The new coronavirus variant, Omicron, has re-instilled fear in the market. Stock markets around the world nosedived on the 26 Nov as governments curtailed international travelling. But, is this sell-off an opportunity for investors? Should you buy stocks as prices dip? More importantly, what does ‘buy the dip’ actually mean?

What does “buying the dip” mean?

Buying the dip, simply speaking, is acquiring assets when prices are falling. This is a contrarian act.

You must have heard of the old adage – ‘prices never move in a straight line’. Financials markets have its ebb and flow. Cycles come and go. Prices rise and fall, even within a bull market.

For example, the last week of November saw the emergence of the Omicron coronavirus. This unexpected development prompted most traders to ‘de-risk’ their positions, especially in assets that are travel-related like airlines and cruise stocks. Asset prices fell across the board.

However, some investors surmised that the odds of a prolonged sell-off is low. The economy is still doing reasonably well, so they think a rebound is on the table. Based on this, they brave the storm and bought amidst a wall of selling. This is ‘buying the dip’. They go against herd.

The opposite of ‘buy the dip’ is to ‘sell the rally’. Traders sell assets when prices are rising. Again, this is a contrarian strategy. But that’s a topic for another day.

Buying the dip is not an easy strategy to follow. Two main reasons impede traders from executing the strategy. One, the trader must be confident that the dip is a dip; and two, the investor must exercise careful judgement in timing the buy. When prices are falling, every asset is seemingly risky.

One famous investor who likes to buy when prices are falling is Warren Buffett, who coined this famous quote: “Be fearful when others are greedy. Be greedy when others are fearful.”

The question is, how do you buy the dip? Is that something everyday investor can learn to do? What sort of things we need to watch out for when buying the dip?

How do you buy the dip?

A dip, by definition, is a mild correction. In contrast, a 20% index-wide decline is a bear market. A 40% fall is an almighty crash. Seldom do market crash like they did in 2008. But when they do, be sure to step out of risky assets and move into cash.

Ergo, when buying the dip, the size of the decline matters.

The first question is this: Under what condition does the ‘buy-the-dip’ strategy work best?

This strategy works best during a prolonged bull market. Prices dip and then rebound soon after. Prices have another dip and then rebound. Repeat.

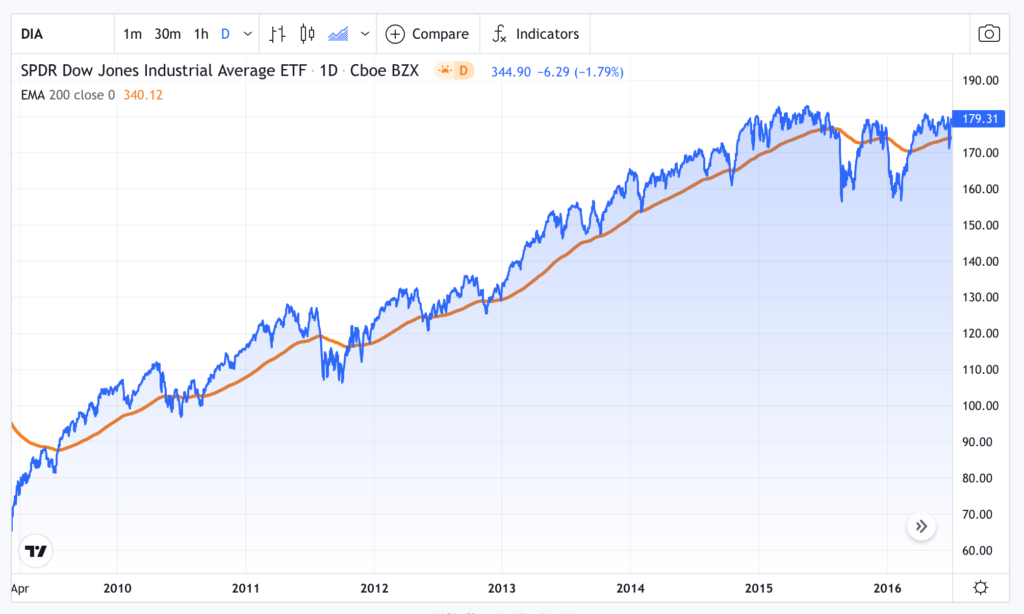

To execute a buy-the-dip tactic, you have to hold a long-term bullish view of the asset. It must still be locked within a cyclical uptrend. One example is the Dow Jones Industrial Index during 2010-2015.

But when should you start buying the dip? Should you buy immediately, or wait until the selling momentum is exhausted?

There are no clear cut-and-paste answer to this question. Because this answer involves devising a strategy that incorporates your portfolio targets, such as:

- Are you adding to a position or buying new?

- Are you holding for the long-term or trading a bounce?

- Stop loss (in case you get it wrong).

The target asset is also an important consideration. Some assets are very volatile. So their corrections could deep but brief. Some assets are less volatile. Their rebounds may take more time.

Buying individual stocks is different to that of a broad stock index. The latter is less volatile.

Generally, we look at 5-10% drop for a broad-based stock index. Individual stocks may drop more – depending on their prior trends.

When should you buy the dip?

Buying assets during a corrective phase can be daunting. This is because you are doing the opposite of what everyone else is doing. You buy while others are selling. And as prices slide further, you may start to wonder – have I got it wrong?

The rule when buying a dip is to make sure that the market is still in a bull market. Should the dip turn into a full-fledged bear market, well, you must activate risk management procedures to cut losses.

There are technical aids for you to decide when and how to buy a dip.

- The first factor to consider is to assess how long the bull trend has been running. For example, if the rally has just begun, chances of another leg up are high. In contrast, if the rally is already 2-3 years long, I would be wary to buying the dip aggressively.

- The second factor is to consider the price action prior to the dip.

When considering these factors, a trend indicator is useful. The most common trend indicator is the moving average with the parameter above 150 or 200 days (or 40 weeks).

This indicator smooths out the price action over the past two hundred days. In doing so, it filters out the real underlying price trend. For example, I use gold prices during 2007-2011 overlay with the 200-day moving average below.

During 2009-2011, prices bounced off the trend indicator 5 or 6 times. Buying each dip here worked very well. The asset is in a bull market; each dip was short and followed by a quick rebound into new cyclical highs.

In a long bull run, this retracement of prices into the trendline should happen 4-5 times.

When should you not buy the dip?

Buying the dip is a strategy that may or may not work every time. After all, nothing is certain in market.

When should you not buy the dip?

The first factor to consider is the time factor. A stock market index that has been rising steadily for several years goes into a correction. Should you buy the dip? The short answer is no – simply because the trend has been running for such a long time. Demand is probably exhausted. New buyers have can be found to resuscitate the trend; new macro factors need to be favourable too.

The second factor that goes against buying the dip is the rapid price acceleration prior to the dip.

By itself, a trend extension does not mean the end of a bull run. It is sharp pace of gains that is unsustainable. A parabolic rally is likely to mark the end of a trend.

Look at the asset below – Bitcoin in 2017. For the whole year, prices rose steadily along the 200-day moving average indicator. The asset also bounced off the trendline several times. Suddenly, the crypto rocketed far above the trend line in an uncontrolled manner.

Any dip following such a massive rise is unlikely to stay a ‘dip’ – because traders are now holding massive gains. Any profit erosion can lead to a cascade of take-profits orders. A dip turns into a crash.

In the same way, look at Tesla (TLSA) now. Prices retraced to the moving average trendline in May before rebounding sharply higher. Prices are now more than 40% above the trendline. Will you buy a dip?

Summary

Buy the dip is tactic that investors use to acquire assets when prices correct from their highs. During a bull run, this strategy works well because it allows investors to buy at cheaper prices before selling off on rallies.

However, as the bull run matures, investors should watch for trend exhaustion and not blindly buy into any dip. A big parabolic rally is a warning sign that trend is coming to an end. In this case, perhaps watching from the sideline is a better thing to do.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.