Every time I get in the car I get peppered with Radio ads for “Lloyds Ready-Made Investing” so I thought I’d have a poke around and see if they are any good compared to the more mainstream investing platforms. Obviously, I listed to Radio 2, so I’m very much the target audience of instead of “can you just play me some decent music” for investing it “can you make some decent investments for me”. Except of course, when I have to listen to Capital London, when my kids are in the car, which is a bit more fast-paced, more like trading. But, if you’re thinking about using Lloyds Ready-Made Investments, here’s what we think of them and some good alternatives if you find they are not for you.

Richard’s Review

Lloyds Ready-Made Investments Review

Name: Lloyds Ready-Made Investments

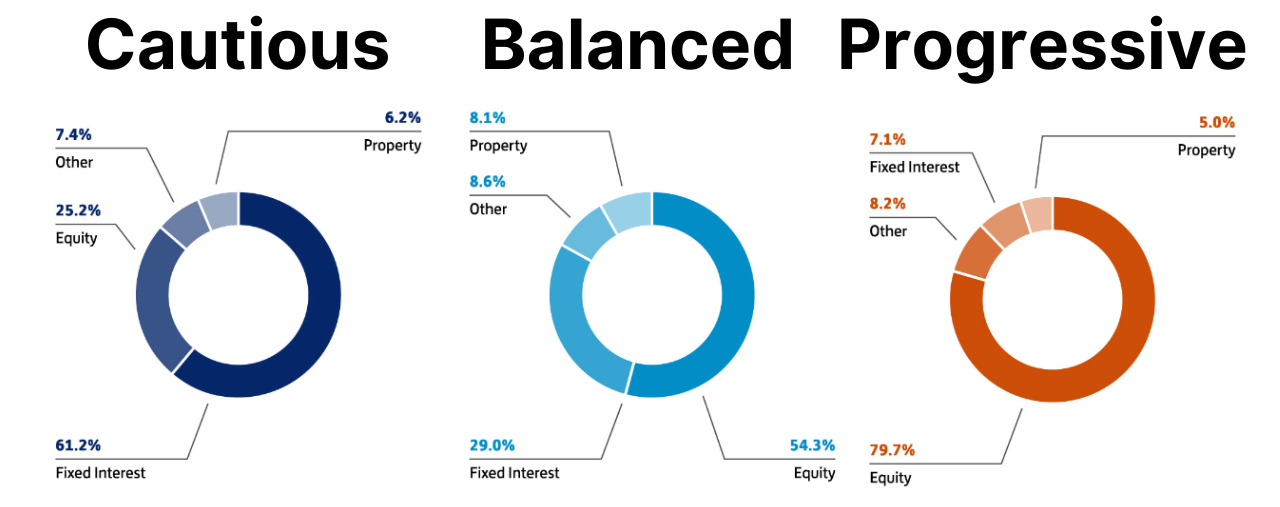

Description: Lloyds Ready Made Investments let customers of Lloyds Bank invest in three Scottish Widows UCITS with varying degrees of risk from Cautious, Balanced and Progressive. The more risk you want take on the more exposure you have to equities in your portfolio.

Are Lloyds Ready-Made Investments good?

If you are a Lloyds Banking customer and just want a simple way to invest in the long-term these ready-made investments are a good choice. The account fee of £36 a year and ongoing charges of between 0.23% and 0.25% are very low and shouldn’t eat into your returns too much. In comparison, the top funds on Hargreaves Lansdown (Fidelity Global and Fundsmith Equity) have ongoing charges of nearly 1%. The fixed fee model for Lloyds Ready-Made Investments also make them cheaper than some robo-advisors that typically charge between 0.25% and 0.75%.

Also, as opposed to digital wealth managers like Wealthify, Nutmeg and Moneyfarm, the Scottish Widows funds you are actually investing in consist of a variety of other funds as opposed to ETFs.

Pros

- Managed investments

- Simple to set up

- Relatively low cost

- Stocks & Shares ISA

Cons

- Only available to Lloyds customers

- Limited range of investments

- Cannot invest in individual shares

- No SIPP or Pension

-

Pricing

(4.5)

-

Market Access

(3)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

3.7Ratings Explained

- Pricing: Very cheap compared to competitors for custody and ongoing fees

- Market Access: limited to only Scottish Widows funds which limited your investment opportunity

- Online Platform: the app is pretty good overall and does everything you need it to, although does suffer from legacy banking restrictions

- Customer Service: By your side as they say, good live chat and phone response and feedback

- Research & Analysis: You can see the Key Facts document and Key Investor Information PDFs, which tell you what you can invest in. However, there is limited market commentary and the factsheet has not been updated since December 2023.

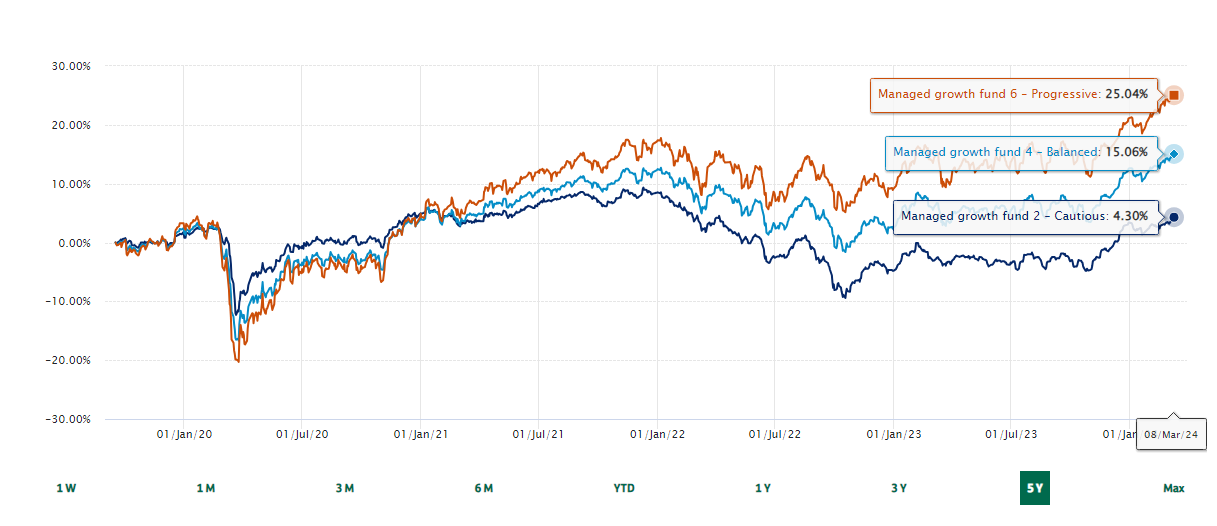

Performance

Over five years the Lloyds Ready-Made portfolios have performed fairly well for those taking on the highest risk fund which is up 25%, but the cautious fund is only up a meagre 4.3%. The fund’s certainly don’t go up in a straight line and there are many occasions when your investments would have been worth less than you put in. This is particularly disappointing when you compare it to Vanguard’s VUSA ETF which tracks the S&P500, which you can buy through Hargreaves Lansdown.

Investments

When you invest in Lloyds Ready-Made Investments you are actually just buying into one of three Scottish Widow Funds. The more risk/reward you are prepared to take the more equities (shares) are in the portfolios.

Alternatives

If you are not a customer of Lloyds Bank, you can’t use Lloyds Ready-Made Investments and unfortunately, Lloyds have still not mastered what people want from their bank account in the same way that Revolut has, which is making it easy.

| Robo Advisor | Fees | GIA | ISA | Pension | JISA | LISA | GMG Rating | More Info |

|---|---|---|---|---|---|---|---|---|

| 0.6% | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | See Portfolios Capital at Risk |

|

| 0.75% - 0.35% | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | See Portfolios Capital at Risk |

|

| 0.75% - 0.25% | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | See Portfolios Capital at Risk |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.