FTSE 100 trading platforms let you speculate FTSE 100 Index (Financial Times Stock Exchange) which is the primary blue chip stock index of the London Stock Exchange, often referred to as the ‘Footsie’ Index and contains 100 of the largest companies on the LSE by market capitalisation.

City Index: Best broker for FTSE 100 CFD trading

- Costs & spreads: 1

- Minimum deposit: £100

- Overnight financing: 2.5% +/- SONIA

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated FTSE trading on MT4

- Costs & spreads: 1

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SONIA

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: FTSE trading with personal service

- Costs & spreads: 1

- Minimum deposit: £1

- Overnight financing: 3% +/- SONIA

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount FTSE trading & investing

- Costs & spreads: 0.005%

- Minimum deposit: $2,000

- Overnight financing: 1.5% +/- SONIA

- Account types: CFDs, DMA, futures & options

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: High-tech FTSE trading platform

- Costs & spreads: 1

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SONIA

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

XTB: Good FTSE 100 trading educational material

- Costs & spreads: 1.7

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best broker for FTSE 100 ETFs & investing

- Costs & spreads: 1

- Minimum deposit: £500

- Overnight financing: 2.5% +/- SAXO RATE

- Account types: CFDs, futures & options

70% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s FTSE trading

- Costs & spreads: 1.5

- Minimum deposit: $50

- Overnight financing: 6.4% +/- SONIA

- Account types: CFDs

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Tickmill: DMA FTSE futures trading on CQG or CFDs on MT4

- Costs & spreads: 0.9

- Minimum deposit: $100

- Account types: CFDs, futures & options

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Methodology: We have chosen what we think are the best FTSE trading platforms based on:

- over 17,000 votes in our annual awards

- our own experiences testing the UK100 trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the UKX trading platform CEOs and senior management

Compare FTSE 100 (UKX) Trading Platforms

| FTSE 100 Trading Platform | FTSE Trading Costs | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 1 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 1 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1.5 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 1.7 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.005% | $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.9 | $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 1 | £100 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 0.7 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

How to choose a FTSE 100 trading platform

We’ve put together a list of the best brokers and platforms for trading the FTSE 100 (UKX) by comparing account types, trading spreads, and overnight financing rates, plus interviewed, reviewed and tested the brokers trading platforms.

If it’s 24 hour pricing and tight spreads plus access to thousands of other products then you will probably want to trade with one of the larger brokers such as IG Group or Saxo Bank. But if you want a more personalised service then you might prefer a smaller broker such as Spreadex.

Your choice of broker will also be influenced by the products you want to trade for example, Pepperstone have a reputation for tight pricing but they don’t currently offer trading on many smaller stocks outside the FTSE 100. Likewise, if you want to trade with tax free profits, Saxo Markets do not offer spread betting, so if you want to bet on the FTSE rather than trade it they won’t be for you.

You can compare brokers and decide which one is the best fit for you by using our comparison tables, either through a general trading account, CFD trading platform or Spread betting broker or if you are interested in investing in a FTSE 100 tracker through ETFs.

Trading on the FTSE 100 has always been one of the most popular markets because of constant, 24-hour movement, economic news as well as good liquidity. The UKX also has a smaller tick size (smallest movement), particularly when compared to other European indices such as the Dax – £5 per point versus €25 per point respectively.

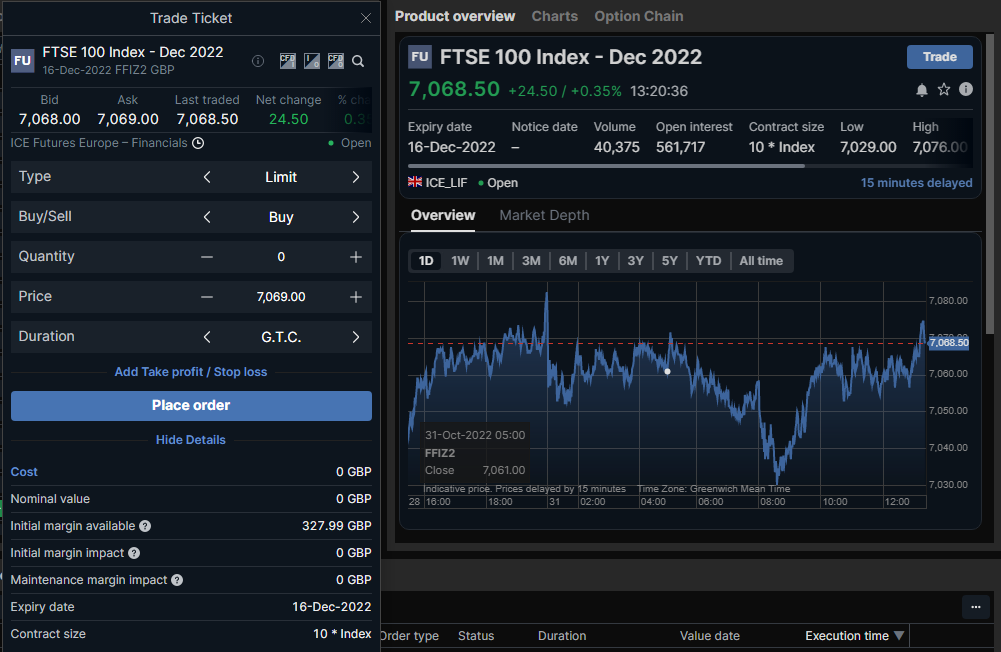

Best FTSE 100 Platform For Futures & Options

We currently rank Saxo Markets as the best broker for trading FTSE futures based on price, market access and our broker matrix.

Futures contracts are derivatives that allow traders to speculate on the future price of a given commodity or instrument; in this case, the future value of the FTSE100 index.

The FTSE 100 futures contracts trade on a quarterly expiry cycle of December, March, June and September. Each of these contracts reflects the market’s expectations for the value of the FTSE100 index at that future point in time. As a contract month expires, so another is added into the cycle.

As is common to many financial futures contracts, the FTSE 100 futures are cash-settled. Meaning buyers and sellers of the contract pay or receive money based on the outcome of their trade. Without the need for delivery of the stocks that make up the index.

All trades are cleared and settled through a central clearing house which becomes the counterparty to those trades. Trades are placed on a margin basis with an initial margin or deposit required at the outset of the trade and variation or maintenance margin provided as needed through the trades lifetime.

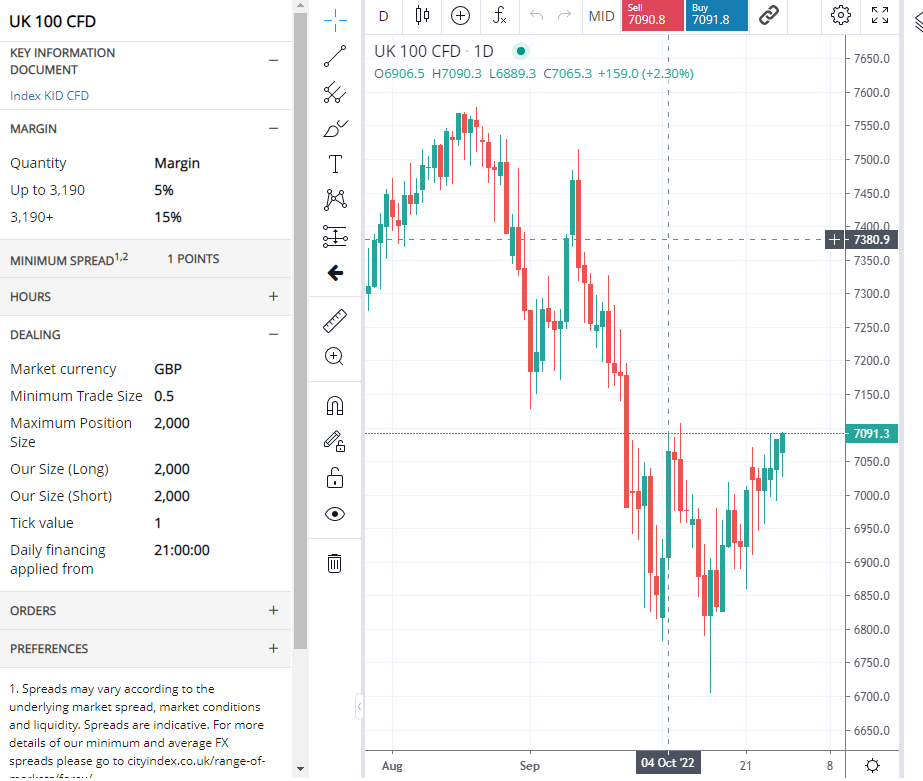

Best FTSE 100 Trading Platform For CFDs

We currently rank IG as the best trading platform for the FTSE 100, as they offer free UKX trading signals and lots of constantly updated news and analysis.

All cash-settled financial and commodity contracts are in effect CFDs or Contracts For Differences. In which, the counterparties to a trade (the buyer and the seller) pay or receive money, at the settlement of their trade, rather than making or taking delivery of the underlying instruments.

A CFD on the FTSE 100 is no exception, such contracts closely resemble the futures contracts described above, but there are some key differences.

Firstly FTSE 100 CFDs trade OTC or Over The Counter and not on a dedicated exchange.

Nor are they centrally cleared which means that the counterparties to a trade are the customer and their CFD provider.

CFDs do not have a fixed expiry date and are not subject to fixed contract sizes.

The FTSE 100 futures contract size is £10.00 per index point. Such that when the index is valued at 7000 points, the futures contract value is £70,000.

However, CFD traders can typically deal in much smaller sizes, for example, at £1 per point, or a tenth of the value of the futures contract.

Best FTSE 100 Trading Platform For Spread Betting

We currently rank IG as the largest and best broker for spread betting on the FTSE 100.

A FTSE 100 spread bet is very similar to both the futures contract and the FTSE 100 CFD. There is one key difference though, and that is that the deal is structured as a bet and not a trade.

Spread bettors trade in pounds or pennies per point and bet on the rise or fall of the FTSE 100 index. Their bookmaker is the counterparty to their bet.

Brokers offer a range of bet durations, for example, daily, monthly or quarterly bets. Perhaps the most significant difference between a spread bet on the FTSE 100 and CFD trade on the index is the tax treatment of any profits made.

Under current UK legislation profits made from betting by individual UK taxpayers are not subject to tax. However, losses arising from betting cannot be offset against capital gains made elsewhere. Profits resulting from CFD trades are subject to tax, though CFD losses can be offset.

The tax treatment of spread betting has made it very popular among retail traders. Unlike fixed-odds betting, however, your potential losses are not limited to your initial stake when you spread bet.

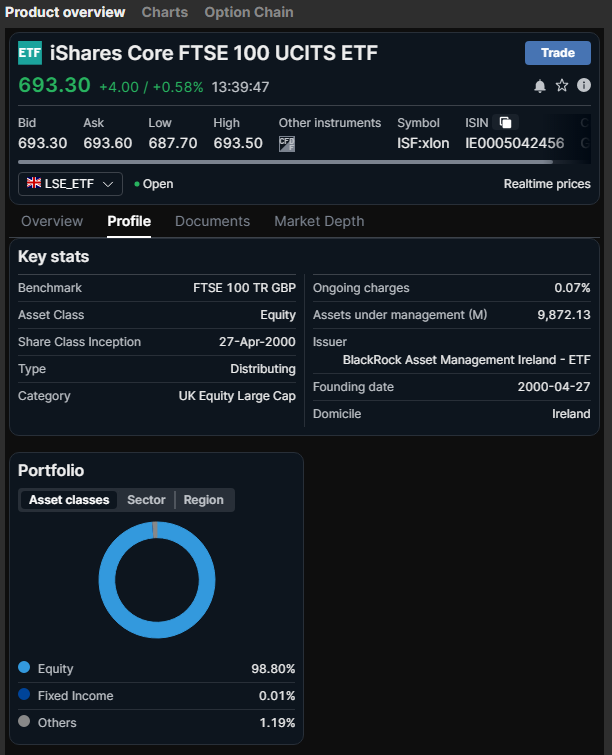

Best FTSE 100 Platform For ETFs

We currently rank Saxo Markets as the best broker for trading FTSE 100 ETFs as they offer DMA CFDs for on-exchange short-term trading as well as investment accounts for long-term investing.

Find a broker for investing in ETFs here

ETFs or Exchange Traded Funds are simply open-ended funds that aim to replicate the performance of a given index, sector or investment style.

For the most part, ETFs offer what is known as passive investing that is they aim to track a particular benchmark rather than outperform it. ETFs are tradeable in the same way that individual shares are.

As such ETFs offer a low-cost way for investors to replicate index or sector performance, and they allow traders to quickly gain exposure to groups of stocks or market themes.

The ETFs, which track the FTSE 100, aim to mirror its performance and will typically own a basket of FTSE 100 shares or derivative contracts over the same or similar stocks to do so.

Investors and traders who are bullish of the index buy an ETF while those who are bearish of the FTSE would sell it. It is possible to sell short of an ETF, i.e. sell it in the hopes of repurchasing the position at a lower price for a profit, but it’s best to check the requirements for doing so with your broker before proceeding.

There are more than half a dozen ETFs that track the FTSE 100 index, though the iShares FTSE 100 ETF (ticker ISF) is probably the best-known and most widely followed among them. Here is a list of some of the most popular ETFs that track the FTSE:

- HSBC FTSE 100 UCITS ETF

- Invesco FTSE 100 UCITS ETF

- iShares Core FTSE 100 UCITS ETF

- iShares Core FTSE 100 UCITS ETF

- Lyxor FTSE 100 UCITS ETF

- Lyxor FTSE 100 UCITS ETF

- UBS ETF (LU) FTSE 100 UCITS ETF (GBP)

- Vanguard FTSE 100 UCITS ETF (GBP) Accumulating

- Vanguard FTSE 100 UCITS ETF Distributing

- Xtrackers FTSE 100 UCITS ETF

- Xtrackers FTSE 100 UCITS ETF Income

How to trade the FTSE 100:

There are multiple financial products derived from the underlying FTSE 100 Index that you can trade with, including:

- Index Futures (formerly LIFFE, now at ICE) through a futures broker

- Options (ICE) – through an options trading platform

- ETFs – through an Exchange-Traded Fund investment account

- Investment Funds – through a fund investment platform

- Spread betting – through a spread betting broker

- Contracts for difference – through a CFD broker

Advantages of trading the FTSE 100

FTSE stock Indices (100 and FTSE 250) are closely watched. The index is attractive to investors and traders alike because:

- International – FTSE 100 stocks are highly international and these companies derive their earnings globally

- Liquidity – FTSE 100 has good trading volumes – as some of the FTSE stocks are huge (e.g. HSBC, BP, and GSK)

- Income – FTSE 100 pays relatively good dividend yields compared to the UK bond yields

Disadvantages of trading the FTSE 100

- Volatile – indices move around a lot

- Risky – it is hard to predict if the UKX index will rise or fall

- Leverage – if you are trading on margin trading losses are multiplied.

FTSE 100 trading tips and strategy:

To trade the FTSE 100 profitably requires a good trading strategy. The following tips may help you to maximise your chances of trading the FTSE 100 successfully over the long term.

- Understand your requirements for trading the FTSE 100. Are you an intra-day or positional trader? Do you invest for the long term? Are dividends important?

- Research various technical (or fundamental) indicators to support the trading objective. There are many technical indicators that you can use, including

- Trend indicators like moving average

- Oscillators

- Support & resistance levels

- Patterns like breakout and reversals

- Backtest these indicators if they are profitable over time. Select a few that you can understand. Check their pitfalls and signal variations over time. Put these indicators into some trading software and backtest. Can you withstand the drawdown?

- Select the indicators that best suit the objective. Once the initial backtest research is completed, setup a mock testing period of, say, six weeks. Assess the results. Are they good? Which type of indicators works better?

- Include risk management factors in your assessment. Important factors like position sizing, leverage levels, stop loss levels and risk-reward ratios must be specified. Trading without risk management is like driving without brakes and safety belts.

- Select trading platforms that support your operations. Capital requirements, platform fees, and trading capability are all important factors to look for. See the comparison table above.

- Commit capital and go live. Make sure that you drip-feed capital into new strategies because there may be many things to iron out before you’re comfortable with it.

Alternative indices to UK FTSE 100 (FTSE 100) trading

You can read about the major indices in our guide to the best indices for index trading.

FTSE 100 trading FAQ:

Stock prices are driving factor of the FTSE 100 as that is what it is based on, but other important factors include:

- Macro factors (e.g. GDP, unemployment, business indicators etc)

- Monetary factors (e.g., Quantitative Easing, rates movements, yield curve etc)

- Technical factors (e.g., new highs or lows)

- Earnings factors (e.g., profitability and earnings momentum)

Another important factor to watch for is commodity prices, as the FTSE 100 Index has large mining and energy sector exposure from shares like; BP, Royal Dutch Shell, BHP, Rio Tinto, Anglo American, and Glencore which are some of the largest energy and mining groups in the world.

The FTSE 100 Index is capitalisation weighted, meaning that larger stocks have a larger impact on the index movements. Formed in 1984, the index is currently maintained by the FTSE Group. The index is calculated throughout a trading session regularly.

FTSE index futures usually expire in March, June, September, and December.

The biggest ETF based on the FTSE 100 Index is the FTSE 100 ETF (ticker: ISF). This ETF is gaining popularity because of the ease of trading, unlike futures or options where there are rollover costs and expiry dates.

On a historical basis, the FTSE 100 is not a particularly volatile index with its mean 30-day volatility. since the year 2000 coming in at 21.5% on a scale of 0 to 100, according to data from FTSE Russell who manage the index. It offers some of the best liquidity for UKX trading.

Prices within standard UK market hours will typically be tighter and will see more activity than those made out of hours. As a rule of thumb the farther you are away from the home session then, the wider the prices are likely to be.

The FTSE 100 index itself is calculated daily in real-time from the opening auction at 08.00 am in London until the closing auction at 16.35pm, Monday to Friday, excepting UK Bank Holidays.

However, FTSE 100 futures are traded in London over a much longer period, which runs between 01.00 am to 9.00 pm. What’s more many CFD and spread betting providers offer prices in the FTSE 100 24 hours per day, five days a week.

You can find expert advisors through MT4 brokers with automated UKX trading strategies. However, trading systems are only as good as the rules that govern them and given the number of variables in play on any given trading day, it’s unlikely that anyone system will be effective all of the time. After all, even the most advanced quantitative hedge funds find it difficult to make money consistently in the current climate.

The term FTSE 100 is trademarked and brokers must pay a licence fee to use the index name. To avoid these license fees, brokers have created their own index based on the underlying price of the FTSE 100 and called it the UKX.

Swing trading is a trading style that aims to identify the beginning or end of trends within the price action of an index or instrument; in this case, the FTSE 100 index or derivatives thereof.

ETFs are becoming increasingly popular among investors who wish to take a longer-term view on a particular index or sector. That’s because ETFs offer a low cost, efficient way to gain market exposure. Moreover, as we noted earlier an index tracking ETF such as ISF (the IShares FTSE 100 ETF) only tries to mirror the performance of the underlying index rather than outperform it, which is much harder to achieve.

Investors can hold ETFs on the FTSE 100 within stocks and shares ISAs and self-invested pension plans or SIPPS as they are known. However, as with any investment strategy, it’s important to assess your risk concentration and individual requirements in terms of income versus capital growth and to seek professional advice.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the FTSE trading platforms via a non-affiliate link, you can view their UKX/UK100 trading pages directly here:

⚠️ FCA Regulation

All FTSE trading platforms that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK FTSE 100 trading platforms are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature FTSE 100 trading platforms that are regulated by the FCA, where your funds are protected by the FSCS.