Markets rebound on discovery of a covid-19 vaccine.

Suddenly, a promising covid-19 vaccine appears on the horizon and sparked a furious rally in many depressed sectors. The vaccine could be a game changer for the economy and investors.

A relief rally or turning point?

“Well when events change, I change my mind. What do you do?” John Maynard Keynes

The biggest development over the past week was one that the world has been hoping for: a vaccine for the deadly coronavirus.

“Today is a great day for science and humanity.’ beamed Pfizer Inc’s Chief Executive Albert Bourla. The $210 billion pharmaceutical company startled the world when it released results on its covid research. Pfizer’s vaccine candidate was ‘found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection in the first interim efficacy analysis.”

The key word here is 90%. No other research comes close. Prior announcements on covid vaccines have disappointed. Not this time. The number completely changes the calculus of the economic recovery. Suddenly, people can see the light at the end of the dark covid tunnel.

The vaccine, a product from the collaboration research between Pfizer and BioNTech, is being raced to approval from multiple medical authorities. Hundreds of millions of doses are swiftly ordered by governments. First emergency application of the drug may come as soon as December.

Stunned by this sudden piece of good news, markets rejoiced. Prices surged. Investors view this vaccine to be a ‘game changer’ in the fight against the covid virus. Beaten-down sectors – especially transport, hospitality and entertainment businesses – all rallied hard in hope of a return to normality soon.

British Airways (IAG) jumped 40 per cent; Cineworld (CINE) rallied 100 per cent. Others like Easyjet (EZJ), Carnival Cruise (CCL), Barclays (BARC), Rolls Royce (RR.) and Burberry (BRBY) all gained significantly. These same sectors are rebounding in other regions, including the UK, US, Europe and Asia. In other words, it is a broad rally.

Meanwhile, market darlings like technology stocks (e.g., Amazon (AMZN), Zoom (ZM), Nvidia (NVDA)), gold and government bonds all saw some outflows. An intra-market rotation is seemingly underway, one that entails buying recovery stocks and taking profits from tech, bonds, and gold.

Zoom, for example, the internet-based communication tool and poster child of the global pandemic lockdown, crashed 35% from its recent peak (see below). Amazon is no higher than its July levels. Even gold is fighting to stay above $1,900.

Against these stark reversal in performances, many are wondering; have we passed the covid abyss? Is this a market ‘turning point’?

Dark clouds remained

Unfortunately, the situation on the ground says we are not out of woods yet. First, covid infections are still spreading fast. In the UK, cases are continuing to range above 20,000 per day. Across the Atlantic, US covid cases surpassed 10 million last Sunday and covid hospitalisation hit a record high this week of 61,964. Daily covid infections are staying above 100,00 per day. Some speculated US is about to hit 200,000 covid cases per day this week.

Japan, a country that has been holding the virus at bay, is warning about a ‘third wave’.

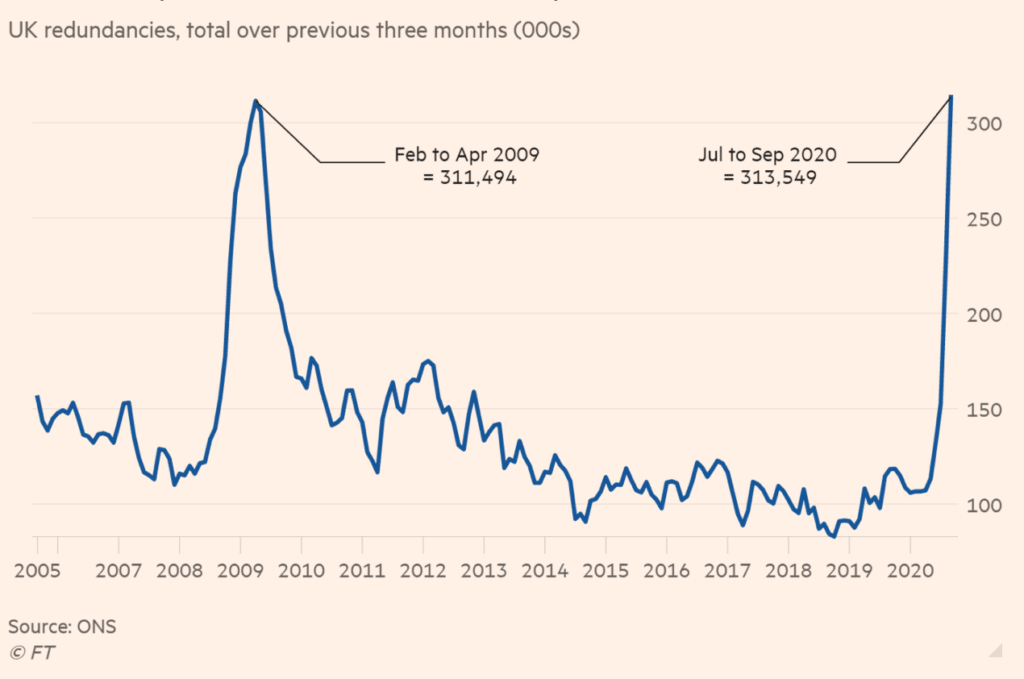

In the meantime, the second national lockdown in England is rolling on. Until December 2, 2020, the date of the re-opening, thousands of shops and venues are to remain closed. The lack of income is hitting employees, businesses, landlords, and the government. Against this backdrop, UK unemployment is surging. Some estimated that jobs are being lost at a rate that rivals the last Great Recession (see below).

Source: FT

At the same time, experts are questioning about the effectiveness of Pfizer’s drug, its immunity duration, and how to scale up the production of the vaccine. Even if Pfizer’s vaccine works, it will not be until spring 2021 when the economy normalises partially. During this period, the ‘stay at home’ mantra is still out in force. The UK government is thinking about implementing a ‘Tier 4’ system after December 2.

How to invest in a turbulent time like this?

Markets are collectively forward looking. Investors anticipate and bet accordingly. This week’s rally shows just how efficient this adjustment can be. One piece of bullish news in a depressed market and stock values increased by the trillions.

Returning to the first question, is Pfizer’s vaccine is a ‘game changer’? Have markets reached an inflection point? Yes and potentially yes. Why? Because the vaccine has inserted psychological floors on battered asset prices. Investor sentiment has changed – because a cure is now on the table. Astute investors will be ready to buy depressed stocks/bonds because they know this could just ‘temporary’ hiccups.

Of course, how asset prices will move from now till the vaccine is fully applied is unpredictable. Markets could suffer setbacks or rack up further gains. Some strategies to buy into a post-covid market:

- Drip feed capital into the stock market. We can not predict whether the pandemic has already passed the nadir. To avoid market timing, it could be better to buy into battered sectors regularly. This evens out entry prices and avoid heavy drawdowns. Buy more on setbacks.

- Diversify among the recovering sectors. As it is hard to anticipate which sectors will do the best post-covid. Buying quality names is preferred. Of course, the riskier the stock, the higher the potential returns.

- Pay attention to green investments. The tectonic shift to greener energy is about to grow in earnest. Recently the UK treasury talked about issuing ‘Green Gilts’ and earlier I wrote wrote about clean energy here. These could be some new sectors to invest in.

- Don’t forget Asia. Countries in Asia generally handled the pandemic better. These economies may well recover and grow faster once Europe and the US recover. The Chinese stock market is riding upwards.

- Buy inflation. Since it touched a low of 0.5% last August, the US 10-year bond yield has been rising. It is now near 1%. This rebound occurred despite the Federal Reserve’s ‘QE-infinity’, where $80 billion of Treasuries are bought per month. These reflationary policies are bullish for commodities and their derivatives, e.g. miners. Look at the chart of Rio Tinto (RIO). Prices are on the verge of a major upside breakout at £50.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.