by Gary Stevenson and was reminded of this absolute gem from Bloomberg I first wrote about in 2015. If you want to do a bit of paper trading but aren’t interested in a demo account then take a look at Bloomberg’s Trading Game. On the basis that you no

Robinhood launches in the UK for a second time

Commission-free investing app Robinhood has launched in the UK for the second time, having failed to gain traction in 2020. Robinhood in the UK UK investors can only buy US shares through a general investment account at the moment. Robinhood, a US-based commission-free share trading platform has a UK operation and the firm is in

Roblox R looking BLX & election factors looms large in the US

One of the stock darlings during the pandemic was the online computer game company Roblox (NAS: RBLX). Roblox shares breakthrough support During those months-long lockdown, youngsters all tuned into the internet-based gaming website to relieve of their boredom. User growth rocketed; sales surged. RBLX was listed with much fanfare back in 2021 and on its

Capital.com stops on-boarding UK accounts

Capital.com has paused the onboarding of new UK client accounts. The broker, which is based in London but has offices and operations around the globe, made the announcement via a notice on its website. In which it said: “We have made the decision to pause onboarding new clients in the UK for now” Adding that

A Market Reality Check & What Is Going On With Tesla?

When even veteran fund managers are scratching their heads about US stock prices, you need to proceed with caution. “Prices,” observed Jeremy Grantham in his latest must-read newsletter, “reflect near perfection yet today’s world is particularly imperfect and dangerous.” Indeed. Bitcoin, gold, S&P, Stoxx and Nikkei have all hit record highs in 2024. Investors believe

ThinkMarkets Launches Spread Betting On ThinkTrader UK

ThinkMarkets has introduced spread betting on its proprietary, ThinkTrader, trading platform, for its UK clients. The new product allows traders to speculate or bet on price movements in financial markets, without the need to take ownership of the underlying assets. What’s more Spread betting offers tax advantages over other forms of margin trading to UK taxpayers.

Webull says it wants to list via a merger with a SPAC

Online trading platform Webull has announced that it has agreed to list its shares on the Nasdaq, via a merger with a special purpose acquisition company (or SPAC). In a deal that would potentially value the combined company at US $7.30 billion. What are SPACs, and why is Webull using this method for its listing?

Public.com calls it a day in the UK

Public.com has announced it is shuttering its UK business, yet it was just seven months ago that I wrote about the launch of the broker, in the UK. The share trading app, which is backed by a host of celebrity investors, offers its US members, access to both traditional and alternative asset classes, and it

IG adds Tipranks to its trading platform

IG has added Tipranks to its platform. Tipranks is an Israeli-based fintech that specialises in financial data and tools that power smarter investment decision-making. Tipranks is probably best known for tracking broker recommendations, that is upgrades downgrades changes to target prices earnings forecasts etc. However the firm offers much more than that. Tipranks on IG On

Is trading on the ThinkMarkets demo account worth it?

It’s nice sometimes to get a little treat when trading. ThinkMarkets website says it will give you £25k for a demo account so imagine my surprise when it was loaded up with a cool £200k in virtual funds. So yes, it’s worth paper trading with Think Markets if you want more than the £25k advertised

XTB adds auto ETF investing plans for UK clients

XTB, the Polish-based multi-asset broker and trading platform has launched a new automated service for its UK clients. Auto invest in ETFs with XTB XTB investment plans allows UK clients to save and invest regular amounts via a range of ETF-based strategies. Using the service, UK investors will now be able to set up regular

Redpin launches to reduce the currency costs of buying international property

Following a £140 investment from Blackstone, Redpin has launched as a brand aimed to reducing currency costs for international property purchases. What is Redpin? Redpin operates globally, serving customers and SMEs in over 235 territories with a network transacting more than $12.6 billion in the last financial year. The company, headquartered in London, plans to

What exactly is a “Rio Trade”?

A “Rio Trade” is a phrase you may hear banded around dealing rooms in the City when things aren’t going quite according to plan. Time for a Rio trade mate! I’ve used the term Rio Trade all my two-decade-long career in the stock market. But the other day, I used the phrase in conversation with

Saxo cuts trading and investing fees

Saxo Markets has cut the fees it charges clients when they trade. A move that Saxo says is designed to empower investors, allowing them to make more of their returns. Commission reductions The broker has introduced what it called “substantial price reductions” cutting commission charges on UK shares US stocks ETPs ETFs Futures Options Saxo

ThinkMarkets adds TradingView charts to Think Trader Web

ThinkMarkets has partnered with Chicago-based Fintech TradingView to improve the analysis and charting capabilities of its Think Trader Web platform. ThinkMarkets Adds TradingView Think Trader Web now offers 13 distinct chart types alongside a suite of drawing tools, with which to annotate and mark up charts. Allowing for easier identification of chart patterns, signals and

Trade one month free with Saxo’s commission credits

Unlike other CFD brokers, Saxo is one of the few platforms that lets you trade with direct market access. This means that when you are trading CFDs, ETFs, bonds futures and options with them you can work orders inside the bid-offer price. As such Saxo, charges commission post trade, as opposed to other CFD brokers

IG bets on betting and appoints Breon Corcoran as new CEO

IG Group, who have been without a permanent CEO since June Felix stepped down for health reasons in the summer, have now made an appointment. The spread betting CFD and share trading brokerage has named Breon Corcoran as the new boss of the business. Though Mr Corcoran won’t take up the role until the end

The generational divide in investment & ESG interest is growing

CMC Invest’s investor survey uncovers some surprising behaviour from investor attitudes during the cost of living crisis. The study contrasts Gen Z and Millennials with older generations, focusing on investment priorities, ESG concerns, and the allure of tax-free investing. Generational Investing Attitudes Survey The survey canvassed a large group of investors across a range of