Italian bank Fineco has been making quite a splash in the UK and European margin trading markets of late.

Not only have the Italian bank caught the eye of Good Money Guide subscribers in the 2020 broker awards and voters they have also captured the attention of US investment bank Citigroup, who have written on the stock today.

Citigroup analysts named Fineco as their top pick among Italian diversified financials noting its many attractive characteristics and highlighting the fact that the company was growing, with strong leverage running through to the bottom line – in other words growing turnover, without increasing cost at the same rate.

Citi also notes that the bank has a transparent (uncomplicated) business model that is profitable and digitally focused. The analysts believe that the markets are picking up on Fineco’s DRUM strategy which stands for Dividend, Resilient revenues, UK opportunities, and a Multi-channel product offer.

In plain English Fineco’s strategy is to build on its number one position in Italian broking where according to Citi it has a 27% market share and to leverage that success in the UK and other European markets.

Fineco offers its clients a full suite of banking products alongside OTC margin trading in FX and CFDs, on-exchange futures and options as well as investing and fund management services, all of which are available from one account.

Fineco will report interim numbers to the end of September 2020 on November 9th.

Citigroup suggests that Fineco’s brokerage revenues are up +110% on a year over year basis thanks to market volatility seen in H1 2020 and though the bank is embargoed from paying dividends at the moment it is Fineco’s stated intention to return to the dividend list as soon as it can.

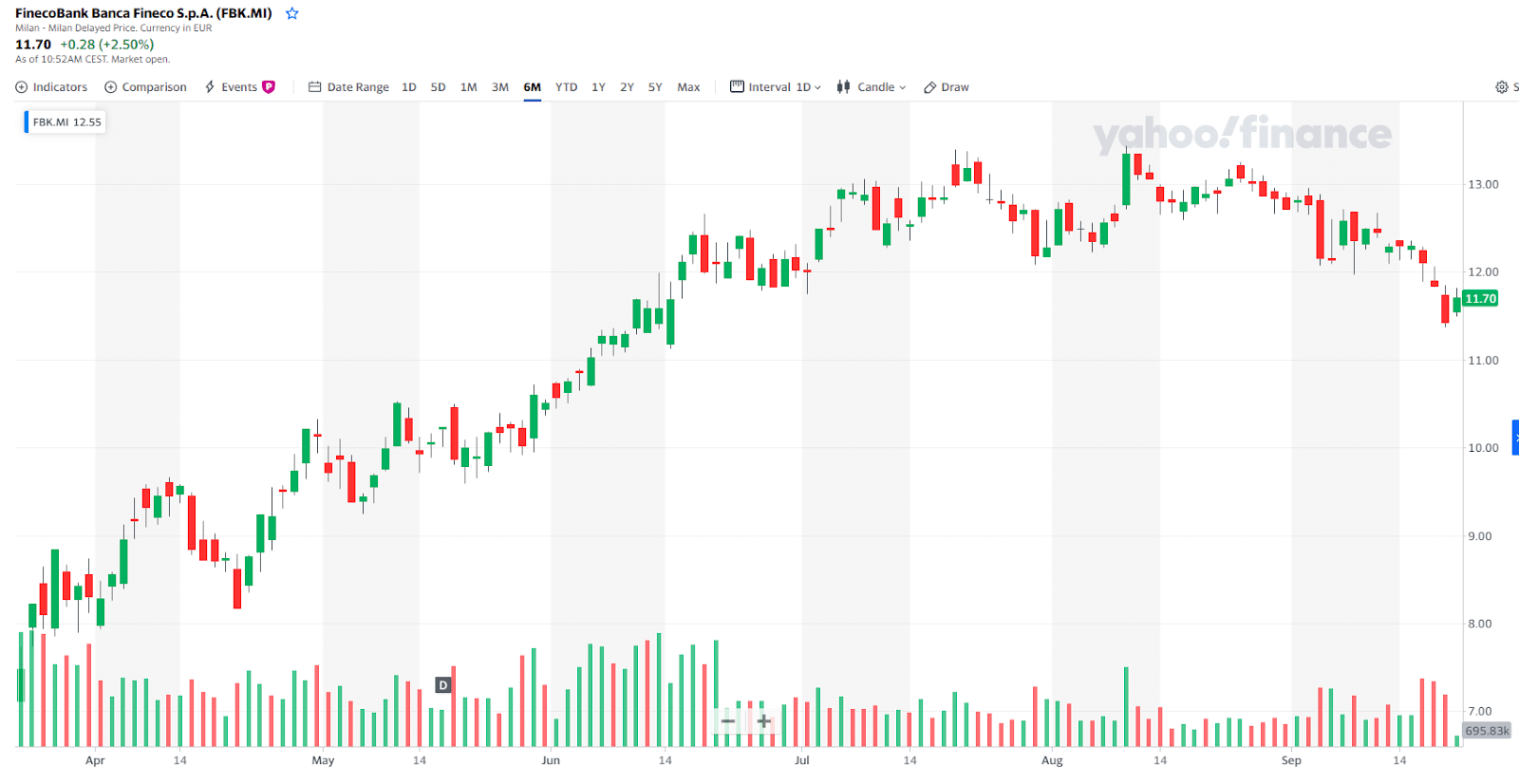

Fineco is quoted in Milan under the Ticker FBK its shares have traded as high as a €13.43 in Mid August and as low as €6.66 in March. At the time of writing, they are trading at €11.70 giving them a market cap of €7.14 billion. It will be interesting to see how the shares fare ahead of the upcoming results.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.