FAANG is an abbreviation deriving from a group of technology stocks around 2012 that are big, fast-growing, and extremely successful. The companies in the FAANG index are Facebook (Meta), Amazon, Apple, Netflix & Google. FAANG stands for the first letter in the original name of its constituents.

FAANG Constituent Companies

Pricing data updates every 15 minutes

| FAANG Company | Price | Market Cap | P/E Ratio | EPS | 1M % Change | 6M % Change | 1Y % Change | Our Rating |

|---|---|---|---|---|---|---|---|---|

| Facebook - Meta Platforms Inc (META) | 481.07 | $1,226.4 bn | 31.43 | 15.31 | -4.84 | 53.20 | 125.78 | |

| Amazon.com Inc (AMZN) | 174.63 | $1,815.7 bn | 60.22 | 2.9 | -1.98 | 37.98 | 68.22 | |

| Netflix Inc (NFLX) | 555.04 | $240.2 bn | 46.13 | 12.03 | -11.57 | 36.43 | 70.60 | |

| Apple Inc (AAPL) | 165 | $2,547.9 bn | 25.67 | 6.43 | -7.65 | -4.62 | -0.99 | |

| Google - Alphabet Inc Class C (GOOG) | 155.72 | $1,923.9 bn | 28.7 | 5.43 | 4.04 | 12.92 | 47.04 |

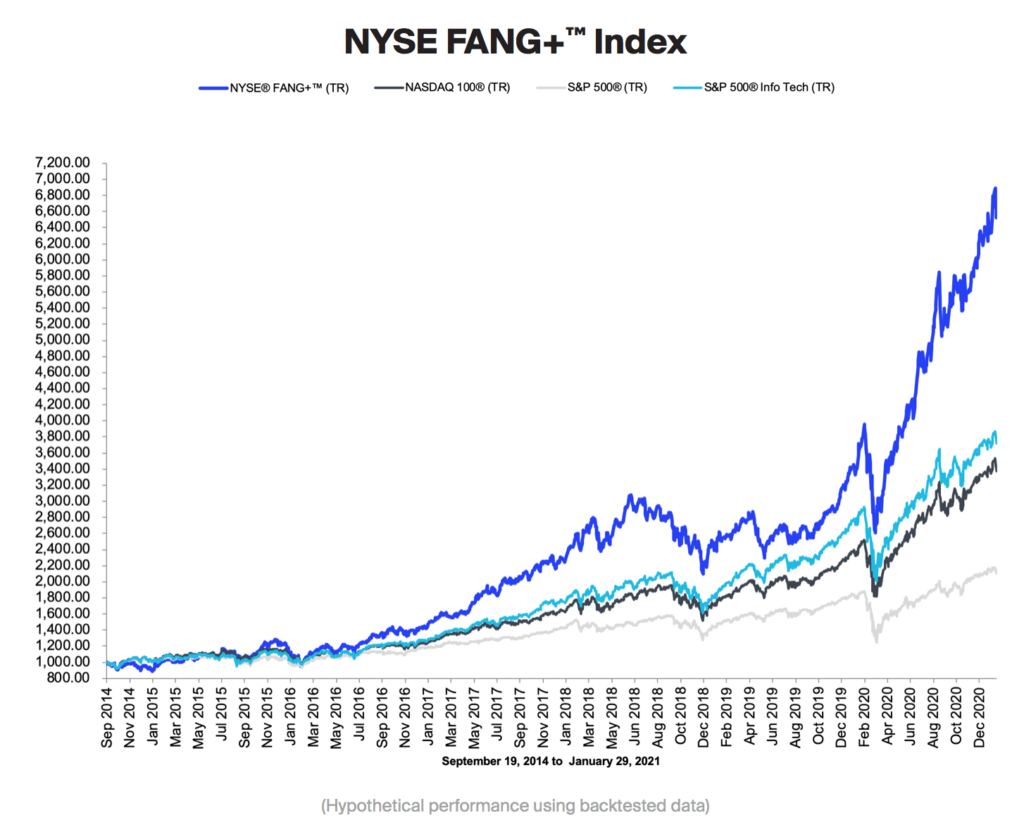

NYSE FANG+® Index

There is also a tradable index on the NYSE ICE exchange where you can trade a more representative list of 10 of the highest rated tech giants called the NYSE FANG+® Index.

You can trade the NYSE FANG+® Index through a futures broker or an options trading platform.

The NYSE FANG+® Index constituents and their individual performance are in the list below.

| NYSE FANG+® Index Constituent | Price | Market Cap | P/E Ratio | EPS | 1M % Change | 6M % Change | 1Y % Change | Our Rating |

|---|---|---|---|---|---|---|---|---|

| Facebook - Meta Platforms Inc (META) | 481.07 | $1,226.4 bn | 31.43 | 15.31 | -4.84 | 53.20 | 131.79 | |

| Apple Inc (AAPL) | 165 | $2,547.9 bn | 25.67 | 6.43 | -7.65 | -4.62 | 0.75 | |

| Amazon.com Inc (AMZN) | 174.63 | $1,815.7 bn | 60.22 | 2.9 | -1.98 | 37.98 | 70.25 | |

| Netflix Inc (NFLX) | 555.04 | $240.2 bn | 46.13 | 12.03 | -11.57 | 36.43 | 72.08 | |

| Microsoft (MSFT) | 399.12 | $2,965.6 bn | 36.1 | 11.06 | -6.14 | 21.20 | 44.91 | |

| Google - Alphabet Inc Class C (GOOG) | 155.72 | $1,923.9 bn | 28.7 | 5.43 | 4.04 | 12.92 | 48.86 | |

| Tesla (TSLA) | 147.05 | $460.8 bn | 34.17 | 4.3 | -16.29 | -30.66 | -8.48 | |

| NVIDIA NVDA) | 762 | $1,905.0 bn | 63.86 | 11.93 | -15.68 | 77.31 | 190.39 | |

| Snowflake (SNOW) | 145.45 | $48.6 bn | #N/A | -2.55 | -10.79 | -2.11 | 7.36 | |

| Broadcom (AVGO) | 1204.71 | $558.3 bn | 44.66 | 26.98 | -5.59 | 39.72 | 93.68 |

What are FAANG stocks?

These companies have grown immensely huge and rich over the past few years – so much so that they are known as the ‘Big Tech’. Even though Microsoft is clearly a part of Big Tech it is not considered part of the FAANG index. By replacing Netflix with Microsoft, we get FAAMG instead of FAANG.

How do you buy FAANG stocks?

You can buy FAANG stocks through almost any investment platform as they are some of the most liquid and heavily traded stocks on the stock exchanges. Some stockbrokers that offer access to US stocks are:

You can also compare all investment accounts for buying US shares here.

If you want to speculate on the price of FAANG stocks going down rather than up, because you say, think this is another tech bubble you can use either CFD trading or financial spread betting.

The dominance of Big Tech

The last decade is really a decade of the Big Tech. As the pandemic curtailed physical travelling, communication and work from home became the new normal. This makes technology indispensable.

Online retailing, virtual communication and work from home are some of the biggest social trends last year. The tech revolution, already happening at a fast pace, suddenly accelerates.

No wonder investors flocked to the sector en masse. In 2020, the seven largest tech companies gained nearly $3.4 trillion in market capitalisation. This is a huge.

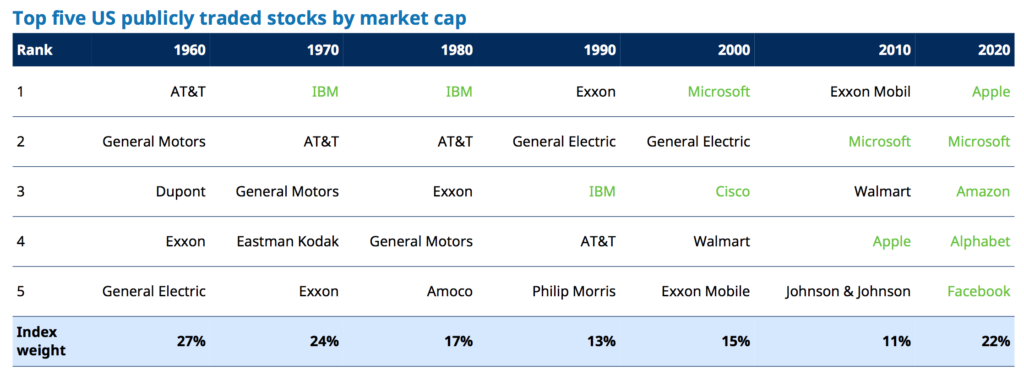

For the first time in the US stock market history, big tech companies now occupy the top five spots in market capitalisation ranking table (see below).

Just a decade ago, traditional firms like Exxon Mobil, Walmart, Johnson & Johnson were part of the ‘blue chips’. No Longer. A paradigm shift has occurred that swept these companies out of the podium, and replaced by technology firms that are dominating major indices like the S&P 500 Index.

For investors, this is the ‘new landscape’.

Source: Schroders

Why are these tech companies so successful?

The answer lies in their business ecosystems.

Each of the large tech firm specialises – and dominates – in one or two niche areas. The key is dominance.

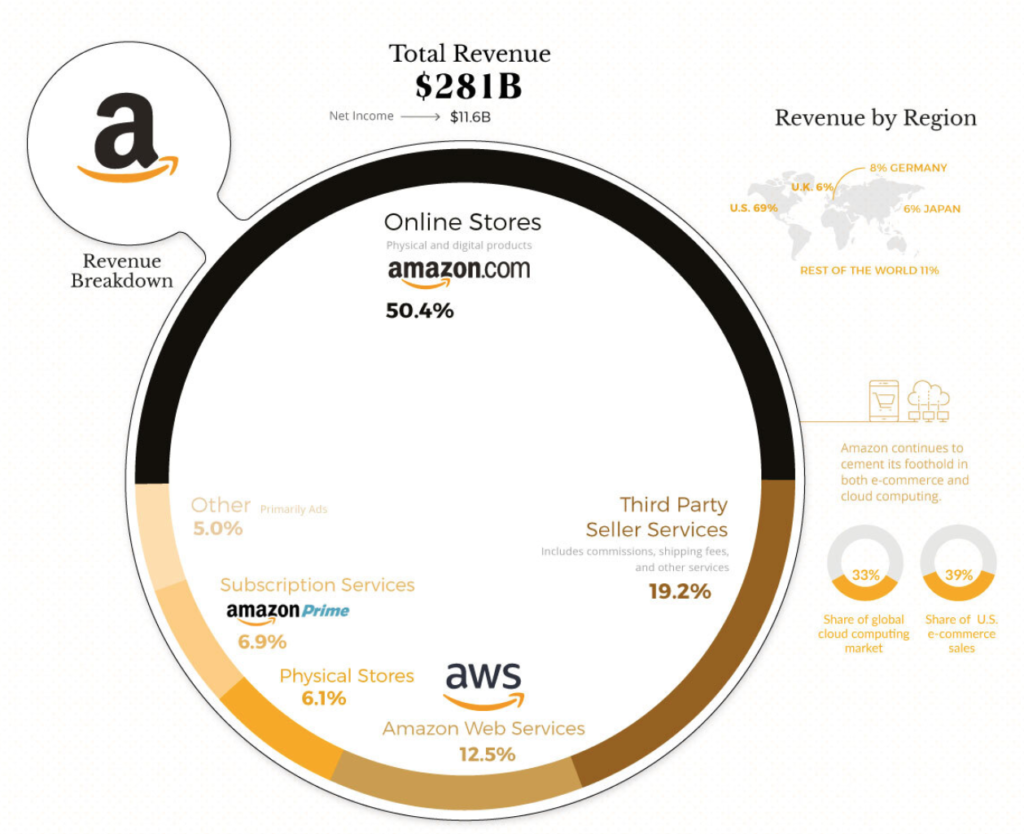

For Microsoft, their windows program, office suite, and Azure cloud are some of their strongest business lines. Most personal computers are run on Windows for the last two decades. For Amazon, its forte is online retailing and cloud computing (see below). And Google built its business ‘moat’ around search engines, Youtube, and other software services. Facebook is dominant in social media, while Apple fosters its own gigantic ecosystem with phones, computers, and other personal devices. Products announced during the Apple Event Days are often trend setting.

Once their platforms have acquired enough customers, their systems enable FAANGS to create a self-reinforcing cycle, such as hosting businesses, leveraging core competencies into other sectors, and locking out competitors. Data is one of the keys. Big Tech leverages data into insights and monetise insights into earnings.

For example, Amazon not only acts as a platform for small businesses, but it also uses these data to sell its own-branded goods. Google and Facebook turn search and social data into advertising gold. Youtube alone brings in $5 billion in revenue in the last quarter.

Source: VisualCapitalist.com

What are FAAMG’s prospects for the next decade?

Due to their competitive advantages and profitability, investors love Big Tech. These companies are cash rich, growing rapidly and holding quasi-monopolistic positions in their respective niches. Apple gained almost $1 trillion in value over the past 12 months.

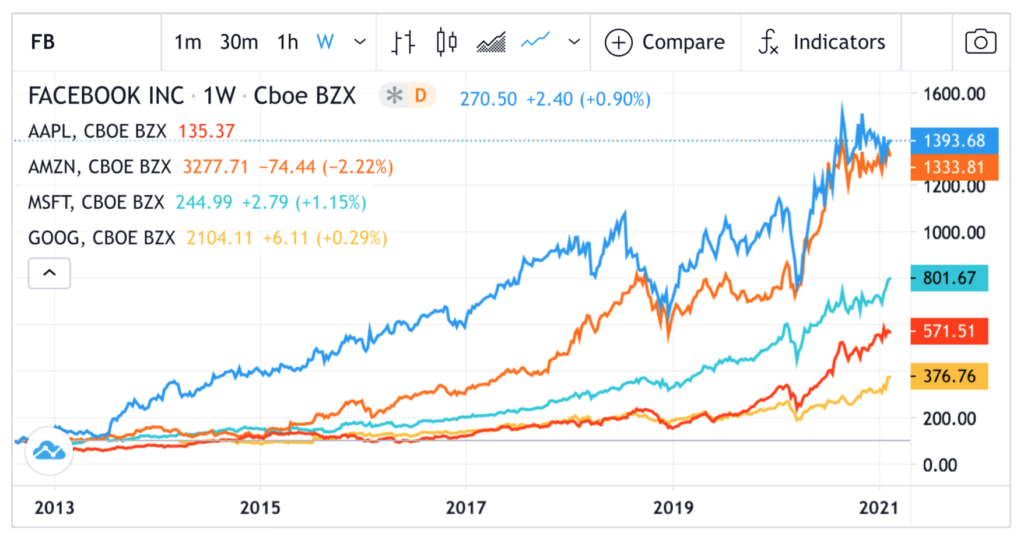

Over the decade, FAAMG have paid handsome returns to investors (see below).

For new investors, however, these spectacular stock market performances are now in the past. What matters now is whether the Big Tech can repeat its performance over the next decade. Should you buy them now?

Yes and no. Yes because these tech companies are continuing to rake in huge profits year after year. For investors with a conservative bias, FAANG should be their top picks in the technology sector. They are the *blue chips* of the tech sector with enviable business models.

For more adventurous investors, however, they should look to smaller tech competitors that could give them more ‘bang for the buck’ so to speak. It is harder to grow when the firm is already worth $1 trillion.

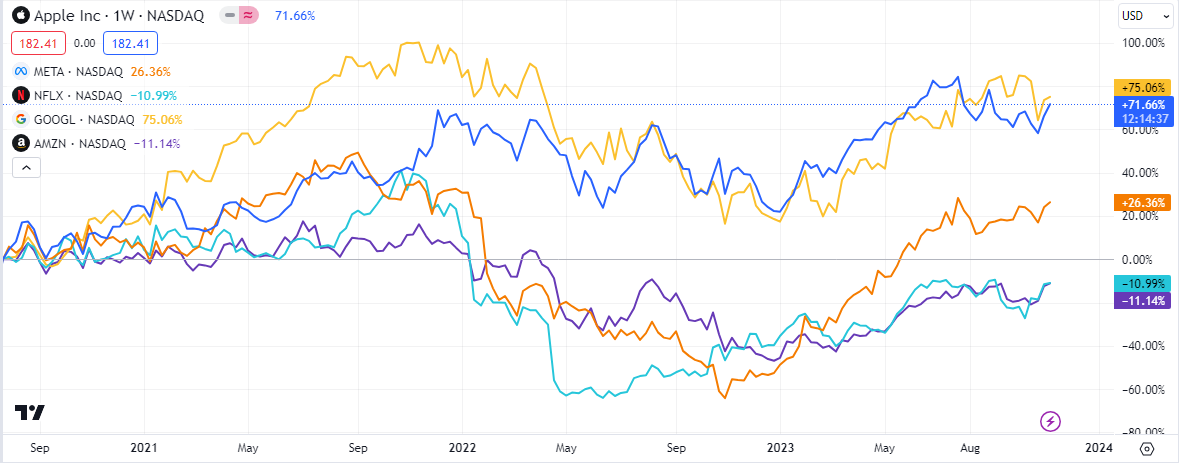

FAANG Stocks Short-Term Chart

FAANG Stocks Long-Term Chart

Opportunities behind FAAMG

Opportunities for these Big Tech included:

- Continuing trends arising from the pandemic such as WFH and online communication and leisure

- Profitability arising from their dominating positions. Apple reported its first $100 billion+ revenue in one quarter recently, with sales growth in nearly every product line.

- Growth into other sectors such as finance and healthcare

Even when their current growth rates slow, FAANG stocks will continue to hold a commanding position in their industries. Investors should hold some exposure here.

However, bear in mind that after a decade of continuing uptrend, FAANG stocks are not cheap.

Future threats facing Big Tech

The big question for investors is whether governments around the world perceive Big Tech as a threat. These online giants are benefitting from the pandemic. Unsurprisingly, a few are advocating an ‘Amazon Tax’ to help pay for the costly pandemic rescue efforts.

Over the next year or so, these threats will continue to bubble, including:

- Windfall tax

- Regulatory curtailment – include fines and restrictions

- Anti-monopoly threats to breakup the company

- Competition from other tech companies

These are no idle threats. Regulatory fines can be absorbed by these companies, but a breakup will throw the firm off its balance.

But make no mistake, these companies will do whatever they can to maintain their current positions. They will throw all their financial resources to hold onto – or extend – their competitive advantages.

How to buy FAANG stocks

Big Tech are so big that they are almost an asset class of its own. Their market capitalisation collectively runs into trillions of dollars. Perhaps it is not surprising that some financial companies are devising ways to sell the FAANG concept.

By and large, there are four ways you can gain exposure to FAANG stocks:

- Buy FAANG shares directly – in your individual stock account (ISA) and normal stock accounts. Equal weighted or just a couple of stocks you like. Warren Buffett holds $130 billion worth of Apple shares and not others.

- Buy funds that hold these stocks – such as Scottish Mortgage Trust (SMT) in the UK. Its December factsheet shows it holds a variety of tech stocks including Amazon.

- Buy ETFs with a large exposure to FAANG – such as Nasdaq 100 exchange-traded ETF (QQQ). Its top three holdings last year were Apple, Microsoft and Amazon. There are other tech-dominated ETFs around.

- Buy dedicated FAANG indices via futures – such as NYSE FANG+ Index, created out of 10 large tech stocks. Interestingly, there is a future contract based on this index. You can trade these through a futures broker.

Source: ICE.com

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.