AJ Bell, is a funny one, they have excellent service, and really low costs, but have always been a bit shy with us. I really like them, and we rate them very highly, but we’ve as yet been able to nail them down for a CEO interview as we have done with Hargreaves Lansdown and Interactive Investor. But we have given the AJ Bell app and platform a thorough going over with real money so you can see what it’s like and if it’s right for you.

- Overview

- Richard's Review

- Awards

- Facts & Figures

- Customer Reviews

AJ Bell Review

Name: AJ Bell

Description: AJ Bell is an award-winning, low-cost online investing platform for UK DIY investors. Founded in 1995, AJ Bell has grown to become one of the UK’s leading investment platforms. Today, it has more than 440,000 customers and assets under administration (AUA) of over £150 billion.

Summary

AJ Bell is an excellent full-service stock broker that offers access to UK and international shares, bonds and funds with some of the lowest fees in the industry.

Pros

- Wide range of investments

- Low account costs

- Discounts for frequent investors

Cons

- High charge when you deal over the phone

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.4Ratings Explained

- Pricing: Really cheap, especially for an incumbent traditional investment platform.

- Market Access: Excellent coverage of all the major stock markets.

- Platform & Apps: Very good, does everything you need it to do.

- Customer Service: Always good, just a great all-round service.

- Research & Analysis: Lots on their website, and in Shares Magazine (which AJ Bell bought in 2008).

Richard’s AJ Bell Review

AJ Bell offers a wide range of services for investors including share dealing, fund investing, cash saving services, and mobile dealing. It also offers a range of accounts including Stocks and Shares ISAs, Lifetime ISAs, Self-Invested Personal Pensions (SIPPs), dealing accounts, investment accounts for children, and more.

- Looking for a JISA? Compare the best junior stocks and shares ISA accounts here

The range of investments available on AJ Bell is vast. Through its platform, investors can access UK shares, international shares, investment funds, investment trusts, exchange-traded funds (ETFs), and bonds.

AJ Bell Dealing account

The AJ Bell Dealing account is an easy-to-use, cost-effective account for investing online. With this account, you can choose from a wide range of investment options, including shares, funds, and ETFs. Key advantages of the AJ Bell Dealing account are that it is clear, well laid out, and user-friendly. Additionally, it offers access to a wider variety of investments than some other brokers.

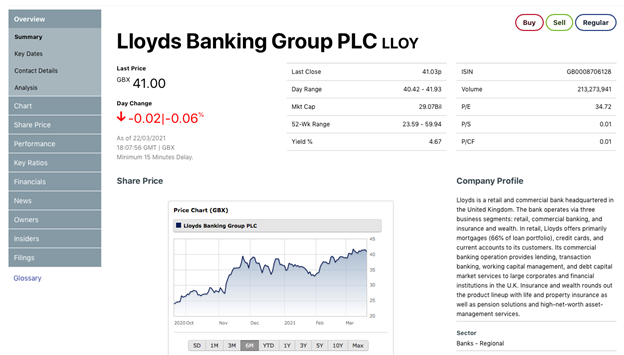

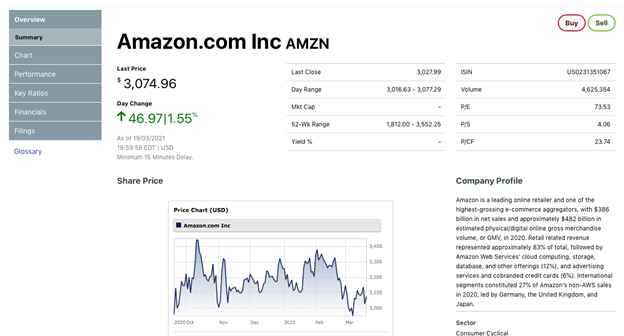

Buying and selling shares online through AJ Bell’s Dealing account is a straightforward process. You simply search for the company you’re interested in and click through to its research page. Here, you’ll receive a quote for the security. You then have 15 seconds to confirm your order at the quoted price.

Once your deal is completed, you’ll receive a contract note with all the details of your trade.

Shares can be bought and sold online through the website or app when the market is open. For UK shares, this is between 8:00am and 4:30pm. Overseas markets have different trading hours.

Unlike a tax-efficient account such as an ISA or SIPP, there are no limits to the amount you can pay into your Dealing account. And you can withdraw your money whenever you like.

The charges and fees for AJ Bell’s Dealing account are shown below. Trading fees are lower than those offered by Hargreaves Lansdown, however, they are higher than those of some newer brokers such as Freetrade and Trading 212, which both offer zero commissions on share purchases.

Account charges and fees

| Buying and selling investments (per deal) | |||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

| Funds custody charge (including unit trusts, OEICs, and structured products) | |||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

AJ Bell Stocks and Shares ISA

A Stocks and Shares ISA is a tax-efficient investment account in which you can invest up to £20,000 per year. When you invest in a Stocks and Shares ISA, you pay no tax on any capital gains or income from your investments.

AJ Bell’s Stocks and Shares ISA offers a number of advantages. These include:

- A wide investment range – you have access to a vast range of investments including stocks, over 2,000 funds, and ETFs.

- Accessibility – you can view your account online 24/7 and deal on the go with AJ Bell ’s mobile app.

- Regular savings – you invest from £25 per month using the regular investment service and pay £1.50 per deal.

- Low-costs – you can deal from £1.50 per trade and you’ll never pay more than £9.95 per online deal.

Fees and charges for AJ Bell ’s Stocks and Shares ISA are listed below. These fees and charges are quite competitive. For example, the 0.25% custody charge on the first £250,000 of assets is lower than rival Hargreaves Lansdown’s equivalent charge (0.45% on the first £250,000 of funds).

ISA charges and fees

| Buying and selling investments (per deal) | |||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

| Funds custody charge (including unit trusts, OEICs, and structured products) | |||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

The main attraction of this Stocks and Shares ISA, relative to competitors’ products, is the range of investments on offer. There are many funds to choose from and many international stocks available. On the downside, trading fees are higher than those offered by some other platforms such as Freetrade and Trading 212, which offer commission-free trading.

AJ Bell SIPP

AJ Bell ’s SIPP is a flexible retirement product that allows you to choose where you invest your pension savings. With this product, you’re in control of how and where your money is invested, and make the decisions that determine how your pension pot performs. You can track your investments online and make changes to your portfolio easily. You have access to a wide range of investments, including shares from over 20 markets, funds, ETFs, and bonds.

AJ Bell ’s SIPP has no set-up fees and there are no charges to transfer a SIPP. You can deal online from just £1.50 for funds and £9.95 for shares. Overall, the SIPP charges are quite reasonable and lower than those offered by rival Hargreaves Lansdown. For example, while Hargreaves Lansdown caps its annual shares custody charge at £200 per year, AJ Bell caps its annual shares custody charge at £120 per year.

SIPP charges and fees

| Buying and selling investments (per deal) | |||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

| Funds custody charge (including unit trusts, OEICs, and structured products) | |||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

The main attraction of this SIPP, relative to competitors’ products, is the range of investments on offer. On the downside, fees are higher than those of some other providers such as Vanguard, which offers fees of just 0.15% and no fund dealing charges.

AJ Bell Cash Savings Hub

AJ Bell ’s Cash savings hub is a one-stop-shop for managing your savings. Designed to help savers get more from their cash savings, the hub provides access to competitive notice and fixed-term savings accounts offered by partner banks such as Aldermore, Paragon Bank, and OakNorth.

One key advantage of AJ Bell ’s Cash savings hub is that no paperwork is required to make a deposit. You can apply for the accounts online in seconds. All you need to get started is an existing AJ Bell account.

Another advantage is that the service is free to use. AJ Bell gets paid by partner banks, not by customers.

Each savings account is protected by the Financial Services Compensation Scheme (FSCS), covering up to £85,000 per bank.

Overall, this product is very similar to Hargreaves Lansdown’s ‘Active Savings’ product. However, the partner banks are slightly different.

AJ Bell Junior SIPP

AJ Bell ’s Junior SIPP is a retirement product designed to help you give your children a head-start financially. You can contribute up to £2,880 per year and contributions are subject to 20% tax relief. The money is tied up until retirement age.

Benefits of AJ Bell ’s Junior SIPP include:

- A wide range of investment options – you can invest in shares, funds, and ETFs.

- Low dealing charges – you can buy and sell funds for just £1.50.

- A regular investment option – you can make regular investments from £25 per month.

- Accessibility – you can manage the account online.

Fees and charges are listed below.

Junior SIPP fees

| Buying and selling investments (per deal) | |||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

| Funds custody charge (including unit trusts, OEICs, and structured products) | |||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

The main attraction of this Junior SIPP, relative to competitors’ products, is the range of investments available. On the downside, fees are higher than those of some other providers. The fee to buy and sell shares with Hargreaves Lansdown’s Junior SIPP, for example, is £5.95 per trade.

AJ Bell Charges and fees

AJ Bell is committed to transparent and fair charges that offer investors excellent value and are among the lowest in the market. On the AJ Bell website, there’s a handy feature that enables you to calculate and compare charges.

AJ Bell ’s charging structure is consistent in approach across all its accounts. This ensures that you pay a fair price irrespective of the account or your investment style.

Platform charges and fees are listed below.

| Buying and selling investments (per deal) | |||

| Funds (including unit trusts and OEICs) online | £1.50 | ||

| Shares (including investment trusts, ETFs, gilts, and bonds) | £9.95 | ||

| Shares, where there were 10 or more share deals in the previous month | £4.95 | ||

| Funds custody charge (including unit trusts, OEICs, and structured products) | |||

| On the first £250,000 of funds | 0.25% | ||

| For funds between £250,000 and £1m | 0.10% | ||

| For funds between £1m and £2m | 0.05% | ||

| For funds over £2m | No charge | ||

| Shares custody charge (including investment trusts, ETFs, gilts, and bonds) | 0.25% | (max £3.50 per month) | |

The trading fees are quite competitive and are lower than those charged by rival Hargreaves Lansdown. Hargreaves’ standard trading fee, for example, is £11.95 per trade. This falls to £8.95 if you make 10-19 trades in the previous month and £5.95 if you make 20+ trades in the previous month. However, they are higher than some other brokers such as Trading 212 and Freetrade, which offer commission-free trading.

There are no account set-up fees, inactivity fees, charges for holding cash, or fees to withdraw cash.

AJ Bell does have exit fees, however. These are listed below. By contrast, rival Hargreaves Lansdown does not have exit fees.

AJ Bell Transfer out fees

| Charge (VAT is payable except where stated) | |

| Transfer out to another UK registered pension scheme in cash | No charge |

| Transfer out to another UK registered pension scheme in specie | £9.95 per holding (no VAT) |

| Transfer out to an overseas pension scheme (QROPS) | £250 |

| Payment by CHAPS | £25 |

| Disinvestment, if holdings need to be sold to cover charges | £9.95 per holding (no VAT) |

| Foreign exchange charge payable when dividends or corporate action payments are converted into sterling | 0.50% (no VAT) |

| Purchase an annuity | £150 |

| Additional charge for transferring in a pension to your SIPP and then transferring your SIPP to another provider or closing it within 12 months | £295 |

| Payments on death or if your pension is to be split/shared as part of a divorce | Time/cost basis. Minimum charge expected to be £250 |

AJ Bell International Investing

AJ Bell ’s dealing service lets you buy international shares online quickly and easily in a SIPP, Stocks and shares ISA, Lifetime ISA or Dealing account. The platform currently offers dealing in 24 international markets including the US, Canada, Japan, France, Germany, Italy, and Spain. Not all shares in these markets are available, however.

Buying international shares through AJ Bell is a straightforward process. You simply search for the company you’re looking for using the site’s search function and go to that stock’s research page. There, you will be given a quote.

International Investing charges and fees

| Buying and selling international shares online (per deal) | £9.95 |

| Buying and selling international shares by phone (per deal) | £29.95 |

| Foreign exchange charge on international dealing and foreign currency funds | |

| First £10,000 | 1.00% |

| Next £10,000 | 0.75% |

| Next £10,000 | 0.50% |

| Value over £30,000 | 0.25% |

| Foreign exchange charge payable when dividends or corporate action payments are converted into sterling | 0.50% |

Foreign exchange fees on international dealing are quite high relative to some other brokers. Trading 212, for example, offers FX fees of 0.15%.

Overall, AJ Bell offers a good range of international stocks relative to other brokers. However, its fees for dealing in international stocks are higher than those of some other brokers such as Trading 212.

AJ Bell Ethical Investing

AJ Bell offers a range of options for the ethical investor. Through the AJ Bell platform, investors can access ethical funds such as the Liontrust UK Ethical fund as well as ethical ETFs such as the iShares MSCI World SRI ETF.

AJ Bell has also created its own ethical fund, the AJ Bell Responsible Growth fund. This is a growth fund that is focused on companies taking their commitment to the environment and society seriously. It invests mostly in aggressive assets such as shares, avoiding certain sectors such as tobacco and gambling, and only investing a little in lower-risk assets such as bonds.

AJ Bell Special Offers

AJ Bell currently offers a number of ‘special offers’ for investors.

These include:

- A reward for opening and funding an ISA or SIPP – when you open an ISA or SIPP and fund it with £10,000 or more by 7 June you can choose either a one-year digital subscription to The Telegraph or a mixed case of wine from Laithwaite’s Wine.

- A free online subscription to Shares Magazine when you open an AJ Bell account and maintain a balance of £4,000 or more.

- A reward for transferring accounts with other providers – when you transfer your SIPP, ISA or Dealing account to AJ Bell , the company will pay up to £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person. To be eligible, the SIPP, ISA or dealing account being transferred must be valued at £20,000 or more. This offer is open to both existing and new customers.

- Rewards for recommending friends – when you recommend AJ Bell to a friend and they open a SIPP or ISA worth £10,000 or more, the company will give you £100 to say thank you, and your friend a free copy of ‘The DIY Investor’ (RRP £17.99) by Andy Bell. You can recommend as many friends as you like. They just need to be new to AJ Bell .

You can find more information on AJ Bell ’s special offers here.

AJ Bell Mobile Dealing & App Features

You can view your AJ Bell account and deal on the go on a variety of apps and devices. Its mobile apps are easy to use, secure, and allow you instant access to your account wherever you are. Apps are offered for a range of devices, including the iOS, Android, Apple Watch, Amazon Alexa, and Google assistant.

Through AJ Bell ’s apps you have the ability to:

- View and check the value of your portfolio

- Deal on the go

- Use the mobile app to enable two-factor authentication for added security

- View all your current active trades

- Read and send secure messages

AJ Bell Awards

AJ Bell always does very well in our awards because of their low fees, customer service and market access. However, their stand-out account has been their SIPP which is great for all-size portfolios as the fees are low and capped.

AJ Bell Facts & Figures

| ⬜ Public Company | ✔️ |

| 👉 Number Active Clients | 350,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | £65 billion |

| 📅 Founded | 1995 |

| Account Types | |

| ➡️ General Investment Account | ✔️ |

| ➡️ SIPP | ✔️ |

| ➡️ Stocks & Shares ISA | ✔️ |

| ➡️ Junior ISA | ✔️ |

| ➡️ Lifetime ISA | ✔️ |

| Dealing Costs | |

| ➡️ UK Shares | £9.95 |

| ➡️ US Stocks | £9.95 |

| ➡️ ETFs | £9.95 |

| ➡️ Bonds | £9.95 |

| ➡️ Funds | £1.50 |

AJ Bell Customer Reviews

Tell us what you think:

Capital at risk

AJ Bell review FAQs:

AJ Bell is a stockbroker and investment platform that lets you invest in UK and international shares, funds and bonds. They were established in 1995, currently have around 350,000 customers and look after over £65 billion of client assets.

Yes, in our awards survey and analysis of investment accounts AJ Bell is consistent at the top of the customer service rankings. They also provide access to a wide range of investments with low account costs.

Yes, AJ Bell has put together a series of low-cost, easy to use and diverse selectio of investment funds to invest in. AJ Bell funds cover growth markets, responsible investing in sustainable companies and funds that generate income rather than focusing on capital growth. You can also invest based on risk from cautious to adventurous and global growth.

Yes. AJ Bell is regulated by the FCA (Financial Conduct Authority) in the UK and your funds are protected by the FSCS guarantee.

AJ Bell differs from Vanguard in that AJ Bell is a full-service stock broker where you can invest in shares, bonds and funds. Whereas Vanguard in the UK only sells it’s own funds. You cannot invest in individual shares with Vanguard. You can also buy Vanguard shares on the AJ Bell platform.

If you want to buy individual shares you need a stock broker.

Yes, AJ Bell is one of the few investment platforms to offer Lifetime ISAs. To transfer a LISA to AJ Bell, you need to open an account and instruct the transfer.

AJ Bell is a public company listed on the London Stock Exchange with the ticker (LON:AJB), which means anyone can own part of it.

Yes, it is safe to invest with AJ Bell because they are FCA regulated, funds are protected by the FSCS, they are a public company and well established.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.