The green industrial revolution is accelerating the transition to electric vehicles. This will be a big theme in the years ahead. This article looks at how investors can participate in the exciting sector and invest in electric carmakers.

The plan to put electric vehicles on the road accelerates

“Now is the time,” wrote the UK Prime Minister this week, “to plan our green recovery with high-skilled jobs that give people the satisfaction of knowing they are helping to make the country cleaner, greener and more beautiful.”

Point Four of his 10-point green industrial plan is to ‘end the sale of new petrol and diesel cars and vans in 2030.’ This, no doubt, is a major policy shift. In just a decade, new internal combustion engine cars will be gone from UK car showrooms. The replacement? Electric cars and vans.

Meanwhile in China, the State Council stated in July that ‘New Energy Vehicles’ – powered by battery and hydrogen – will comprise 25% of all vehicles in 2025. And in the US, the incoming Biden administration is planning substantial changes to tackle climate change. Part of the plan involves putting more electric vehicles (EV) on the road.

In short, the multi-decade ‘Green Revolution’ is here. Investors cannot ignore the trend on the road. The world is on the brink of another ‘horse-to-car’ transport revolution.

In the next few years, vast opportunities will emerge in the EV sector as the race to be next-generation automakers heats up. These once-in-a-decade opportunities must be grasped.

What is an electric vehicle? 5 points to know

1. EV is a vehicle powered by energy stored in batteries. It differs from combustion engines which uses fuel (from petrol or diesel). Over time, the cost of car batteries fall.

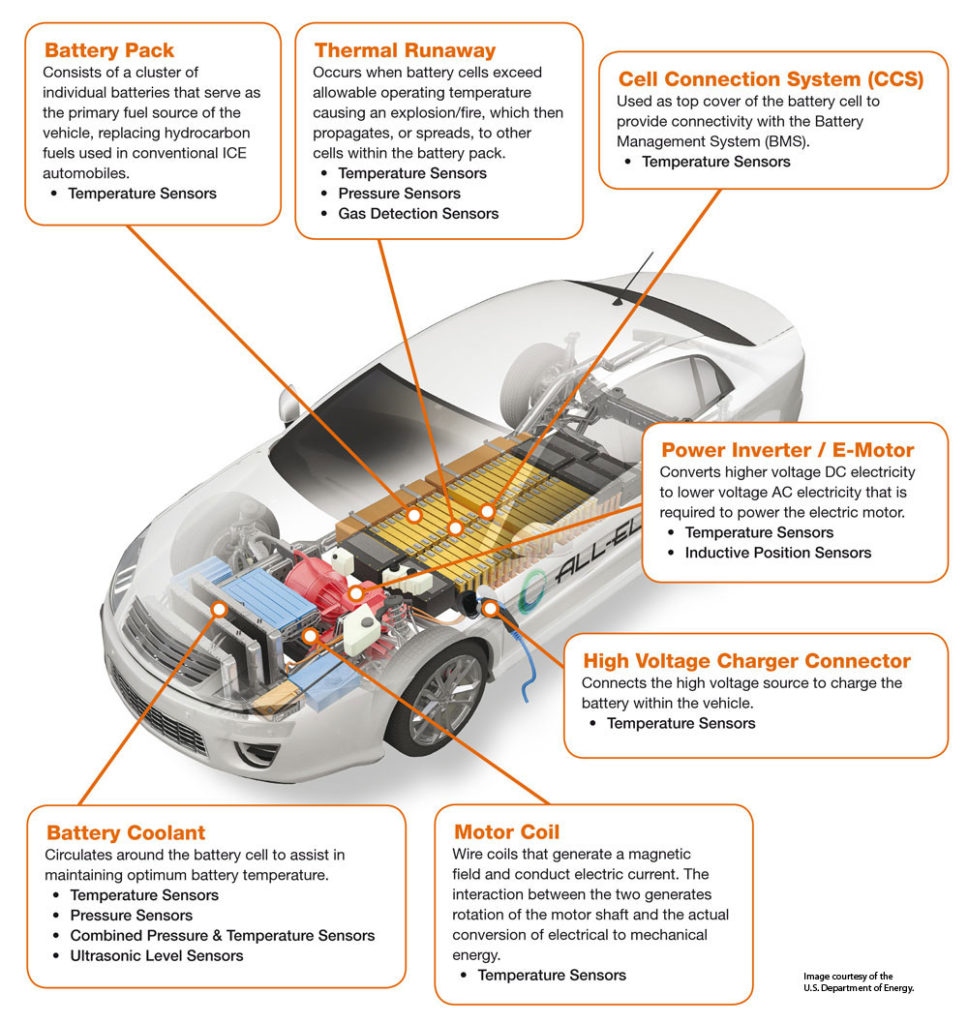

2. Car batteries are stored in tight packs, often at the base of the car. These batteries are dense; hence heavy. Plus, modern EV contains lots of sensors and cables, which further increases the weight (see below). Tesla S, a sedan EV, weighs about 2,200kg. Its battery pack alone weighs 550kg!

3. Car batteries are rechargeable and are mostly made from lithium-ion. Within these lithium batteries, the frequently used chemical compound is “Lithium Nickel Manganese Cobalt Oxide” or NMC, which contains about 10-30% cobalt. This is used in 30% of all EVs.

4. Charging an electric car at home takes 3-8 hours, depending on the car model. The key equation to remember:

Battery Size / Charging Speed = Charging Time

Shortening the charging time requires a faster charging speed. Look at this fantastic page for a comparison of charging time between different EV models.

Source: piher.net

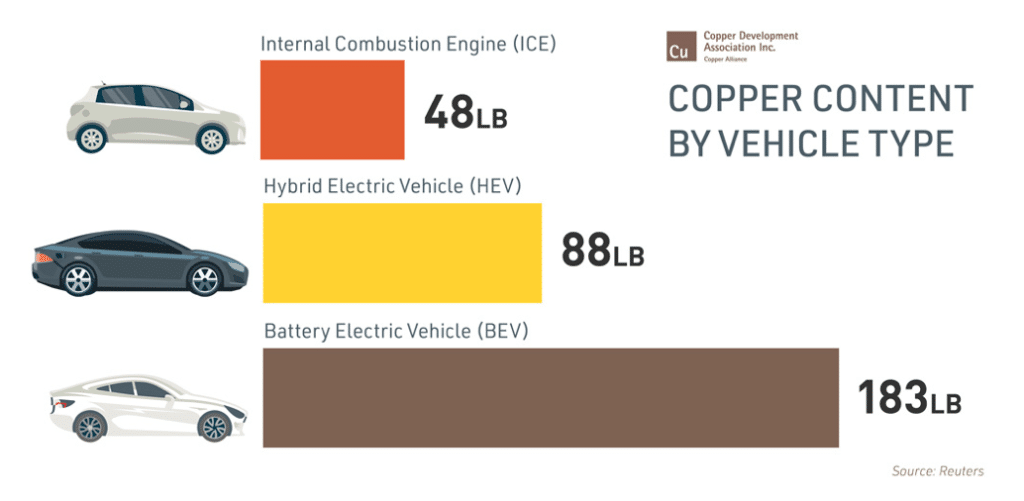

5. Electric cars still require plenty of raw materials, such as rubber and copper. According to the Copper Association, the usage of copper in an EV is actually three times higher than traditional ICE cars (see below). This means the demand for raw materials will increase as EV sales accelerate.

Source: Copper.org

What does it mean for investors?

“During the gold rush its a good time to be in the pick and shovel business.” – Mark Twain

The story of EV is clear. The Green Industrial Revolution will accelerate the shift to EV. For investors, this sector presents exciting opportunities in the decade ahead due to a regulatory-led demand boost.

A watershed moment for the EV sector is the inclusion of the $450billion Tesla (TSLA) in the S&P 500. The company will not be the last to join the blue chip index.

Here are some points to remember when investing in the EV sector.

1. Beware of the hype

The first point to remember is that plenty of new companies will take advantage of the hype surrounding the EV sector. Two decades ago, many DotCom companies rushed to the market to raise money from overly-excited investors. Many believed in the hype. They overstayed the party – and lost their shirts in the subsequent bust (2000-2003). In many ways, this is a repeat of the cycle, but we are still in the early-mid stage.

Many Tesla-wannabe are stampeding to the market to draw in capital. Li Auto (LI) from China was listed in the summer and has doubled. Arrival from the UK is set for a $5.4bn listing in Nasdaq. Right now, the EV sector has a very good story to sell.

2. Be aware of the risk in the sector

Because EV is a new sector that requires heavy capital investment, company losses are all too frequent. Remember, Tesla only started making its first full year of profits in 2020 despite reporting billions of sales. Deep pockets and repeated fundraising are required for new EV companies. Some will make it; some don’t. There is always some risks of new EV firms going under.

Moreover, there is the issue of fraud. Nikola (NKLA), an electric truck maker, suffered a massive drop its share price after Hindenburg Research accused the firm of ‘intricate fraud’. Its chairman was forced out; investors deserted the firm (see below). It will not be the last.

Investing in a stock after an 10-20 fold rally entails great risk.

3. Do not ignore traditional automakers

Traditional automakers are playing catchup by investing billions in their current products. Audi, BMW, Mercedes, Volvo, Nissan, Toyota, GM, etc are all racing to level up with the leader Tesla. Competition will heat up.

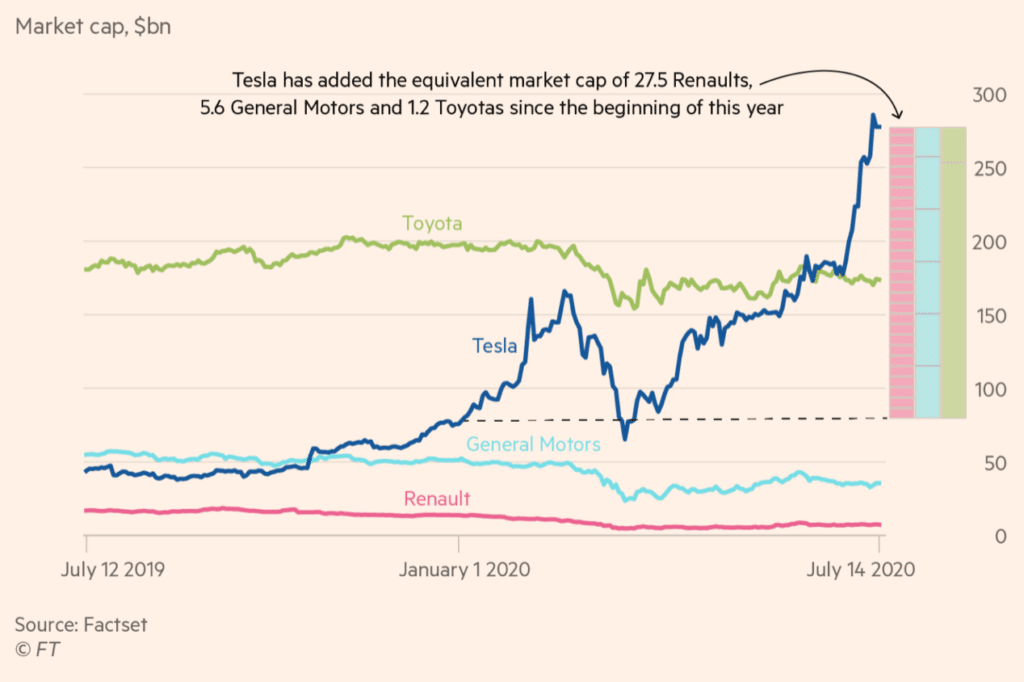

Just a few weeks back, Tesla became the most valuable carmaker in the world that has added to the equivalent of 5x General Motors this year (see below). Will this relative trend continue? I doubt it.

Fortunately, the global car market is large enough for some of these traditional automakers. The key is execution and product differentiation, either via price, software capability, charging ease, battery mileage, autonomous features, safety and reliability.

Volvo, for example, will be selling electric volvo trucks in 2021. GMC is starting to sell electric pickup trucks, a popular vehicle model in the US.

Source: Financial Times (paywall)

4. Diversify around the EV supply chain

Buy the shovel maker during a gold rush can be a profitable strategy, as Mark Twain observed.

This means buying the component makers within the EV ecosystem. One example is the battery makers. Others include EV computer chips or software developers, or key material suppliers. From time to time, these critical EV component suppliers can be a better investment than EV manufacturer themselves.

Further, investing in EV in different countries, such as China, could lower risk.

A partial list of what is investable:

- EV Battery makers – Contemporary Amperex Technology (300750.SZ), Panasonic (6752.JP), LG Chem (051910.KS)

- EV Chipmakers – NXP Semiconductors (NXPI), Maxim Integrated Products (MXIM)

- Hydrogen – Plug (PLUG), Bloom Energy (BLOOM), Fuelcell (FCEL), ITM Power (ITM UK)

- Cobalt/Lithium/Copper miners – Sociedad Quimica y Minera de Chile (SQM), Albemarle (ALB), Antofagasta (ANTO.UK), Global X Lithium ETF (LIT)

- China – NIO (NIO), Li Auto (LI), XPeng (XPEV), BYD (1211 HK)

Of course, there will be new companies/stocks to look at during the decade-long EV revolution. Companies that solve critical EV issues. For example, how to dispose of the growing amount of exhausted batteries in EV.

Northvolt, a company in Sweden, is trying to solve this problem using an automated system.

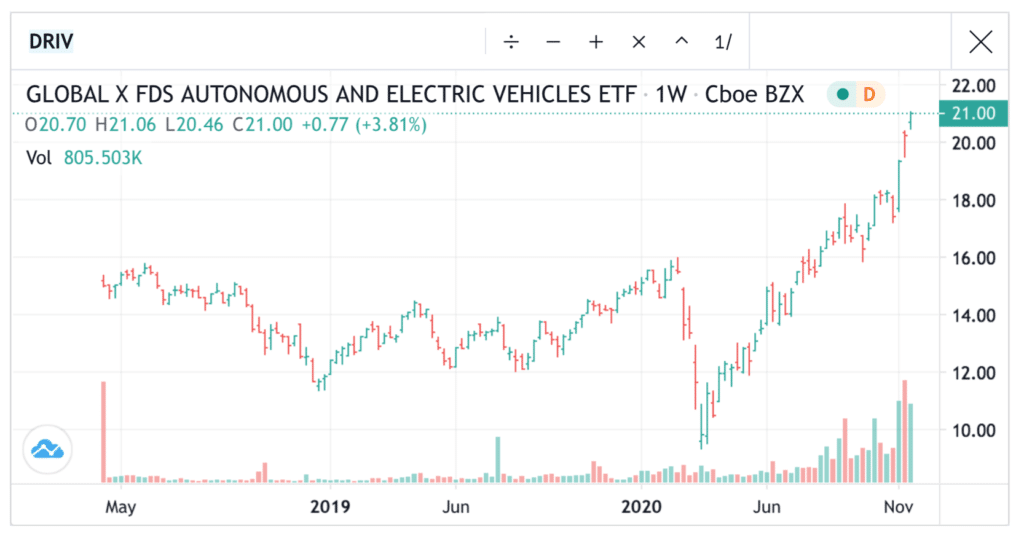

For an ETF approach, look to Global X Electric Vehicles (DRIV), a newly-listed ETF with 75 positions in the Fund.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.