We have ranked, compared and reviewed some of the best commodities brokers and trading platforms in the UK regulated by the FCA. Commodities brokers enable traders and investors to speculate on the price of commodities markets such as gold, oil, and corn through financial products like futures, options, CFDs, financial spread betting and ETFs.

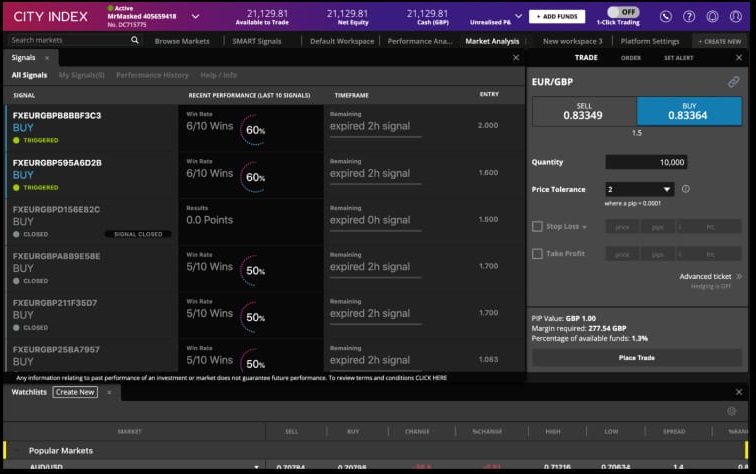

City Index: Best for commodities trading ideas and signals

- Commodity markets available: 20

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Pricing: Gold 0.8, Oil 0.3

- GMG rating: (4.2)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Commodity Trading Review

Name: City Index Commodity Trading

Description: Trade over 20+ different commodity markets with spread betting and CFD spreads from just 0.06pts. In business for 40 years, City Index is a trusted market leader that’s authorised and regulated by the Financial Conduct Authority (FCA). Exclusive to City Index, get trading ideas and post-trade analysis to improve your trading performance.

70% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodity markets available: 20

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Pricing: Gold 0.8, Oil 0.3

Pros

- Tax-free commodities spread betting

- Trading signals and portfolio analysis

- Wide range of commodities to trade

Cons

- No DMA commodities trading

- No physical commodity ETFs

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2Pepperstone: Best for trading commodities on MT4 & MT5

- Commodities markets available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.5 , Oil 2.5

- GMG rating: (4)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Commodity Trading Review

Name: Pepperstone Commodity Trading

Description: With Pepperstone you can trade commodity CFDs or spread bet on Gold, Silver, Crude, Natural gas with razor sharp pricing, low spreads and fast execution without worrying about physical delivery, ownership and rollovers.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodities markets available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.5 , Oil 2.5

Pros

- 28 commodities on MT4/MT5

- £1 minimum deposit

- Commodities spread betting

Cons

- Third-party commodity trading platforms

- No commodities futures and options trading

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Spreadex: Best commodities trading platform customer service

- Commodities markets available: 20

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.3, Oil 0.28

- GMG rating: (4.1)

- Customer rating: 4.2/5 (177 reviews)

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Commodity Trading Review

Name: Spreadex Commodity Trading

Description: Spreadex lets you trade over 20 commodities including Gold from only 0.4pts as a spread bet or CFD. They were also recently voted by traders for ‘Best for Efficiency of Taking Trades’ in the Investment Trends Awards.

72% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodities markets available: 20

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.3, Oil 0.28

Pros

- Excellent customer service

- Tight commodity spreads

- Commodities spread betting

Cons

- No DMA commodities trading

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.1CMC Markets: Best range of commodity markets to trade

- Commodities markets available: 100+

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.3, Oil 0.3

- GMG rating: (4)

- Customer rating: 3.6/5 (107 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Commodity Trading Review

Name: CMC Markets Commodity Trading

Description: CMC Markets lets you spread bet and trade commodity CFDs and with leverage on 100+ instruments. Commodity markets include Gold, Silver, Brent and West Texas Crude Oil plus commodity indices, with tight spreads, lightning-fast execution and some of the highest customer satisfaction in the industry.

74% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodities markets available: 100+

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.3, Oil 0.3

Pros

- Trade over 100 commodity markets

- Low minimum deposit of £1

- Tight commodity spreads

Cons

- Better for active traders

- No DMA commodities trading

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

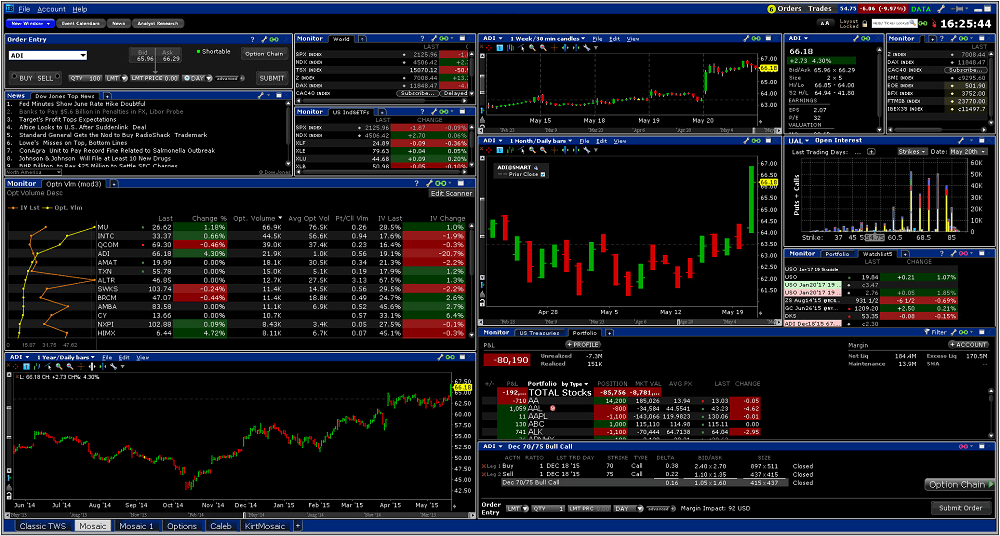

4Interactive Brokers: Best for on-exchange commodities trading

- Commodities markets available: 20

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Pricing: Gold 0.0007%, Oil 0.0007%

- GMG rating: (4.2)

- Customer rating: 4.4/5 (758 reviews)

60% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Commodity Trading Review

Name: Interactive Brokers Commodity Trading

Description: With IBKR you can trade commodities on powerful, award-winning trading platforms as a CFD, ETF or on exchange futures and options. Execute commodity trades in over 100 order types from limit orders to complex algorithmic trading.

60% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodities markets available: 20

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Pricing: Gold 0.0007%, Oil 0.0007%

Pros

- Commodities futures and options

- DMA commodities trading

- Low commissions

Cons

- No commodities spread betting

- No guaranteed stops

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

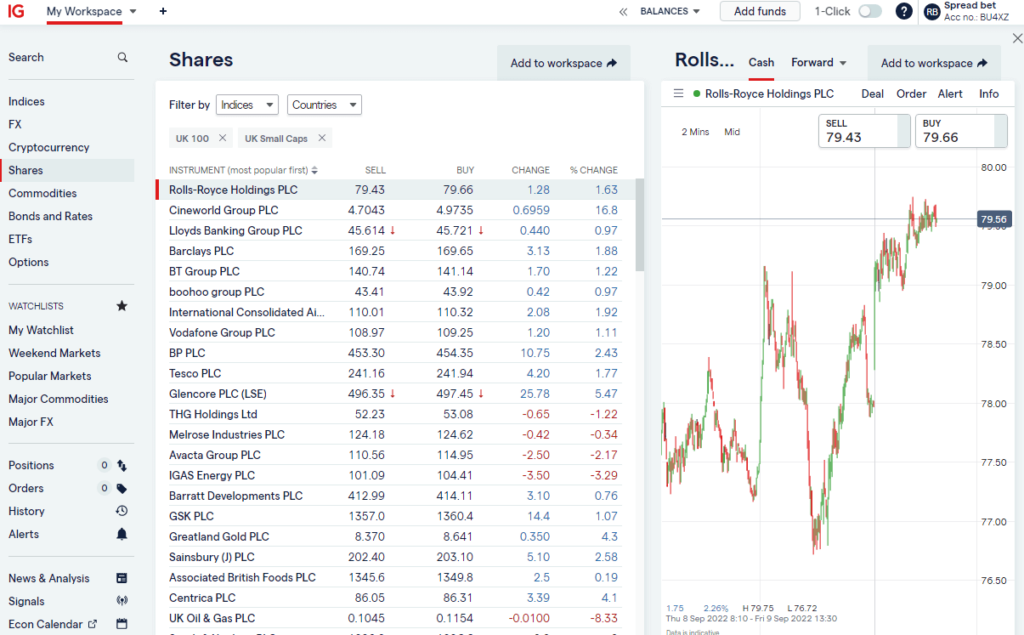

4.2IG: Best for high-volume commodity traders

- Commodities markets available: 35

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Pricing: Gold 0.3, Oil 0.28

- GMG rating: (4.2)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Commodity Trading Review

Name: IG Commodity Trading

Description: Trade over 35 commodities or a range of commodity stocks and ETFs as a CFD or spread bet on spot prices or with (exclusive to IG) an undated contract. Commodity trading spreads are from just 2.8 points on Brent Crude and 0.3 on gold and you can also attach a guaranteed stop to limit your risk, even in the most volatile market conditions.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Commodities markets available: 35

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Pricing: Gold 0.3, Oil 0.28

Pros

- Trading commodities on 25 markets

- Commodities spread betting

- Excellent OTC commodities liquidity

Cons

- No DMA commodities trading

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

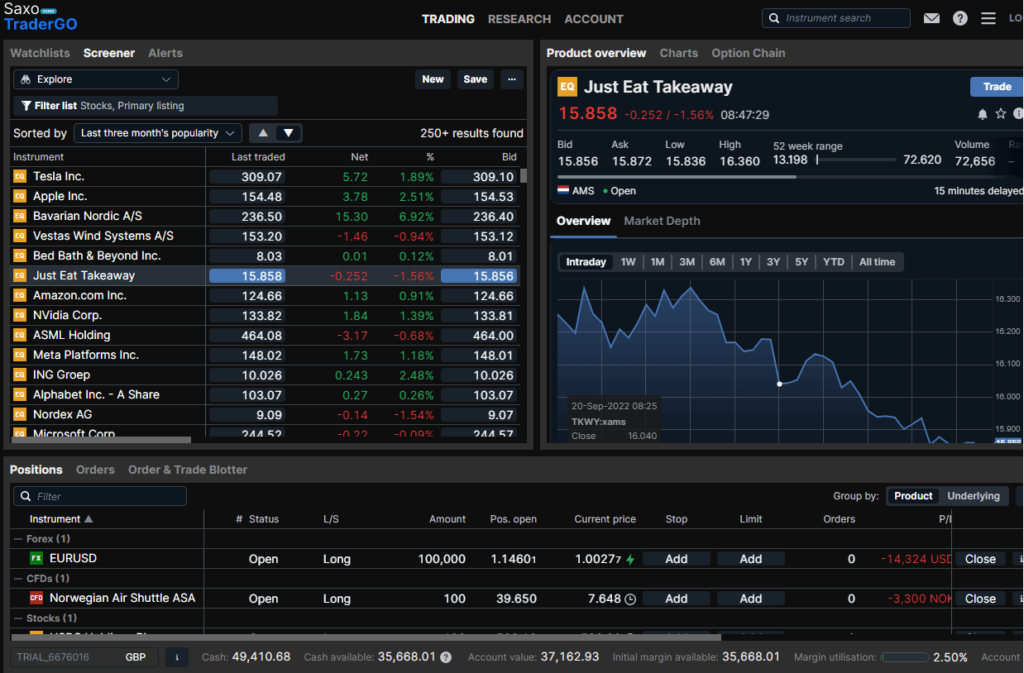

4.2Saxo Markets: Best for direct market access commodity trading

- Commodities markets available: 25

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Pricing: Gold 0.5, Oil 0.28

- GMG rating: (4.2)

- Customer rating: 3.6/5 (52 reviews)

70% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets Commodity Trading Review

Name: Saxo Markets Commodity Trading

Description: Saxo Markets customers can trade a wide range of commodities as CFDs, futures, options, spot pairs or exchange-traded commodities (ETCs) with tight spreads, integrated Trade Signals, news feeds and innovative risk-management features.

64% of retail investor accounts lose money when trading CFDs with this provider

Summary

- Commodities markets available: 25

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Pricing: Gold 0.5, Oil 0.28

Pros

- DMA commodities trading

- Professional platform

- Low commissions

Cons

- No commodities spread betting

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.2XTB: Good Commodity trading educational material

- Commodities markets available: 22

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Gold 0.35, Oil 0.3

- GMG rating: (4)

- Customer rating: 4.7/5 (117 reviews)

81% of retail investor accounts lose money when trading CFDs with this provider

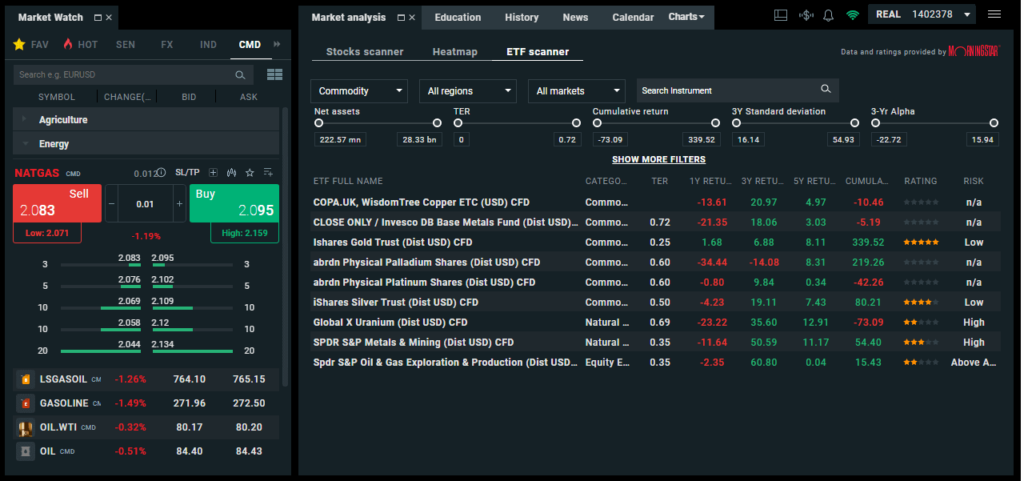

XTB Commodity Trading Review

Name: XTB Commodity Trading

Description: There are two ways to trade commodities with XTB, CFDs on the commodities, or commodity ETF CFDs. The ETF scanner provides quite a handy way to see what ratings Morningstar gives them, which can give you an indicate of how well they perform as investments.

81% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Commodities markets available: 22

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Gold 0.35, Oil 0.3

XTB also produce their own news and analysis, which features commodities that are approaching or have broken through key trading levels. It’s quite a nice touch that you can trade direct from the news article as well as place corresponding stops and limits.

If you would rather speculate on the outright price of the underlying commodities XTB groups commodity CFDs together by markets such as agriculture, energy, industrial metals, precious metals and livestock.

Pros

- Multi-asset trading

- Competitively priced

- Lots of markets to trade

Cons

- Not UK HQ’d

- No basket trading

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4eToro: Good for social and copy commodities trading

- Commodities markets available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Pricing: Gold 0.9, Oil 1.4

- GMG rating: (3.8)

- Customer rating: 3.4/5 (223 reviews)

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

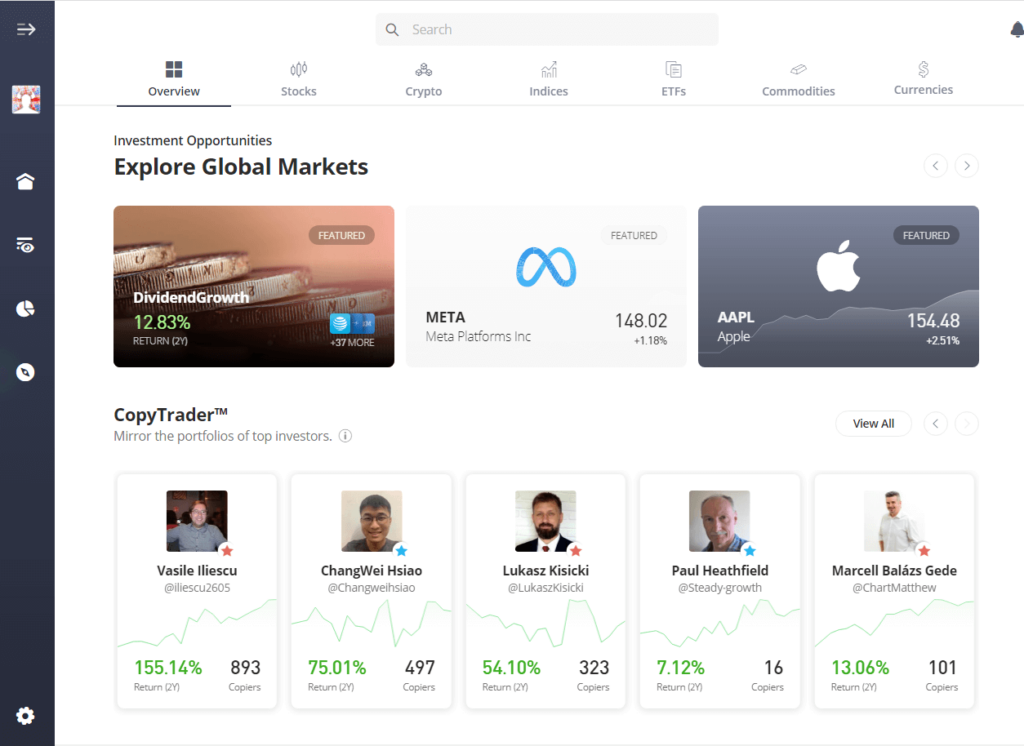

eToro Commodity Trading Review

Name: eToro Commodity Trading

Description: At eToro, trading commodities is straightforward. eToro’s platform is easy to use and enables traders and investors to trade a wide range of commodities. You also get the benefit of being able to set your own leverage when trading commodity CFDs, so you can reduce your risk by increasing your margin rates.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Summary

- Commodities markets available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Pricing: Gold 0.9, Oil 1.4

Pros

- Social and copy commodities trading

- Set you own commodities leverage

- Easy to use

Cons

- Accounts must be in USD

- High FX conversion charges

- No commodities spread betting or DMA trading

-

Pricing

(3.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(3.5)

-

Research & Analysis

(4)

Overall

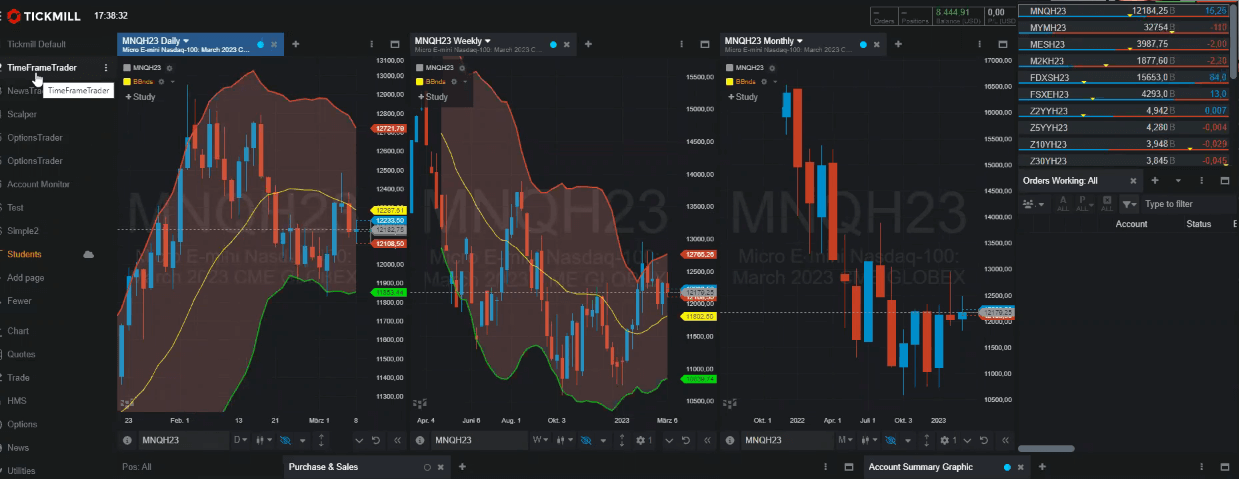

3.8Tickmill: MT4, MT5 & CQG commodity trading platforms

- Commodities markets available: 6

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: Gold 0.9, Oil 0.4

- GMG rating: (4)

- Customer rating: 0.0/5 (0 reviews)

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Commodity Trading Review

Name: Tickmill Commodity Trading

Description: Tickmill’s is a good choice for those wanting to scalp the commodity markets as they offer DMA commodities trading on CQG on mini and micro futures. Tickmill also offers tight spreads on MT4 & MT5 on the most popular commodity markets for those who want to automate their trading.

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

- Commodities markets available: 6

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: Gold 0.9, Oil 0.4

Pros

- DMA commodity trading

- Low-cost commodity CFDs

- Lots of platforms

Cons

- Limited commodities to trade

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4❓Methodology: We have chosen what we think are the best commodity trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the commodities brokers with real money

- an in-depth comparison of the features that make them stand out compared to alternative commodities trading platforms.

- interviews with the commodity broker CEOs and senior management

Compare Commodities Trading Platforms

You can use our comparison table of what we think are the best commodities brokers to compare how many commodities they offer, spreads, pricing, commissions and what types of accounts they offer that can help new commodity traders

| Commodity Trading Platform | Commodities Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 20 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 28 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 35 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 20 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 100+ | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 25 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 15 | $10 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 20 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 6 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 22 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 20 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 25 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Beginners

City Index is the best commodities broker we feature for beginners as the trading platform offers the most heavily traded commodity markets with good liquidity. City Index’s Smart Signal feature also provides unique trading signals on when to buy and sell and shows how successful they have been in the past. Once you have built up a few historic commodity trades their Performance Analytics will show you what commodities you are best at trading and which ones to avoid.

| Beginner Features: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Low-Risk Products | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Investment Account | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

Advanced & Professional Traders

Saxo Markets is a good choice for experienced commodity traders as in addition to commodity CFDs they also offer on-exchange commodity futures and options. The SaxoTraderGo platform is robust enough for institutional traders and provides a wide range of advanced order execution options.

See which trading platforms offer advanced commodity trading features.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

Account Types

Interactive Brokers and Saxo Markets offer the most account types. However, if you are a UK trader they do not offer financial spread betting on commodities. If you want to trade commodities with tax free profits, then IG, is the next best option. See which brokers offer the most ways to trade commodities in the below comparison table.

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Futures Trading

Saxo Markets is the best broker for trading commodities futures. Commodities futures allow traders to buy or sell a specific amount of a commodity at a specific date in the future. A farmer may use them to lock in the current market price and sell a harvest of corn before it has been grown, whereas a trader may use them to speculate on the price of corn moving higher or lower in the hope of making a profit.

A commodities futures broker will provide access through futures trading to commodities exchanges such as the CME or CBOT. Our guide on how to trade futures explains the risks and rewards of futures trading.

Trading Options

Interactive Brokers is the best broker for trading commodity options as they have one of the most complex options dealing systems on their desktop platform and access to most commodity options exchanges.

Commodities options are traded on exchange-like futures and can be used for physical trading or speculation. Commodities options differ from commodities futures in that you are trading the right to a certain amount of a commodity at a certain point in the future, not the obligation. Here’s how options trading works.

CFDs

CMC Markets is the best broker for commodity CFD trading as they provide over 100 commodity markets based on cash or forward prices. You can also see what percentage of CMC Markets clients are long or short a particular commodity, then filter that by profitable clients to use as a leading or contrarian indicator.

Trading commodities via CFDs enables traders to speculate on the price of commodities with leverage. Leveraged trading enables traders to enter into a “contract for difference” based on the opening and closing prices of a trade. The user of margin means that traders only need to deposit a small percentage of the value of the commodities they are trading through a commodities broker which increases their exposure to the market. Commodities CFDs are OTC (over-the-counter) derivatives products which means that traders never actually own the underlying commodities. They are simply speculating on the price.

Spread Betting

IG is the best broker for spread betting on commodities, as because of their size they can offer some of the best liquidity on commodity spread bets. They are also the oldest commodity spread betting provider having been founded in 1974 as “Investors Gold Index” to enable non-professional clients to bet on the price of gold.

Spread betting on commodities is another form of OTC margin speculation and allows traders to bet on the price movement of commodities. The key advantages over CFDs are that in the UK there is no capital gains tax on spread betting profits. Because of this commodity spread betting is unique to the UK. Commodities spread betting should not be confused with futures spread trading which speculates on the divergence between different monthly futures.

ETFs

IG is the best broker for commodity ETFs as you can either buy exchanged traded funds in an ISA, or investment account in the long term or trade in the short term as a spread bet or CFD.

Trading commodities through ETFs can be done through most stockbrokers and investment platforms. Commodity ETFs are traded on stock exchanges like shares and can be held in normal accounts, ISAs and SIPPs. The price of commodities ETFs tracks the price of underlying commodities thus providing a simple way for investors to get exposure to commodity markets without entering into traditional derivatives contracts.

Market Access

CMC Markets offers the most commodities to trade, with over 100 markets available.

See which commodities broker offers the most commodities as well as other markets for traders.

| Market Access: |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 9000 | 5233 | 10000 | 8,000 | 3700 | 2,100 |

| Forex Pairs | 84 | 51 | 338 | 62 | 182 | 100 | 54 | 20 | 138 | 57 |

| Commodities | 25 | 38 | 124 | 32 | 19 | 20 | 20 | 10 | 28 | 22 |

| Indices | 21 | 34 | 82 | 28 | 29 | 13 | 17 | 10 | 23 | 25 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 5000 | 500 | 1575 | na | 450 | 230 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2000 | 3500 | 2110 | na | 1575 | 1080 |

| ETFs | n/a | 2000 | 1084 | 107 | 675 | 1100 | 160 | na | 0 | 138 |

⚠️ FCA Regulation

All commodities trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK commodity brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature commodity trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.

Commodities Trading Platform FAQ:

The main things to consider when choosing a commodities broker are:

- Are they right for your level of experience?

- How many commodities do they offer?

- What are the commissions and fees?

- How can you trade commodities?

- What sort of added value does the broker offer?

In this guide to the best brokers for trading commodities, we will go through each point and highlight which broker is best for each point so you can make the best choice for the specific type of commodity trading you do.

A commodities broker will set up a trading account, so you can trade on commodities direct on a commodities exchange like CME (Chicago Mercantile Exchange) or LME (London Metal Exchange) using their exchange membership or via OTC derivatives products like CFDs or financial spread bets.

The main ways to trade through a commodities broker are:

- Futures

- Options

- CFDs

- Spread Betting

- ETFs

Yes, if you call the market correctly, you can make money trading commodities. However, commodities trading is a high risk and it’s important to note that only around 20% of retail commodity traders make money.

As a financial instrument in the UK commodities trading is regulated by the FCA.

The most popular commodities on trading platforms are:

- Crude Oil

- Gold

- Corn

- Natural Gas

- Soybean

- Silver

- Wheat

- Coffee

- Cotton

- Copper

Commodities brokers make money through fees and financing charges. Commodity broker costs can be broken down depending on how a commodity is traded.

The different types of commodities brokers make money and charge clients thus:

- Futures – commission charge on a per lot basis

- Options – commission charged on a per lot basis

- CFDs – the bid/offer spread is widened, and overnight interest is charged on positions

- Spread Betting – the bid/offer spread is widened, and overnight interest is charged on positions

- ETFs – commission charge on buys and sells, plus an account maintenance charge

Yes, forex brokers tend to offer commodities as they are quite similar in popularity. The best forex broker for trading commodities is IG, as they offer a large market range with competitive pricing.

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the commodity brokers via a non-affiliate link, you can view their commodities trading pages directly here: