We have ranked, compared and reviewed what we think are some of the best forex brokers & FX trading platforms in the UK that are regulated by the FCA.

City Index: Best forex trading platform trader tools

- Forex pairs available: 182

- Minimum deposit: £100

- Account types: CFDs & spread betting

- FX overnight financing: 2.5% +/- SOFR

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

- GMG rating: (4.3)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Forex Trading Review

Product Name: City Index Forex Trading

Product Description: City Index won “best forex broker” in our 2022 awards as they offer a huge amount of forex pairs (182), with tight pricing and a wide range of different account types, including spread betting and CFDs.

70% of retail investor accounts lose money when trading CFDs with this provider

Summary

- Forex pairs available: 182

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SOFR

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

Added Value:

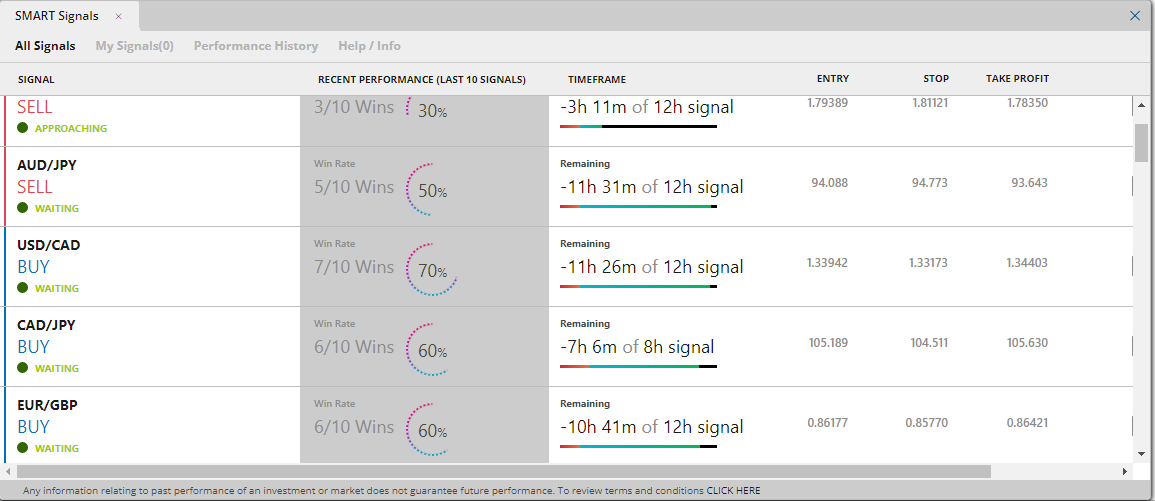

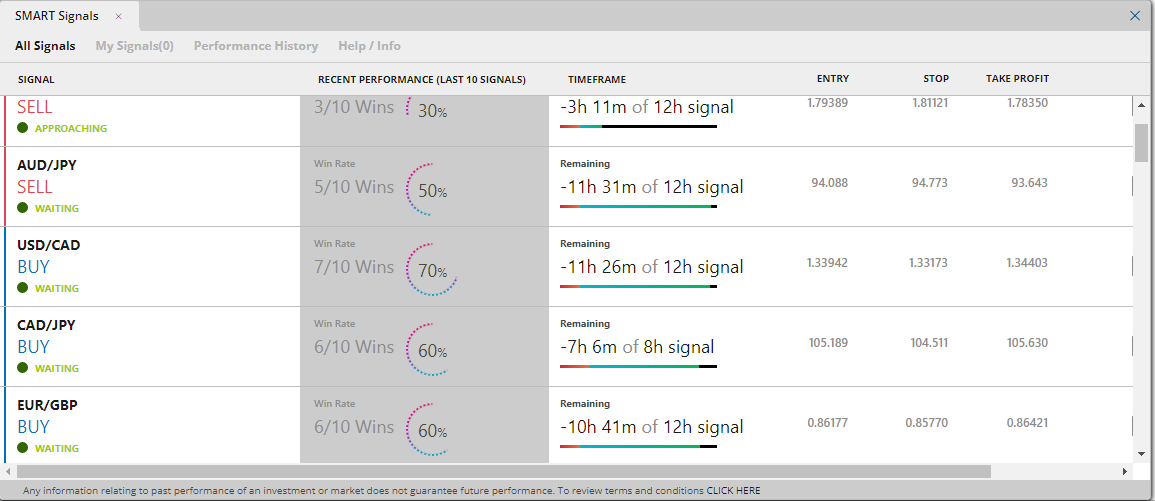

For forex traders that want a bit of added value rather than just a click-and-trade account, they also offer free Forex trading signals through SMART Signals City Index also provides some insightful analysis of your previous forex trading with their Performance Analytics.

Trading Platform:

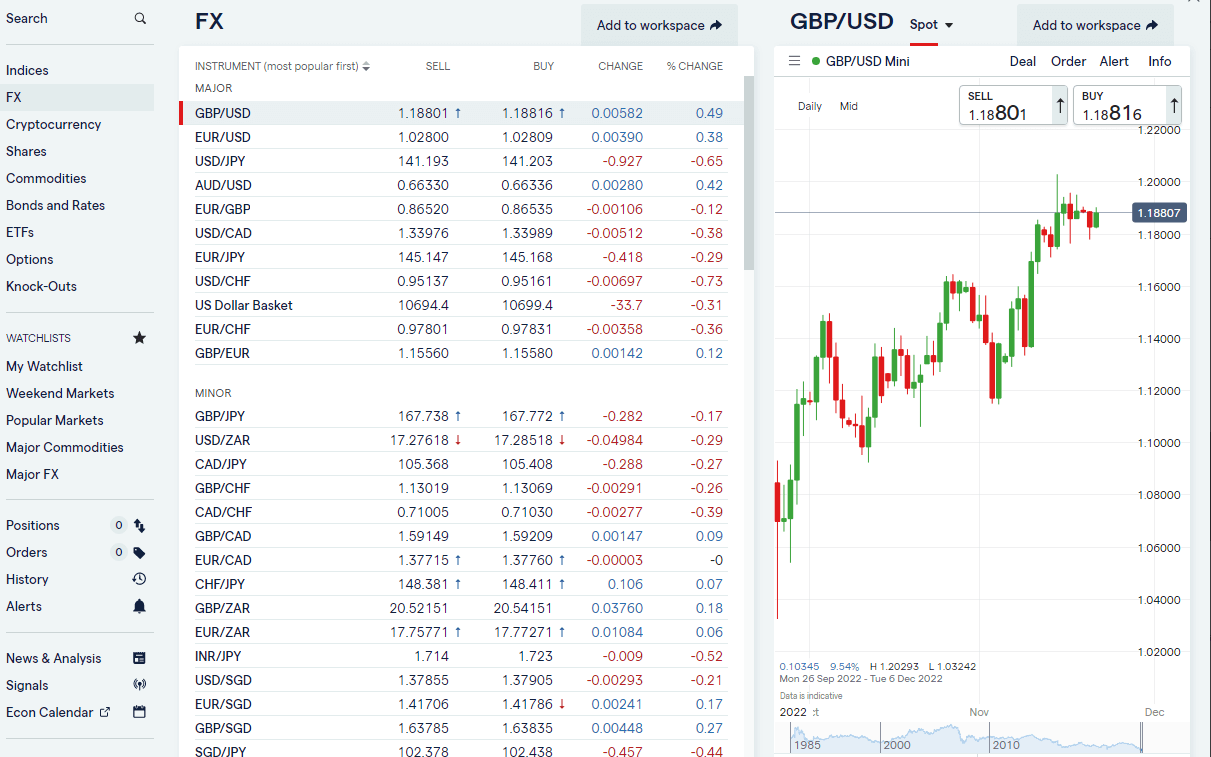

On the FX trading platform, currency pairs are listed by major pairs and also separated by base currency so you can easily see EUR, USD and GBP FX crosses. You can trade forex options as a CFD or spread bet. As well as trading FX, you can also invest in the currency markets through a range of ProShares and Invesco ETFs. One really nice feature of the platform is that when you trade forex you can set your price tolerance, so if you want to place a limit order rather than market or fill or kill, you will still get filled within a few pips (depending on how many you set) of your limit rather than missing out entirely.

Trading Signals:

Trading Central is also integrated into the platform, which will show you which currency pairs have the most “market buzz” and see a constantly updated stream of technical analysis highlighting potential forex trades with pivot points, an indication of whether to go long or short, alternative scenarios and key support and resistance levels.

Pros

- Smart forex trading signals

- Post forex trade success analytics

- Forex trading news, research and analysis

Cons

- No on-exchange forex futures

- Forex options only as a CFD or spread bet

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.3Pepperstone: Good for automated forex trading strategies

- Forex pairs available: 100

- Minimum deposit: £1

- Account types: CFDs, spread betting

- FX overnight financing: (1/FX Rate) * (Trade Size*Tom Next)

- Pricing: EURUSD 0.1, GBPUSD 0.4, USDJPY 0.4

- GMG rating: (4)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Forex Trading Review

Product Name: Pepperstone Forex Trading

Product Description: Pepperstone has four forex trading platforms, MT4/MT5, cTrader and TradingView and is generally one of the cheapest brokers for forex trading. Forex trading is cheap with Pepperstone because they focus on FX as a core market rather than offering lots of stocks and less popular assets.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Summary

- Forex pairs available: 100

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: (1/FX Rate) * (Trade Size*Tom Next)

- Pricing: EURUSD 0.1, GBPUSD 0.4, USDJPY 0.4

Tight Pricing

Pepperstone are able to offer some of the tightest forex spreads and commission for major FX pairs. You can also trade minor and exotic FX crosses as a spread bet or trade CFD. Although no currency futures or options. Liquidity, pricing, and execution time on Pepperstone’s platform are good, given its access to multiple Tier 1 banks.

MT4/MT5

Pepperstone’s USP, when compared to other forex brokers, is their MT4 offering for traders who want to automate their forex trading strategies. Pepperstone has done partnerships with FX Blue which measures currency strength and also has a free (for clients) package of MT4 indicators which can be used to set up and simulate, then go live with trading algorithms based on technical indicators and price action.

Forex Trading Platform

For forex traders, who want manual execution, the cTrader forex trading platform offers good functionality where you can trade directly from the charts, as well as drag and drop stops and limits.

You can also trade forex via TradiingView and if you are in the UK, Pepperstone is one of the view firms that lets you trade on TradingView as spread bets.

Pros

- Good MT4 forex indicator package

- Automated forex trading

- Tight forex spreads

Cons

- No forex futures or options

- Limited forex pairs

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4Spreadex: Best forex broker for customer service

- Forex pairs available: 60

- Minimum deposit: £1

- Account types: CFDs, spread betting

- FX overnight financing: Tom Next +0.8%

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

- GMG rating: (4.3)

- Customer rating: 4.2/5 (177 reviews)

64% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Forex Trading Review

Product Name: Spreadex Forex Trading

Product Description: Spreadex focuses on tax-efficient forex spread betting but has recently added the ability for traders outside of the UK to use their platform by trading Forex CFDs. The platform has recently had a facelift and provides a very clear overview of the major markets, with clear order tickets, with key fx pairs trading info prominently displayed.

Summary

- Forex pairs available: 60

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: Tom Next +0.8%

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

Customer Service

One of the key benefits of Spreadex’s forex trading platform, is customer service. They have experienced dealers, that you can quickly get through on the phone, or via the platform’s chat functionality, plus voice brokerage. The ability to trade forex over the phone is something that few brokers offer nowadays, so it’s good to know that you still can, if you need to.

Forex Trading Platform

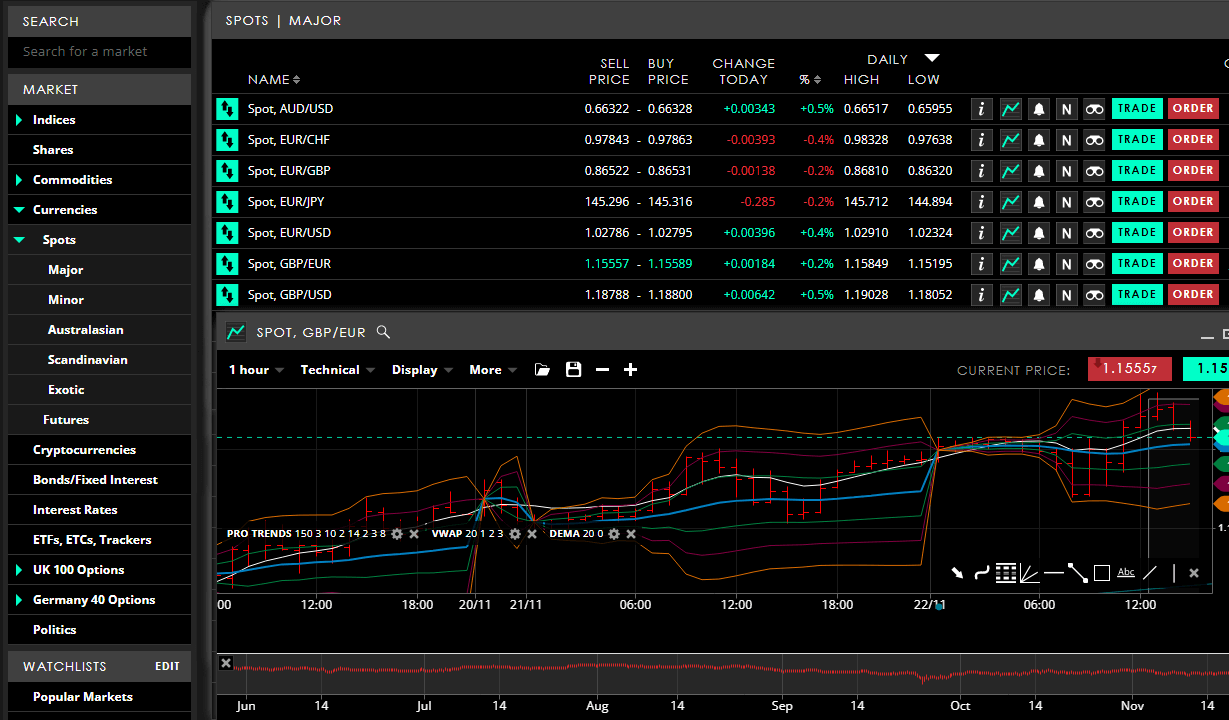

The desktop version of the forex trading platform is tabular which saves automatically on exit so you can spread it over multiply screens in one browser, window or detach modules to run separately. Spreadex, have built the trading platform in house, and they have some very good charting functionality where it is quick and easy to overlay technical indicators, that other forex brokers do not offer like VWAP.

Usability

It’s a good platform to get started on as you can trade forex from as little as £0.5 a point. One advantage of spread betting on forex is that your P&L will be in £, so you do not have to worry about FX fees on your resulting profit and loss. Spreadex also offers guaranteed stop losses, for added risk management and trailing stops, which move along with your profitable positions. For forex traders, that look at futures levels, you can also work limits with a time limit, so you don’t need to worry about leaving GTC orders open indefinitely.

Pros

- Excellent customer service

- Good range of FX pairs

- Competitive overnight financing rates

Cons

- No DMA forex trading

- Limited FX options

-

Pricing

(4)

-

Market Access

(5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(3.5)

Overall

4.3CMC Markets: Best forex broker 2023

- Forex pairs available: 338

- Minimum deposit: £1

- Account types: CFDs, spread betting

- FX overnight financing: Tom Next +0.98%

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

- GMG rating: (4.6)

- Customer rating: 3.6/5 (107 reviews)

67% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Forex Trading

Product Name: CMC Markets Forex Trading

Product Description: CMC Markets is suitable for forex traders who want tight pricing with robust technology, but also the options to trade peripheral markets should opportunities occur. CMC Markets won three awards in 2020 for its FX product, including our own Good Money Guide Best Forex Broker award in 2023, and it remains one of the best services out there.

Summary

- Forex pairs available: 338

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: Tom Next +0.98%

- Pricing: EURUSD 0.9, GBPUSD 0.9, USDJPY 0.9

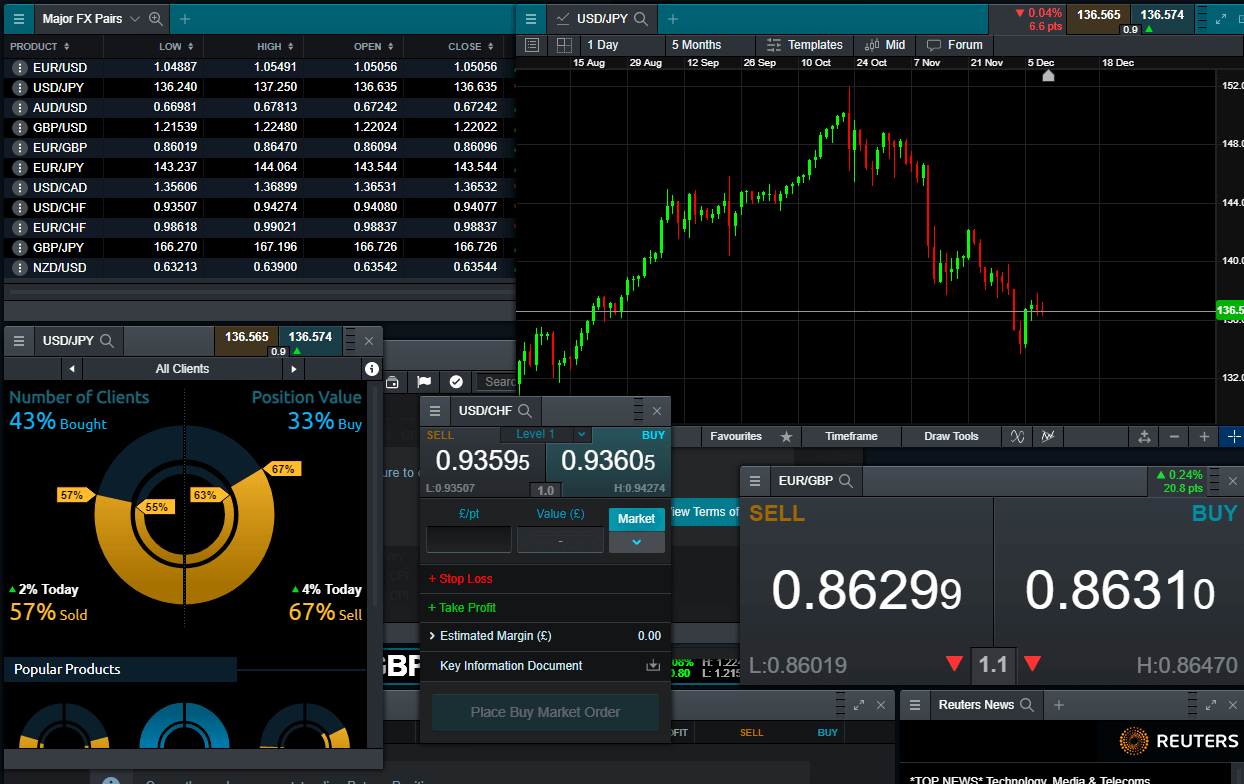

Based on our broker matrix CMC Markets offers the most currency pairs of all the forex brokers we compare. 338 at last count. This is made up of both cash markets, but also CFDs and spread bets based on future prices (not DMA futures, but OTC derivatives based on the cost of carry). The Fx platform lets you rank all 388 fx pairs based on change and market so you can see what is most volatile and what are the cheapest and most expensive crosses to trade. They are also split into developed markets, which will traditionally have more liquidity and emerging markets, where prices may be more volatile.

Prime Forex Services

However, as well as being a client-facing forex broker, CMC Markets also provide liquidity to a wide range of smaller brokers. This means that there should always be good FX liquidity capable of filling large and high-frequency orders from even the most active traders.

And of course, you can see what other traders on the CMC platform think of specific forex markets with the “market pulse” tools. The client sentiment indicator shows how many clients are long or short an FX market, and the Chart forum gives analyst views from a technical perspective.

Forex Trading Platform:

There are a few things that are unique to CMC’s forex trading platform, which are quite handy, for example, the web version is modular so you can set it to update all windows (news, pricing, sentiment, charts etc.) when you click on a new pair, or you can keep them separate. Which can give you either a good market overview, or let you focus on an individual asset.

They also have 12 “Forex Indices” which are baskets of currency pairs that track the same base currency. So instead of speculating on the USD versus a specific currency, you can speculate on how the USD will perform against a broad range of economies, like a sector position in stock trading.

There are a couple of FX ETFs to trade that track GBP, EUR and USD, but there are no OTC options markets, nor can you trade on exchange futures with DMA.

Pros

- Tech-heavy FX trading platform

- Wide range of forex pairs to trade

- Good forex sentiment indicators

Cons

- No DMA forex trading for retail clients

- Limited forex option

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.6Interactive Brokers: Good for advanced and professional forex traders

- Forex pairs available: 100

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- FX overnight financing: -3.188% / -1.188% (BM -/+ 1%)

- Pricing: EURUSD 0.0008%, GBPUSD 0.0008%, USDJPY 0.0008%

- GMG rating: (4.3)

- Customer rating: 4.4/5 (758 reviews)

62.5% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Forex Trading Review

Product Name: Interactive Brokers Forex Trading

Product Description: Interactive Brokers is by far the most advanced forex broker we feature if you need it to be. Interactive Brokers is one of the best forex trading platforms for advanced and experienced traders but is also simple enough to be used by beginners who want to stick with one brokerage as they progress.

Summary

- Forex pairs available: 100

- Minimum deposit: £2,000

- Account types: CFDs, DMA, futures & options, investing

- Equity overnight financing: -3.188% / -1.188% (BM -/+ 1%)

- Pricing: EURUSD 0.0008%, GBPUSD 0.0008%, USDJPY 0.0008%

Forex Trading Platform:

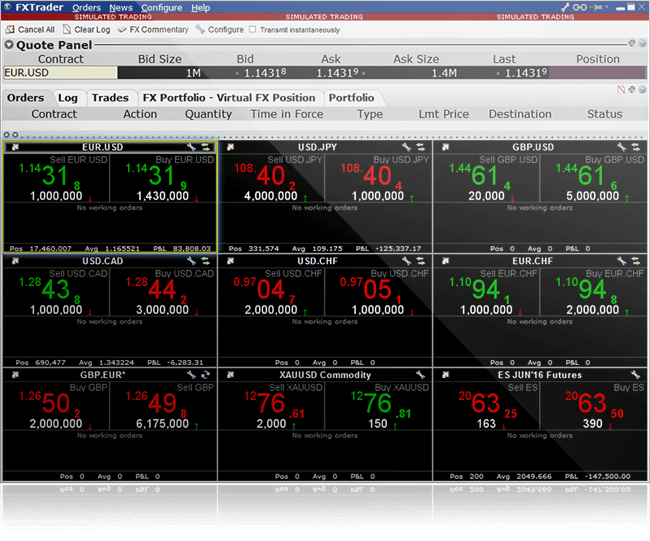

IBKR has two different forex trading platforms, IBKR Trader Workstation for advanced traders, which comes with some very complete order routing tools for larger orders. The Interactive Brokers web portal platform is much more suited to more casual forex traders and lets you go long or short currency pairs based on position size rather than lots by placing limit, and market entry orders and you can set your stop and limited exit orders based on P&L rather than price.

It’s also worth noting that if you want to trade margin products with Interactive Brokers you need at least $2,000 in your account.

Pros

- Lots of FX pairs

- Excellent forex trading platform

- Low commission on raw prices

Cons

- No guaranteed stops

- No spread betting

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(3)

-

Research & Analysis

(3.5)

Overall

4.3IG: Excellent all-round forex trading platform for most types of FX trader

- Forex pairs available: 51

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- FX overnight financing: Tom Next +0.8%

- Pricing: EURUSD 0.9, GBPUSD 0.6, USDJPY 0.9

- GMG rating: (4.3)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Forex Trading Review

Product Name: IG Forex Trading

Product Description: Due to its size, IG offers some of the best liquidity for forex trading, meaning that smaller clients get tight pricing and high-volume forex traders won’t find it hard to execute larger orders. IG’s forex trading offering is one of the best around with a wide-ranging and competitive margin FX service across several dealing platforms which will comfortably meet most retail traders’ needs.

Summary

- Forex pairs available: 51

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Equity overnight financing: Tom Next +0.8%

- Pricing: EURUSD 0.9, GBPUSD 0.6, USDJPY 0.9

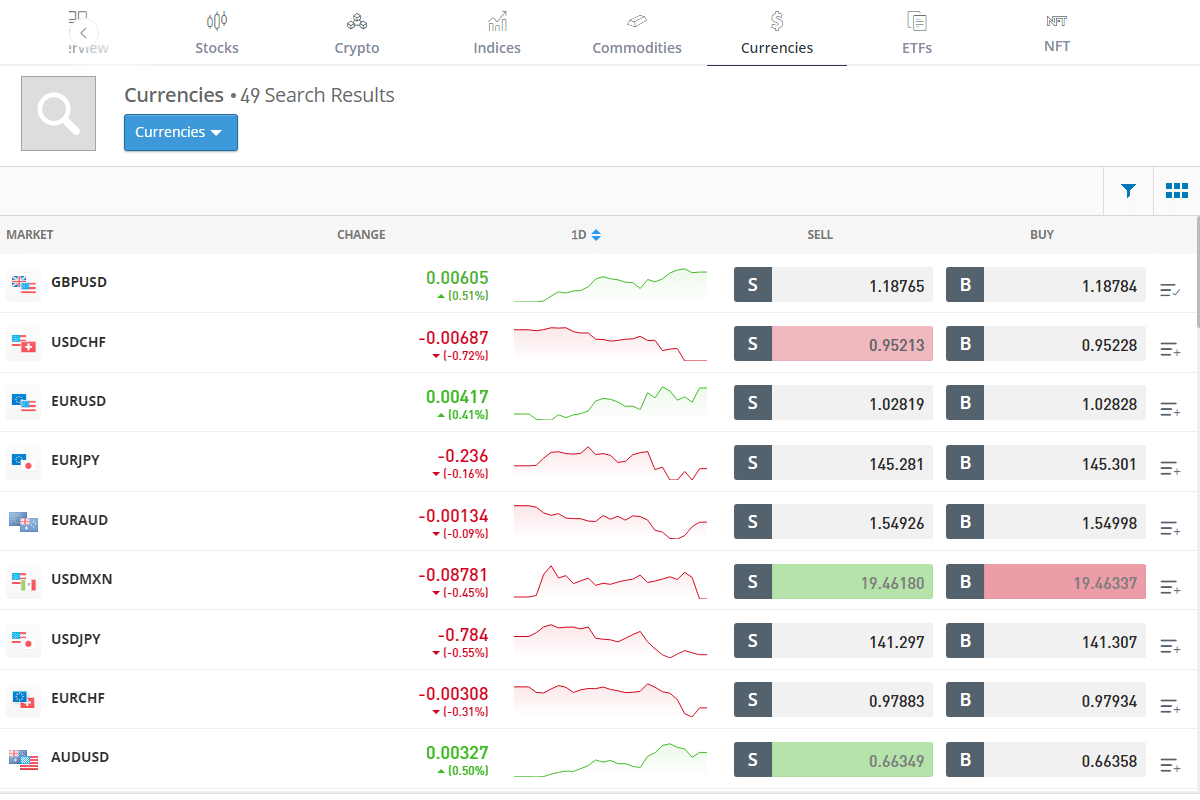

You can trade forex as either a spread bet or CFD in the UK, and on the platform forex pairs are grouped by, major, minor, exotic and emerging crosses, which is rankable by the popularity of an FX pair.

Forex Signals

You can also hunt out upcoming trading signals, which are directly linked to a trading ticket (with corresponding stops and limits) for quick execution. These stops can be guaranteed stops (which will always be filled at your price no matter is the market gaps below) or trailing stops that move based on how profitable your position is).

Forex Options

You can trade forex options on a daily, weekly or quarterly basis for major pairs from £1 per point, if you want to take limited-risk forex positions. One of the lesser used but most helpful features through is the ability to trade forex when others can’t over the weekend. IG provides a weekend market for EURUSD, GBPUSD and USDJPY on Saturday and Sunday. Pricing is obviously wider, it does help provide some more control over your positions.

Forex Trading Platform

To trade an individual forex pair, the platform “workspace” gives a good overview with quick access to news, analysis, and integrated trading signals (from Autochartists and PIA). The market data page also gives some good indicators of IG client sentiment, how much a forex pair has been traded within the last hour and month, what excepted price ranges are and what volatility has been like.

Pros

- Excellent range of forex pairs

- Good forex news, analysis and signals

- Deep FX liquidity

Cons

- No forex futures

- Forex options only available as a CFD or spread bet

-

Pricing

(4)

-

Market Access

(5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.3XTB: Good Forex trading educational material

- Forex pairs available: 57

- Minimum deposit: £1

- Account types: CFDs

- FX overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: EURUSD 0.9, GBPUSD 1.4, USDJPY 1.4

- GMG rating: (3.7)

- Customer rating: 4.7/5 (117 reviews)

77% of retail investor accounts lose money when trading CFDs with this provider

XTB Forex Trading Review

Product Name: XTB Forex Trading

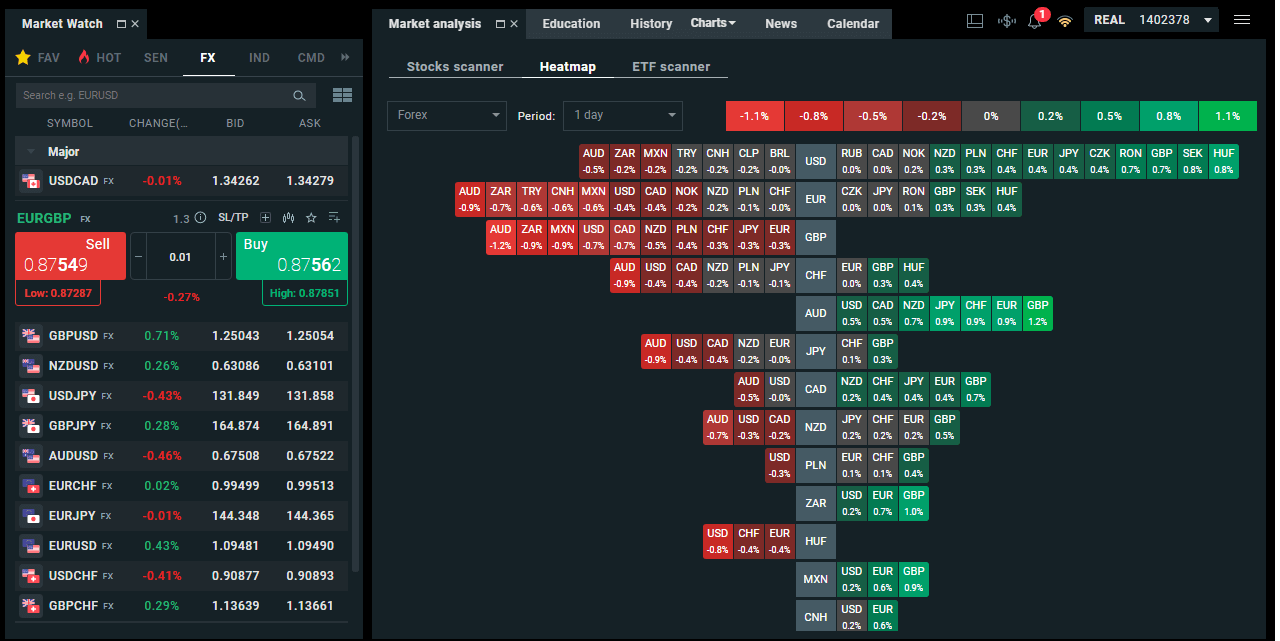

Product Description: You get a little bit more than just point and click when trading forex with XTB. Specifically, XTB produce their own currency news, have an excellent FX heat map function and simple dealing ticket. Some brokers I feel overcomplicate their forex layout, but XTB, has all the pertinent information where you need it.

Summary

- Forex pairs available: 57

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: EURUSD 0.9, GBPUSD 1.4, USDJPY 1.4

Trading Platform:

One feature I particularly like on the dealing ticket is that the spread is shown as both a spread and pip, with pip value and daily swap (overnight funding) costs clearly displayed. Plus you can see the performance of where a currency pair sits within the one day range compared to the other major forex pairs.

Pros

- Multi-asset trading

- Competitively priced

- Lots of markets to trade

Cons

- Not UK HQ’d

- No basket trading

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(3.5)

-

Research & Analysis

(3.5)

Overall

3.7Saxo Markets: Excellent on-exchange and DMA forex trading platform

- Forex pairs available: 84

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- FX overnight financing: Tom/Next Swap +/-0.60%

- Pricing: EURUSD 0.7, GBPUSD 0.7, USDJPY 0.7

- GMG rating: (4.6)

- Customer rating: 3.6/5 (52 reviews)

64% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets Forex Trading

Product Name: Saxo Markets Forex Trading

Product Description: Saxo Markets is an excellent forex broker suitable for experienced traders who want a robust forex trading platform with an institutional pedigree. The ability to trade on exchange forex futures or on-exchange FX options gives Saxo Markets the edge over most forex brokers who just offer CFDs or spot FX.

Summary

- Forex pairs available: 84

- Minimum deposit: £1

- Account types: CFDs, futures & options, DMA, investing

- Equity overnight financing: Tom/Next Swap +/-0.60%

- Pricing: EURUSD 0.7, GBPUSD 0.7, USDJPY 0.7

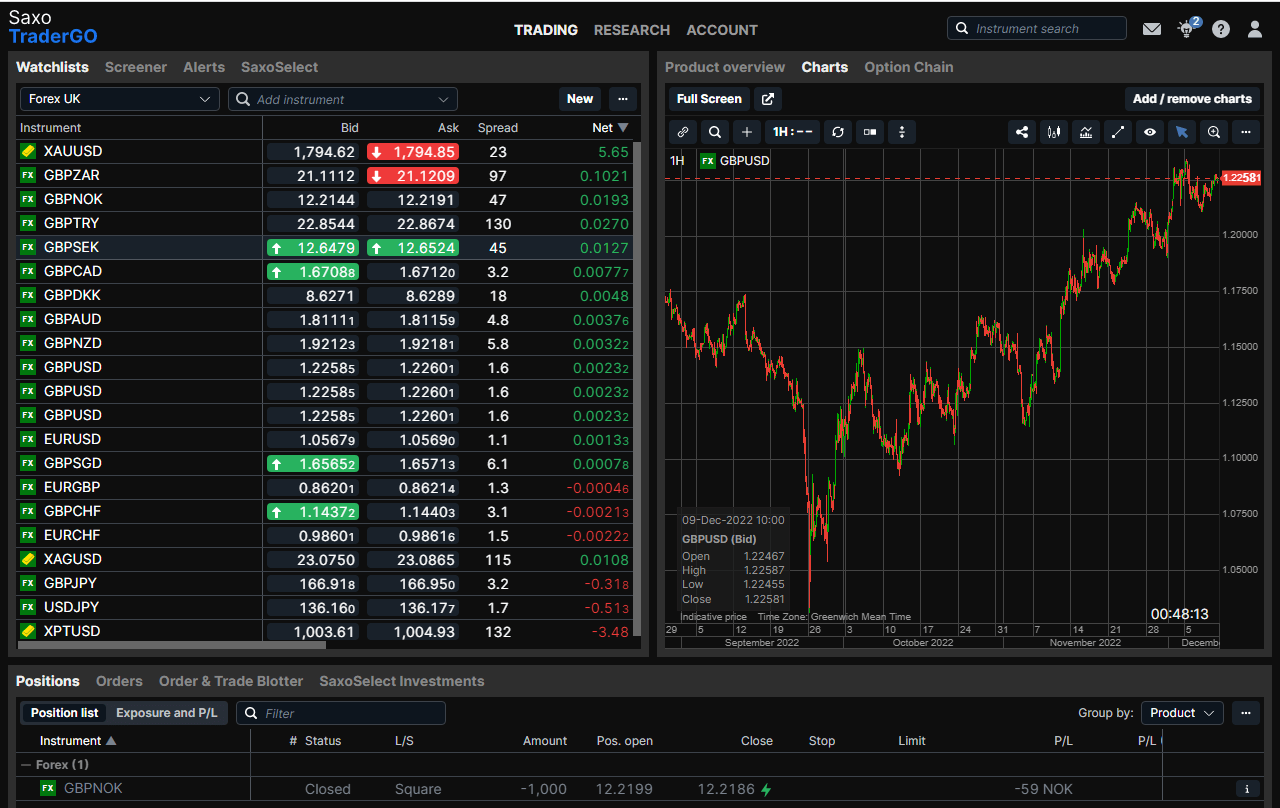

Saxo Markets offers traders a choice of their own proprietary forex trading platform SaxoTraderGo, as well as MT4, although SaxoTraderGo, is in my view by far the better platform. You can view major forex pairs and rank them by performance, change of various timescales, volume on the bid/offer, market spreads.

Forex Trading Ideas

If you need trading ideas, in the standard FX watchlist you can also see emerging, bullist and bearish forex trading signals. Once you click on a signal (which is displayed based on the time scale, 1D, 4h, 30 mins etc.) an order ticket is created that gives the expected direction, the technical pattern name and type as well as the success probability, the quality of the signal and the option to add a stop loss or take profit limit. You can also filter Forex pairs, by percentage returns sub-categorising major, minor and exotic markets.

Research

Saxo Markets forex trading research tab on the platform also provides insights from their analysts, about which markets are in focus and what economic indicators may have an upcoming affect on prices. They have also have good educational articles, videos and podcasts for those that want to learn more about forex trading risk management.

Forex Trading Platform

Despite being an institutional grade forex trading platform, I actually fine it one of the easiest to use, with the ability to drag and drop a forex pair between charting, options chains, research and your positions tab.

Pros

- DMA & on-exchange forex futures and options

- Good forex analysis and research

- Discounted forex pricing for large accounts

Cons

- No forex spread betting

- High minimum deposit of £500

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.6eToro: A simple forex trading interface and the ability to control your leverage

- Forex pairs available: 41

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- FX overnight financing: 6.4% +/-2.9 SONIA

- Pricing: EURUSD 0.8, GBPUSD 2, USDJPY 0.8

- GMG rating: (3)

- Customer rating: 3.4/5 (223 reviews)

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Forex Trading Review

Product Name: eToro Forex Trading

Product Description: There are two aspects to eToro’s forex trading offering that makes it stand out. Social trading where you can copy other forex traders trades and the ability to set your own leverage. As forex trading is notoriously difficult, and I would say that the majority of eToro’s client are early-stage traders, the ability to reduce the amount of leverage is a very useful.

Summary

- Forex pairs available: 41

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Equity overnight financing: 6.4% +/-2.9 SONIA

- Pricing: EURUSD 0.8, GBPUSD 2, USDJPY 0.8

Forex Leverage Control

When you reduce your leverage it means you reduce your risk, by putting up more margin when trading forex. So, for example, when you open a forex dealing ticket, your leverage is set at 30x, but you can reduce this to 1x. Meaning that if you want to speculate on $1,000 of GBPUSD, on 30x leverage, you would only have to put up $41 in initial margin, meaning you are potentially risking $959 that you don’t have. But, if you set your leverage to 1X yo have to put up the whole, $1,000 which reduces the temptation to take on excessive risk, with money you do not have.

Forex Copy Trading

The other feature that is unique to eToro is the ability to follow other forex traders through copy trading. However, it should be noted, though that if you are planning to trade forex by copying what other traders do it can be as hard as choosing your own trades. Just because a trader has done well in the past or if you think their trading ideas look good it does not mean they will be profitable in the future. Social trading is really only good for idea generation, which means you ultimately have to decide if you agree or disagree with another traders outlook.

Forex Trading Platform

Pros

- Social and copy forex trading

- Easy-to-use forex platform

- Can change your FX leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Limited FX market range

-

Pricing

(3)

-

Market Access

(3)

-

Online Platform

(3)

-

Customer Service

(3)

-

Research & Analysis

(3)

Overall

3Tickmill: MT4 & CQG forex trading platforms

- Markets available: 62

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: EURUSD 0.1, GBPUSD 0.3, USDJPY 0.1

- GMG rating: (4.1)

- Customer rating: 0.0/5 (0 reviews)

71% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Tickmill Forex Trading Review

Product Name: Tickmill Forex Trading

Product Description: One thing that makes Tickmill’s forex trading stand out is the range of platforms and ways to trade. You can trade forex CFDs on MT4 & MT5 or you can trade forex with DMA (Direct Market Access) on mini, micro and standard futures contracts with CQG.

Summary

- Markets available: 62

- Minimum deposit: £100

- Account types: CFDs, futures & options

- Pricing: EURUSD 0.1, GBPUSD 0.3, USDJPY 0.1

Tickmill Forex Trading Platform

Pros

- DMA forex trading

- Low-cost forex spreads

- Wide choice of forex platforms

Cons

- No financial spread betting

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1❓Methodology: We have chosen what we think are the best forex trading platforms in the UK based on:

- over 17,000 votes in our annual awards

- our own experiences testing the forex brokers with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the brokers CEO and senior management

How To Choose A Forex Broker

When choosing a forex broker, there are several key points to look out for, but most importantly, you need to choose a broker that’s the right fit for you. One that matches your trading knowledge, abilities and finances, and other requirements. For example, new traders are unlikely to benefit from opening an account with a broker that’s aimed at experienced algorithmic traders, and those traders won’t thrive in an environment designed for beginners.

The main things to consider when choosing a forex broker are:

- Usability – if you are new to forex trading you will want a forex broker that offers a simple trading platform. As if you are using a professional forex trading platform it will be overwhelmingly complicated

- Added Value, Research & Analysis – how much does it cost to trade and how wide are the spreads

- Professional Services – if you are an experienced forex trader you will need a broker that offers advanced order types and professional leverage and pricing.

- Market Access – how many forex pairs do they offer? This increases the universe of potential currency pairs you can trade.

- Account types – does the forex broker offer spread betting, spot, CFD and DMA trading?

- Leverage & Margin – this relates to how far you can stretch your money and maximise your exposure. The more leverage the higher the risk makes forex trading very risky.

In the below section, we cover all of these points in detail and also highlight our choices for the best UK forex brokers and trading platforms for each category.

Different Types Of Forex Brokers

These are the main different types of forex trading:

- Spot – where you buy and sell physical currency in full or on margin

- CFDs – “contracts for difference” is when you technically enter into a contract based on the opening and closing price of a trade. However, in reality it is similar to Spot

- Spread Betting – is placing a bet for an amount per pip a currency pair moves

- Futures – on exchange futures contracts are for set amounts and for certain dates in the futures, usually for more experienced traders

- Options – you can either trade on exchange or OTC currency options, through a options trading platform

You can find out more about their forex brokerage service in our video interview with Ryan O’Doherty from CMC Markets

Compare Forex Brokers

| Forex Broker | Forex Pairs | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 182 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 100 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 51 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 60 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 84 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 100 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 338 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 41 | $10 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 62 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 80 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. |

Best Overall

CMC Markets won “best forex broker” at our 2023 awards. CMC Markets consistently offers the most fx pairs, tightest spreads and best trading technology for retail forex traders. They are also a well-established, capitalised and public company. In this interview with CMC Markets, we cover what forex trading is, why and if you should trade forex, what forex pairs to trade, types of forex orders, what are the main risks of forex trading, trading forex around economic figures, technical analysis versus fundamental analysis as well as managing fx risk.

Beginners

City Index is one of the best forex brokers for beginners as it has a wealth of educational videos, analysis and trading signals as well as offers forex CFDs and spread betting.

Established names like IG Group score well as a broker for those that are new to trading or have a small deposit. However, there are alternatives to consider as well. Both CMC Markets and Spreadex can accommodate smaller deposits and new forex traders. Both of these businesses have straightforward intuitive trading platforms.

You can see in this comparison table which forex brokers offer beginner-friendly features like educational tools, leverage control, forex trading signals and lower-risk currency investment products.

| Beginner Features: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Low-Risk Products | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Investment Account | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

Trading with smaller deposits is popular among new traders who are reluctant or unable to commit a large amount of capital to FX trading. Over time, they may increase their trading deposit as they become more familiar with the way FX trading works and more confident in their ability to make a return on their trading capital.

- Further reading: If you are new to forex see our how to trade forex guide

Please also note that trading forex on leverage is not suitable for complete beginners. For a limited risk way to speculate on currencies you might want to consider purchasing an ETF that tracks a currency pair.

Added Value, Research & Analysis

City Index offers the most trading signals (though Smart Signals and Trading Central) and constantly updated analysis and FX news flow. Here is an example of their forex trading signals which displays whether a signal is a buy or sell, it’s time frame and the historic performance.

In our forex platform reviews, we always highlight what a platform does to help traders perform. For example, IG has trading signals from Autochartist, City Index has SMART Signals and CMC Markets provides information on what their profitable clients are trading so you can see where the “smart money” is going.

This comparison table shows which forex brokers add value by providing tools like post-trade analysis (so you can see where you trade well), client sentiment indicators (that show if traders are long or short an FX pair), news, analysis and trading ideas.

| Added Value: |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Trading Ideas | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Client Sentiment | ❌ | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

| Post Trade Analytics | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ❌ |

| News & Analysis | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ | ✔️ |

| Web Based Platform | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

FX trading and the terminology involved can seem quite daunting to new traders, so it’s important that you feel comfortable with a broker’s offering, and that things that you don’t understand are explained clearly to you. Whether that’s through a website Q&A section or suite videos on YouTube or a help desk. If you find that the broker isn’t able to explain things to you clearly and concisely, then maybe they are not right for you.

In my view, the better the quality for education and added value the better the trading platform. This is because forex brokers that want to form long-term relationships with their clients want them to be profitable traders and to do that traders need to be educated, guided and helped. Forex platforms are not allowed to provide direct advice to clients (see should you use an advisory broker) but they are able to provide educational material to help you become a better trader. After all, the more you trade the more the broker makes from you as a customer.

Professional Traders

Saxo Markets was voted the winner in the Best Professional Trading Account category in our 2023 awards, and also won Best DMA Broker for those that would like to trade on exchange FX futures.

Compare which forex brokers offer features that appeal to advanced and professional clients like DMA access, voice dealing, API access and prime brokerage.

| Advanced Features: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ❌ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Algo Trading | ❌ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ✔️ | ❌ |

| Prime Brokerage | ❌ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

For high-net-worth individuals who are likely to have deposits over the £85,000 FSCS limit, it’s important to look for a provider with a decent balance sheet and a good track record. For example, IG Group has a market cap of £2.79 billion and has been in business for more than 40 years. Fineco is a fully-fledged and listed Italian bank with a market cap of €9.0 billion. Whilst privately held Saxo Bank Group had a total balance sheet equity of DKK 7.082 billion in 2019 and is 50% owned by Chinese conglomerate Geely Holdings.

Professional traders need to meet strict criteria around experience, knowledge of volumes traded and financial wherewithal. If you do qualify as a professional trader, you will enjoy higher rates of leverage and access to a wider range of products than retail traders. Professional traders are the most profitable group for FX brokers and they tend to offer those clients additional perks as well.

Market Access

CMC Markets offers the most currency pairs with 338 currency crosses to trade.

You can see in our broker matrix how many currency pairs each forex platform provides access too. As well as what other markets you can trade, if you want to seek out opportunities beyond FX.

| Market Access: |  |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 9000 | 5233 | 10000 | 8,000 | 3700 | 2,100 |

| Forex Pairs | 84 | 51 | 338 | 62 | 182 | 100 | 54 | 20 | 138 | 57 |

| Commodities | 25 | 38 | 124 | 32 | 19 | 20 | 20 | 10 | 28 | 22 |

| Indices | 21 | 34 | 82 | 28 | 29 | 13 | 17 | 10 | 23 | 25 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 5000 | 500 | 1575 | na | 450 | 230 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2000 | 3500 | 2110 | na | 1575 | 1080 |

| ETFs | n/a | 2000 | 1084 | 107 | 675 | 1100 | 160 | na | 0 | 138 |

There are as many potential FX trading combinations as there are currencies in the world, however, not every single currency is tradable or liquid, and in developing markets in particular, exchange controls are often in operation, which limits the availability of that currency.

On the face of it, that shouldn’t affect the cash-settled, non-deliverable contracts traded in rolling spot FX and spread betting. However, in practice, it does because these contracts are priced based on the underlying deliverable markets.

Alongside the FX majors, we have what are referred to as crosses. Crosses are FX rates that don’t include either the US dollar or the euro. So, for example, GBPCHF, the British pound versus the Swiss franc, is a pair that’s composed of two currency majors, but not the dollar or the European single currency.

In the table below, we have set out some examples of tradable pairs and crosses but there are many more combinations available. However, margin FX brokers do not make prices in all FX pairs and crosses largely due to liquidity constraints and the cost of dealing, or the width spreads in the less liquid offerings.

The most you should expect to see on offer are between 50 or 60 combinations, although many brokers may have a more restrictive list than this. It is also worth noting that leverage ratios can be tighter in less liquid FX rates as well.

Whilst it is important to note that having a wide range of forex pairs to trade is helpful if you scanning the entire market for price patterns (for example with City Index’s SMART Signals), the more exotic (or less common) a currency pair the harder it will be to trade. Exotic currency pairs are generally harder to trade because there is less liquidity, meaning fewer buyers and sells, which results in wider prices (bid/offers) which means the market has to move more before you can lock in a profit on a trade. There is also less news flow than on vanilla (more common) currency pairs, which is one of the major factors that move currency prices.

Account Types

Forex brokers like Saxo Markets and Interactive Brokers offer DMA currency trading through currency futures.

For spot FX there is no central market – foreign exchange prices are determined through various liquidity providers.

Platforms like Currenex offer a form of DMA, whereby the platform aggregates orders from multiple brokers showing liquidity depth. Although this is still an OTC market.

You can work orders inside the price, but it’s not as functional as an established exchange.

Also, when trading SPOT FX, your positions are rolled T+1, rather than settling at a set date in the future.

Things to consider when trading FX DMA:

- With DMA FX trading there will be a commission added to the trades.

- With CFD FX brokers and spread betting commission is generally built into the price making it easier to calculate P&L.

- It may not be worth trading DMA FX if you only have a small account.

- DMA brokers tend to only offer accounts with competitive pricing to large private and institutional accounts.

This comparison table of FX trading platform account types shows which brokers offer spot, CFDs, DMA and futures and options forex trading.

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Leverage & Margin

All retail forex brokers regulated by the FCA offer the same margin of 3.33%

Being able to trade forex on margin means that you can leverage your risk capital (money) to get more exposure to the market.

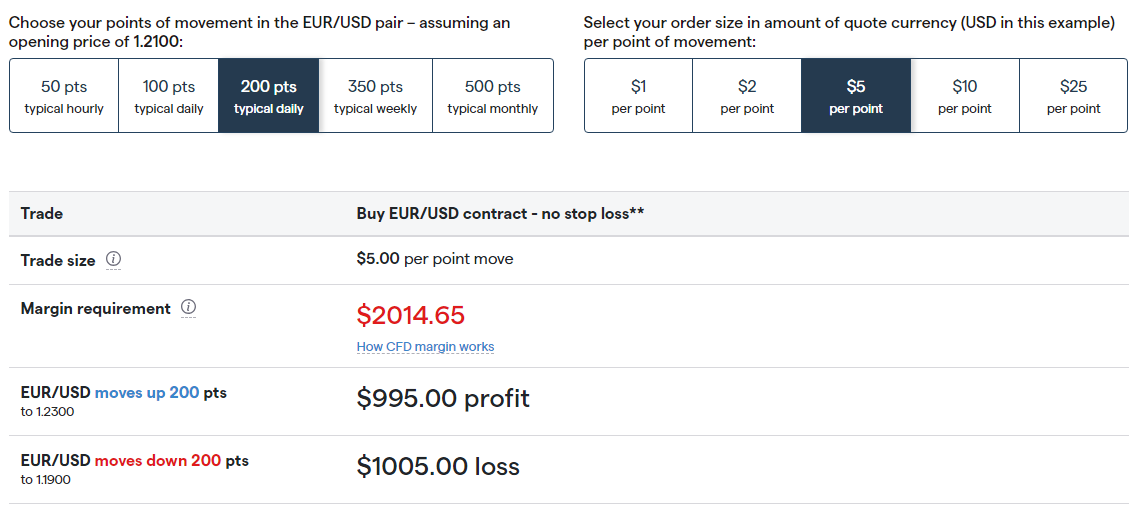

Here is an example of the margin used on a forex trade from IG. One of the largest forex brokers in the UK. It shows how much margin would be required based on a typical trade.

Source: IG.com

The main advantage is that you only need to put down a small deposit to open forex positions, for retail traders the FCA has stated that you need to put down a minimum of 3.33% of the value of a trade. So with brokers like City Index or IG, if you want to trade £100,000 you only need to put down £3,330 as margin (this is called initial margin). You will of course need to put down more if the trade more if the market moves against you to cover your losses (this is called variation margin).

The obvious disadvantage is that it is possible to lose money quickly and losses are multiplied significantly. If you are putting down a margin of 3.33% it means you are trading with 30 times leverage so if you have a position using £1,000 in margin on a £30,000 position and the market moves against you by 1% that means that you lose, £300, which is nearly 30% of your initial margin (deposit).

It is possible to lower your margin rates with a forex trading platform like eToro who let you set your own leverage if you want to reduce your exposure. It is also quite common for brokers like City Index to let you trade via an amount rather than on a per-pip basis. It is possible to get higher leverage if you are trading through a professional trading account, but that is only for sophisticated and very experienced high-net-worth traders.

Currency Futures

Interactive Brokers offer one of the best solutions for trading on exchange forex futures as they are one of the cheapest and biggest brokers globally.

Most FX futures are denominated in USD and traded through exchanges like the CME.

- Further reading: You can see more info on the CME FX Futures here.

FX futures are set in lot sizes and deliverable at a certain date in the future. So the price will be slightly different from the underlying mid-market because the futures price is based on the cost of carry (determined by the prevailing currency interest rates).

When trading on exchange you can see the order book (in lots) and work bids and offers inside the market prices, just like trading stocks on the stock market.

When trading on exchange FX, you can also trade FX options – to do so you need a futures broker (not a CFD broker).

Currency Options

Saxo Markets is the best broker for trading forex options as they offer them as CFDs or on exchange contracts and have an intuitive and robust currency options chain on their SaxoTraderGo platform. Interactive Brokers, is also an excellent choice for on exchange Forex options, they are slightly cheaper but do not have the personal service or voice brokerage that Saxo Markets provides.

Forex options are exchange-traded and listed currency options on the CME, which offers 24 different contracts. Options are a form of derivative that confers the right but not the obligation on a buyer of the contract, to be able to buy or sell a predetermined amount of the underlying instrument that the options contract is over.

Sellers or writers of options contracts are obligated, however, and must buy or sell the specified amount of the underlying instrument if they are called upon to do so during the lifetime of the contract.

Options trading allows a trader to speculate on a potential outcome over a fixed time with a small stake. Options contracts are traded in series, for example, on a monthly rotation, and options are offered over a range of levels above and below the current price, which are known as strike prices.

Options also come in two different flavours: Call options, which confer the right to buy, and Put options, which confer the right to sell.

So if we have a rotation or series of 12 monthly contracts with 20 strike prices in each month, and both puts and calls available, we have 12*20*2 potential trade combinations. That’s 480 opportunities, and that is just what’s available for one instrument. That compares very favourably with the binary choice of buying or selling in a standard FX trade.

Options have a finite life and to some extent, the valuation or price of an option over its lifetime is predictable in advance. Largely because the time value of options decays at a known rate and with a particular profile. The time value component of an option erodes more quickly the closer we get to the expiry date, and once the time value of the option has been eroded, the option contact only has an intrinsic value if it is in the money.

That is, the strike price of the option is advantageous compared to the current price of the instrument that the option is over. Such that you can buy the underlying more cheaply than the current offer price, via the option, in the case of a call. Or sell the underlying at a higher price than the current bid in the case of a put option. The more in the money an option is, then the higher its value.

Option prices are driven by other factors, including interest rates, volatility, or the propensity for rapid price change in the underlying instruments, and they are sensitive to changes in key ratios used in pricing models. Those sensitivities are known as the Greeks, as they are named after letters in the Greek alphabet.

As well as exchange-traded options or CFDs over the same, there are OTC options on FX and among those are exotic options. Options are considered complex products and exotic options even more so, and as such, these are not products for inexperienced traders. Only those with a clear understanding of the pricing mechanisms and risk-reward profiles of options should consider trading them.

Spread Betting

CMC Markets offers some of the tightest spreads on the most forex pairs for those that want to spread bet on currencies.

As an alternative to trading CFDs on forex , individuals and UK taxpayers can spread bet on foreign exchange.

Spread betting, as the name suggests, are wagers on the performance of an instrument or market rather than a trade, and though the methodology and pricing of these two types of transactions can look very similar, the tax treatment of any profits made in them is very different.

Profits made from trading are subject to UK capital gains tax, whilst under current legislation, profits generated through spread betting are tax-free. By the same token, losses made in trading can be offset against capital gains made elsewhere, whilst spread betting losses cannot.

- For more information forex trading tax, read our Q&A: Do you have to pay tax on forex trading?

The tax treatment is the principal difference between the two forms of speculation, however, some spread bets may be priced in a similar way to futures contracts; that is with the cost of carry or financing included in the quote at the outset, rather than being charged daily, as is the case in forex trade. Spread bets are also likely to have a fixed expiry, whether that’s daily, weekly or quarterly. While FX trades, which are effectively CFD trades, have no fixed expiry unless you are trading a currency future or option, rather than the rolling spot contract.

The mechanics of spread betting on FX are very similar to those of trading FX. Of course, you will need to open a spread betting account to spread bet, rather than a trading account. You will also want to familiarise yourself with the bets that spread betting providers offer and the contract lifetimes, and the way that they are priced that could be very different for say a rolling daily bet, a weekly bet or indeed a monthly or quarterly bet.

One obvious thing to try to do is to match the contract you are going to be betting on with your time horizons, and style of speculation daily bets won’t be much use to you if you have a two- or three-week-time horizon. Equally, a quarterly contract may not be your best choice if you are an intraday bettor.

Forex Broker FAQs

All forex trading platforms in the UK must be regulated by the FCA

Forex trading is a highly regulated industry, for the benefit of traders and brokers. The UK regulator, the FCA (Financial Conduct Authority) ensures that forex brokers are adequately capitalised (have enough money) to provide forex trading services, that they treat their customers fairly and adhere to strict standards of compliance and anti-money laundering.

Never trade with a broker that is not FCA regulated. You will see many adverts for offshore brokers offering forex trading online, as it is possible for offshore brokers to offer forex trading to UK residents. Being regulated in Cyprus also means that a broker can show that they are regulated in the UK and show up on the FCA register. So if you check the FCA website to make sure a broker is legit, they will show up. But, if they are not fully authorised and regulated by the FCA then client funds are not protected under the FSCS. The FSCS basically protects a certain amount of clients funds should a broker go into administration, see their website for more information here. If your broker is only based offshore you’ll have little hope of getting any money back.

On the Good Money Guide, we only feature forex trading platforms that are regulated by the FCA.

IG, City Index, Saxo Markets and Pepperstone allow scalping on forex markets.

Scalping the forex markets is a very popular form of trading as it involves trading in and out of positions very quicky trading to make short-term profits on very small price movements.

Scalping is a well-established FX trading strategy. However, these days, it’s becoming increasingly automated and time-sensitive. So, whilst retail traders can pursue a scalping strategy, they will probably want to find a decent and reliable trading bot or expert advisor to help them with both spotting opportunities and trade execution.

To be effective, scalpers need to have low network latency and maximum platform uptime, and they may wish to consider using a VPS service, which creates a virtual trading platform on a server that is co-located in the same data centre with the broker’s own servers. That service will usually come at a cost, or with minimum volume requirements attached.

Some forex platforms ban scalpers because they find it difficult to hedge smaller positions and some traders take advantage

The most effective way to scale the forex markets is by using an ECN or STP broker, however, you will want to ensure that you know exactly what your cost per trade is because one of the most important facets of scalping is being able to cut or scratch non-performing trades for the lowest possible costs, and of course to make profits on those trades that you don’t cut. But to book a net profit, your trading P&L will need to exceed your trading costs.

There is no such thing as a free lunch they say, and that rings true in trading. Brokers have costs and they need to meet those costs somehow, whether that is through the spread and/or commissions or trading against their clients via B-book. Where brokerage services are offered free, for example, in trading US equities, the broker is paid by a market maker or high-frequency trader for their client’s order flow. The adage that if something looks too good to be true then it probably is, remains good advice.

We have ranked Pepperstone as the best forex broker for trading EURUSD with spreads starting from 0.13 pips.

For this ranking of the best forex trading platforms to trade EURUSD we have ranked by which forex broker has the cheapest trading costs.

- For a more in-depth comparison of forex brokers that offer EURUSD trading view our EURUSD forex trading platform comparison.

We have ranked Pepperstone as the best broker for trading GBPUSD based on their spreads of 0.44

For this ranking of the best forex trading platforms to trade GBPUSD we have ranked by which forex broker has the cheapest trading costs.

- For a more in-depth comparison of forex brokers that offer GBPUSD trading view our GBPUSD forex trading platform comparison.

We have ranked Pepperstone as the best broker for trading USDJPY based on their spreads of 0.25 pips.

For this ranking of the best forex trading platforms to trade USDJPY we have ranked by which forex broker has the cheapest trading costs.

- For a more in-depth comparison of forex brokers that offer USDJPY trading view our USDJPY forex trading platform comparison.

The most popular currency pairs for forex trading are the G10 forex crosses as they are the most liquid with the most news flow. Of those the top three traded forex pairs are, EURUSD, GBPUSD and USDJPY. For more information read our guide to the top ten forex pairs for trading

Richard Berry

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the forex brokers via a non-affiliate link, you can view their forex trading pages directly here: