Facebook, now Meta, was one of the greatest success (business and investing) stories of the past decade, starting in 2010. It has connected people to each other and the market like nothing before. Some people have made millions and even billion through owning shares in facebook. If you too want to try and profit from Facebook’s success like Zuckerberg you can buy shares in Meta (NASDAQ:META), through a share dealing account that offers access to US shares.

How to buy Meta/Facebook shares (NASDAQ:META) from the UK

🧑🎓Here are the steps to follow for buying Facebook shares from the UK.

- Open an account with a share dealing platform that lets you invest in US stocks

- Decide how much you want to buy and deposit fund your account

- As Apple is a US stock and traded in USD you need to convert your funds to USD. You can either do this before trading or the share dealing platform will do it automatically for you.

- In your share dealing platform type in Meta’s NASDAQ stock symbol (Meta) and click “buy”. You can be given the option to buy at the currency price (market order) or set a maximin price at which you want to buy at (limit order).

🤔Note: In the US they refer to Meta shares as Meta stock, but they are the same thing…

⚠️What to watch out for! When you buy a US stock like Meta a hidden cost is often the exchange rate a share dealing platform charge for converting GBP into USD. You can compare these in our US share dealing platform comparison table.

💡Hints: Here are some of the best accounts for buying Meta shares

- Interactive Brokers offers the cheapest FX rates for buying Meta shares

- Hargreaves Lansdown provides an excellent service if Meta is only going to be a small part of your portfolio.

- Dodl offers a very low account, dealing and fx cost for new and small investors.

- IG offers free US share dealing if you trade a certain amount each month.

How much does it cost to buy Meta shares (NASDAQ:META)?

Buying one NASDAQ:META share costs $499.76. However, as well as the $499.76 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

What is the live Meta (Facebook) share price?

It’s also important to remember that share prices can move quickly, for example, the current NASDAQ:META share price is $499.76 which is a change of 0.47 or 0.09% from the last closing price of 499.76 with 9,847,925 shares traded giving NASDAQ:META a market capitalisation of $1,274,090,667,696. The most recent daily high has been 504.77 and daily low 497.11. The NASDAQ:META share price 52 week high has been 531.49 and the 52 week low 207.13. Based on the most recent NASDAQ:META share price opening of 499.76, the current NASDAQ:META EPS (earnings per share) are 15.31 and the PE (price earnings ratio) is 32.65.

Pricing data last updated 16/04/2024 16:00.

Is the Meta (NASDAQ:META) a good investment in the long run

- Meta reported better-than-expected results; shares soared 24%

- $40 billion share buyback planned

- Selling pressure abates; but shares now near-term overbought

From its IPO in May 2012, Meta’s share price have rocketed to levels beyond one’s wildest imagination. At its peak, the social network company was worth more than a trillion dollars – one of the few companies to achieve this amazing and rare feat. The others being Apple (NASDAQ:AAPL), Google, Amazon (NASDAQ:AMZN), and Microsoft.

With the benefit of hindsight, the tech company was a fantastic investment during 2012-2022. If you had bought Facebook at its mammoth IPO at $25, you would have multi-bagged the investment over the next decade (see below).

Facebook owed its extreme success to growth. In the years following its listing, Facebook acquired tens of companies to solidify its leading position in the global social network. These major acquisitions included WhatsApp (for $19 billion), Instagram for another $1 billion and Oculus Reality for $2 billion.

However, all that growth is now history. Economic conditions that had propelled many tech companies into trillion-dollar titans have completely stalled or reversed. By conditions I meant higher interest rates, a saturated social network market or cheap liquidity. All these headwinds mean the Meta will have a harder time repeating its secular bull run in the foreseeable future.

Indeed. The company plunged from near $400 to below $100 in a year. In early 2022, for example, Meta posted a record one-day loss of wealth in market cap (of $232 billion!). Prices kept dipping; and investors fled.

But that bearishness has disappeared as soon as monetary conditions turn less hawkish. Moreover, Meta is planning a mammoth $40 billion share buyback this year – equivalent to its entire $40 billion cash reserves. By going ‘all in’ to support its share price, Meta’s shares may start to develop a base above $100.

The optimal time to buy is when there is fear in the market.

If you look back at Meta’s share price history, there were three periods of sustained weakness. 1) After the IPO, 2) 2018 and 3) 2020. In the first three setbacks, the share bounced back higher after a few quarters of setbacks.

In late 2022, I pointed that Meta’s decline was already more than a year old. Was that a time to buy? Yes, if you believed in the company’s long-term story. No, if you subscribed to the trend-following theory, which states that you should stay out of a stock until its prevailing downtrend has changed.

After a sharp rebound, however, Meta’s long-term trend have switched from extremely bearishness to neutral. Is now a good time to buy?

Two things to note: One Meta’s rally is overbought. This is logical given its 100% rally in just two months. Two the market is pricing into quite favourable macro conditions (like ‘peak rate’).

Should investors turn negative at any point in the near term, a correction from here may happen. Should I would not chase now, preferring to wait for a modest correction to ease gently into the stock.

Meta’s share price has declined substantially from its peak at $380. Currently, prices are trading in the vicinity of $180 (bottomed out last year at $90). After a wild roller-coaster ride, are Meta’s shares undervalued now?

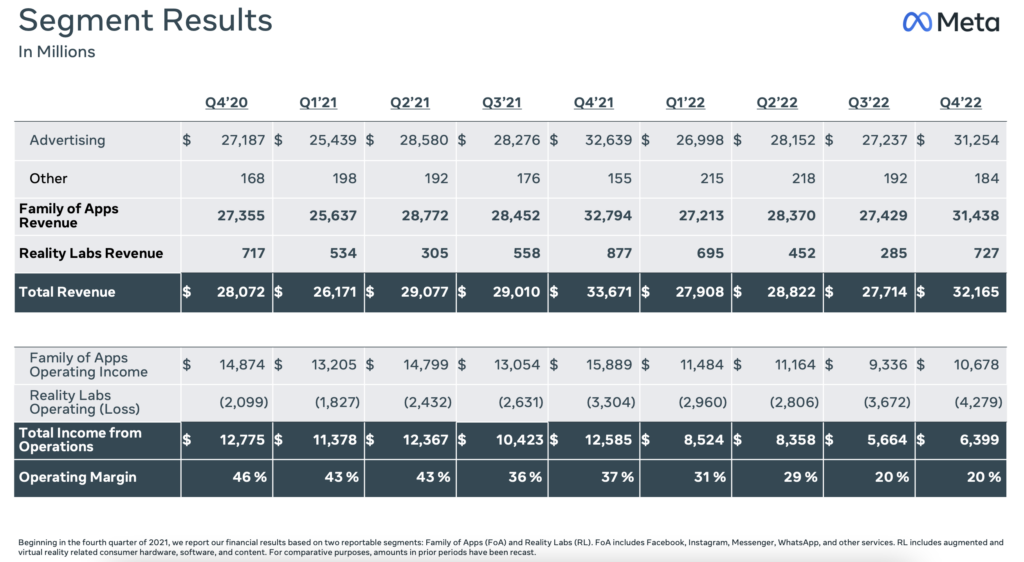

Not exactly. There are a few reasons for opinion. One, Meta’s market cap is currently trading at half a trillion ($500 billion). Against its annual operating income of $23 billion, the company is not exactly ‘cheap’. Two, its operating margin is falling. 2023-2024 could see a further fall unless Meta’s revenue rises and costs fall. Three, Meta’s pivot into a new business called Metaverse remains a loss-making division. (Simply speaking, Metaverse is a form of virtual reality where people live and interact using avatars.) Even though Facebook went as far as changing its name to Meta, it is still reliant on the older divisions to generate profits.

In fact, I would say the market is slightly overvaluing the company at this point as I am unsure if Meta’s 4Q rebound in revenue can be sustained.

Source: Meta

In late 2022, Meta’s future earnings were projected to contract faster than expected. This caused its share price to tank on 27 October 2022, especially after the company reported weaker-than-expected revenue in the last quarter ($30 billion).

However certain conditions have changed that arrested its decline, including:

- Favourable monetary policy – the market has ‘decided’ that the Fed will not raise interest rate much more from here.

- Oversold conditions – Meta has been declining for months, leading to deeply oversold technical conditions.

- Better-than-expected earnings – more importantly, the company is trying to trim its cost base and raise profitability

Taken together, Meta’s share price nearly doubled from its 2022 lows as shorter sellers trim their positions.

While Meta’s share price have rallied hard this week, many analysts are still holding out their relatively subdue price projections.

According to the Financial Times, 37 analysts are putting out ‘Buy’ or ‘Outperform’ ratings on Meta. But with Meta’s share price running weak, Wall Street is not upgrading the tech firm.

Meta’s median price target is at $212 – just 10-15% above current prices. Even though Meta’s shares may probe the psychological $200 level, I do not expect a sustained breakout this time.

But with the company announcing a $40 billion share buyback (8% of current market cap), there will be a downside limit on Meta’s share decline.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.