Speculative interests are back in crypto coins, it seems.

About three weeks ago, I highlighted the tightening (triangle) pattern in Bitcoin (BTC), the largest crypto coin in circulation. (You can check out the size of crypto coins here in coinmarketcap.com.)

As BTC’s chart shows, prices have not moved much since. In fact, the instrument is continuing to coil into an even tighter range. Low volatility, lower trading range, and near-zero mainstream coverage means that the eventual breakout point is drawing closer and closer. You can say that BTC is in a volcanic ‘dormant’ stage.

Which direction will the breakout be? Difficult to say if we just look at BTC’s chart. But, more importantly, smaller crypto coins are already giving us some clues.

XRP, for instance, surged by nearly 20% over the past few sessions. This latest rally definitely broke the downtrend from 0.50 (see below). Prices also crossed the 50-day moving average for the first time in 10 weeks.

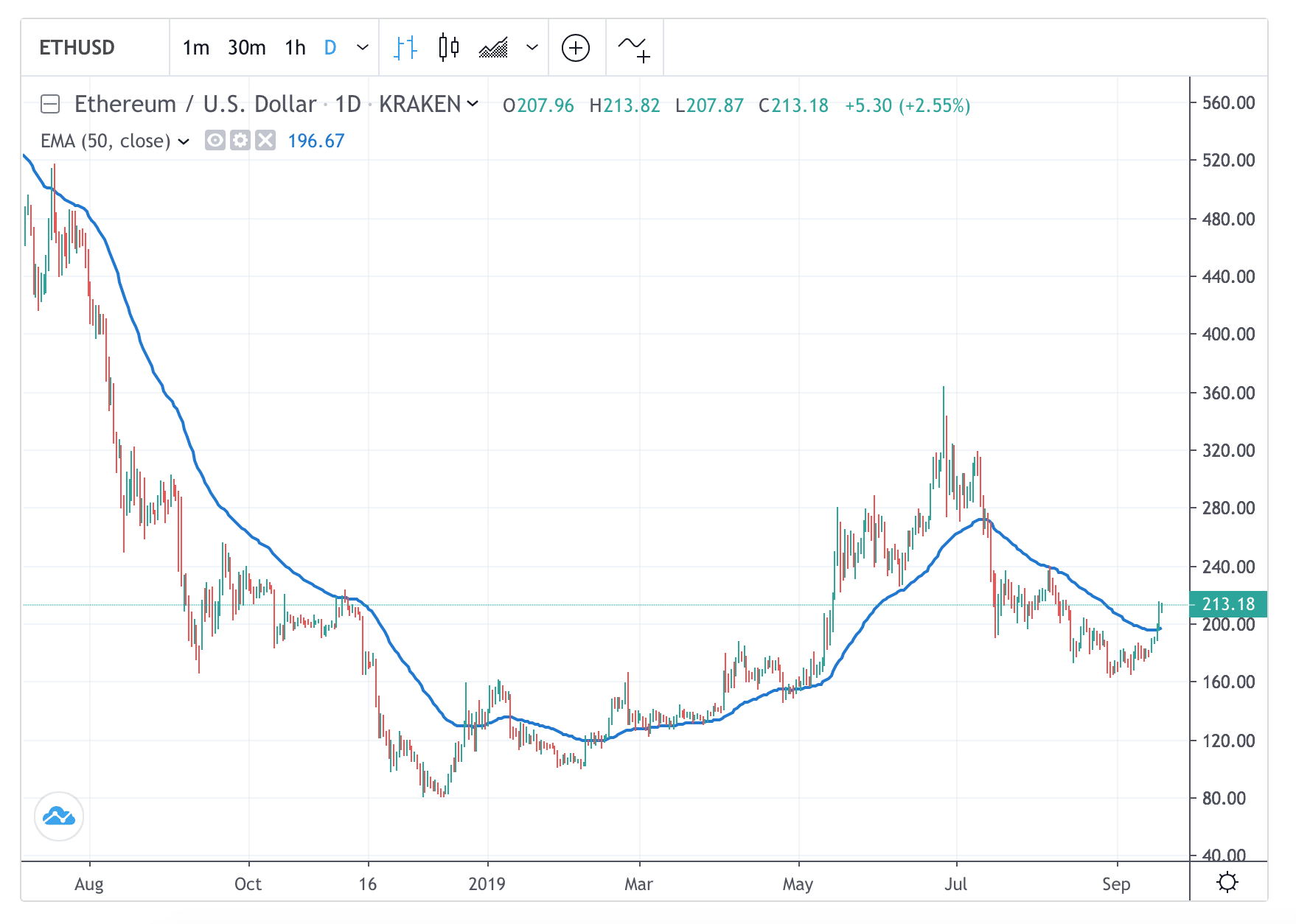

Ethereum (ETH) also surged in recent days. Prices have gained by more than 25% from its 160 lows, which signalled that the bear trend from 360 could be over (see below).

Other smaller crypto coins also showed similar rebounds off their intermediate lows.

But what is the connection between these rallies with Bitcoin? Well, for one, it could suggest that ‘smart money’ are quietly building up positions in these smaller – but more speculative – coins in anticipation of the upside breakout in Bitcoin. View alternatively, short sellers in these smaller coins are closing out their positions.

Therefore, I would think that BTC’s eventual breakout will be northwards. A re-test of its 2019 highs near 14,000 is possible.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.