- easyJet’s 1Q results beat market expectations

- Shares soar 10% to a multi-month high; rally above psychological level £5

- Technically, the airline appears to have bottomed out

Is the worst over for the UK budget airline easyJet? While there is no easy way of making money buying easyJet (EZJ)’s shares these days, it appears that its relentless decline is starting reverse. The many false starts are starting to change. Perhaps the fading energy and cost-of-living crises are lifting the airline sector again.

Is easyJet a good investment in the long term? (LON:EZJ)

Richard Branson is famous for saying this about airlines:

“If you want to be a millionaire, start with a billion dollars and launch a new airline.”

As you can see from easyJet’s multi-year share price chart below, its best bull run occurred nearly a decade ago, during 2011-2014. In that bull cycle, prices soared from £3 to more than £15 – a gain in excess of 400 percent.

Since reaching those peaks, each rebound in easyJet’s share price grew weaker and weaker, until prices totally collapsed during the pandemic. Last year, the budget airline had to seek a rights issue of £1.2 billion to strengthen its balance sheet. In 2022, easyJet’s shares slumped to a multi-year low of 260p.

The case for buying easyJet shares and other airline stocks now is simple to state: it is a bet on the economic recovery down the road. Airline stocks are (in)famously cyclical. They profit mightily when the economy is growing, as passengers fly when they have higher disposable income. The sector is heavily consumer-dependent.

However, the airline sector is also well-known for being a bottomless pit for capital. Many airlines have gone bust over the last few decades. Dilutions, the axing of dividends and a collapse in share prices are some of the dangers known to equity shareholders.

Therefore, we would watch to buy the sector only when the market and economy have moved past the current economic challenges. Trying to pick a bottom in the airline sector could be perilous. Either stay out and watch to buy, or buy and wait for better times. You choose.

Airlines are best bought when the sector is past the darkest period.

Airline stocks have never been an easy sector to hold in the long term. We now know that international travel can cease at any time. In the words of the investing guru Warren Buffett (2007):

“The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers.”

True enough. Since the pandemic, Eazyjet has had a major cash call and is now fighting to grow. In some ways, the budget airline now is not the same one as before the pandemic. Dilution is one difference.

As I have mentioned in the past, I would prefer to wait until the recession is over to buy airline stocks. Technically, enter the position when the sector is making higher lows and higher highs.

- Expert guide – How to invest in a recession

Valuing any stock these days is difficult, as share prices are swinging wildly both ways. An ‘undervalued’ stock can become even more undervalued a few weeks later when prices plummet by 30%.

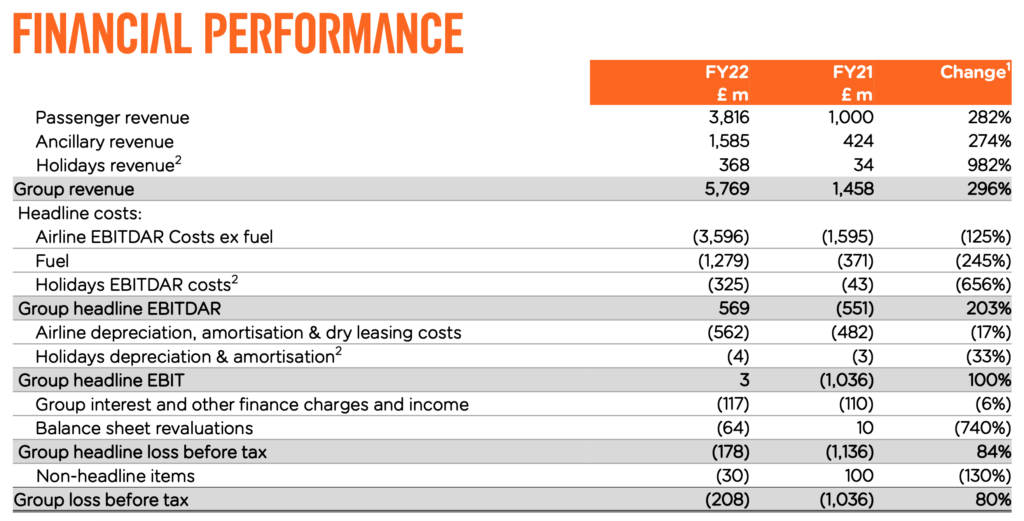

For easyJet, its share price in the second half of 2022 was around 300-400p, with some overshoot on either side. In the FY 2022, revenue came in at £3.8 billion and the loss for the entire year came in at just £200 million (see below).

In the latest RNS release on January, the airline stated that its “first quarter financial performance was ahead of expectations as yields strengthened, with revenue per seat increasing 36% year on year. Airline ancillary revenue continued to perform well, at £20.12 per seat, also increasing 36% year on year. easyJet holidays remains the UKs fastest growing major holiday company, with a 161% increase year on year in customers as demand for travel in the UK remains strong.“

Therefore, it is clear that the company should be able to weather the current macro environment without any further major dilution.

Source: easyJet.com

easyJet has had a rollercoaster ride this year. From a high of 700p, prices subsequently slumped by more than 50%. Prices have recovered somewhat of late, due to three reasons:

- Oversold recovery – chartwise, EZJ’s decline was extremely oversold back in autumn. A modest let-up in pessimism caused its share price to rebound immediately. Prices have risen nearly 100% from its 2022 lows

- Better-than-expected results – from other airlines. For example, IAG (IAG:LSE) reported pre-tax profits of €800 million while Wizz (WIZZ:LSE) announced a 40% rise in 2Q revenue (vs ’20).

- A fall in oil prices – which is supporting the profit margins of airlines

What is EasyJet’s share price prediction?

City analysts are moderately bearish on the airline stock, with many holding ‘Sell’ or ‘Underperform’ ratings. This is unsurprising given the backdrop of macro uncertainty.

For example, in early 2022 there were no ‘Underperform’ ratings. Now there are five.

Moreover, the median price target is at 472p – which the airline has beaten already reached in late January. At the time of writing (25 January), EZJ is trading above 500p

All these tell us the investment community is perhaps overly bearish on the stock and brokers are now scrambling to upgrade their profits and revenue forecasts for the budget airline.

How do you buy shares in easyJet (LON:EZJ)

To buy shares in Easyjet (LON:EZJ), you need a trading platform or share dealing account. Follow these three steps if you want to buy shares in Easyjet:

- Decide if you want to buy Easyjet shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Easyjet shares (LON:EZJ)?

Buying one LON:EZJ share costs 512p. However, as well as the 512p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current LON:EZJ share price is 512p which is a change of -9.8 or -1.88% from the last closing price of 512 with 4,547,284 shares traded giving LON:EZJ a market capitalisation of £3,881,010,688. The most recent daily high has been 520.4 and daily low 507.4. The LON:EZJ share price 52 week high has been 591.07 and the 52 week low 350. Based on the most recent LON:EZJ share price opening of 512, the current LON:EZJ EPS (earnings per share) are 0.43 and the PE (price earnings ratio) is 11.98.

Pricing data last updated 16/04/2024 17:07

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.