We have ranked, reviewed and compared FDAX trading platforms, costs, spreads, overnight financing rates and account types so you can choose the best trading platform for trading the DAX. The best DAX trading platforms that let you speculate on the German Dax 40 index (Deutscher Aktienindex), an equity index launched in 1988 that tracks the performance of 40 of Germany’s leading stocks.

City Index: DAX trading signals and post-trade analysis

- Costs & spreads: 1

- Minimum deposit: £100

- Overnight financing: 2.5% +/- SONIA

- Account types: CFDs & spread betting

69% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone: Automated DAX trading on MT4

- Costs & spreads: 0.9

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SONIA

- Account types: CFDs & spread betting

75.3% of retail investor accounts lose money when trading CFDs with this provider

Spreadex: DAX trading with personal service

- Costs & spreads: 1

- Minimum deposit: £1

- Overnight financing: 3% +/- SONIA

- Account types: CFDs & spread betting

72% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers: Discount DAX trading & investing

- Costs & spreads: 0.005%

- Minimum deposit: $2,000

- Overnight financing: 1.5% +/- SONIA

- Account types: CFDs, DMA, futures & options

60% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets: Best broker for DAX CFD trading

- Costs & spreads: 1

- Minimum deposit: £1

- Overnight financing: 2.9% +/- SONIA

- Account types: CFDs & spread betting

74% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets: Best broker for DAX futures & ETF trading

- Costs & spreads: 1

- Minimum deposit: £500

- Overnight financing: 2.5% +/- SAXO RATE

- Account types: CFDs, futures & options

70% of retail investor accounts lose money when trading CFDs with this provider

XTB: Good DAX trading educational material

- Costs & spreads: 1

- Minimum deposit: £1

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Account types: CFDs

81% of retail investor accounts lose money when trading CFDs with this provider

eToro: Copy other people’s DAX trading

- Costs & spreads: 1.5

- Minimum deposit: $50

- Overnight financing: 6.4% +/- SONIA

- Account types: CFDs

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Tickmill: DMA FTSE trading on CQG or CFDs on MT4

- Costs & spreads: 0.9

- Minimum deposit: £100

- Overnight financing: n/a

- Account types: CFDs, futures & options

75% of retail investor accounts lose money when trading CFDs and spread bets with this provider

❓Methodology: We’ve chosen what we think are the best DAX trading platforms based on:

- Over 17,000 votes in our annual awards

- Our own experiences trading the DAX in the accounts with real money

- An in-depth comparison of the DAX trading features that make them stand out compared to alternatives.

- Interviews with the DAX trading platform CEOs and senior management

Compare DAX 40 Trading Platforms

| Dax Trading Platform | Dax 40 Trading Costs | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 1 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.9 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 1 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 1.5 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 1 | £1 | See Platform | 77% of retail investor accounts lose money when trading CFDs with this provider | |

| 0.9 | $100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 0.005% | $2,000 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 1 | £100 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider. | |

| 0.6 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

How To Choose A Dax 40 Trading Platform

The best DAX trading platform for you will depend very much on what you are looking for from your broker. If it’s 24-hour pricing and tight spreads, plus access to thousands of other products then you will probably want to trade with one of the larger brokers such as IG Group or Saxo Bank. However, if you want a more personalised service, then you might prefer a smaller broker such as Spreadex.

Your choice of broker will also be influenced by the products you want to trade.

For example, let’s say you want to spread bet rather than trade CFDs. In this case, you’ll need to choose from those providers that operate as spread betting brokers as well as CFD brokers.

You can compare brokers and decide which one is the best fit for you by using our comparison tables, or if you are interested in investing through ETFs here

Best DAX Trading Platforms By Account Types

You can use this broker to see which broker offers the most types of account for trading the DAX.

| Account Types: |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Spread Betting | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| DMA | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Investments | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ✔️ | ❌ |

| Futures & Options | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Cheapest DAX Trading Platforms

You can use this comparison table to compare DAX CFD spreads, overnight financing and minimum deposits.

| DAX Costs |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| Spreads | 1 | 1 | 1 | 1 | 1 | 0.005% | 1 | 1.5 | 1 |

| Overnight Funding | 2.5% +/- SONIA | 2.5% +/- SONIA | 2.9% +/- SONIA | 2.9% +/- SONIA | 2.5% +/- SAXO RATE | 1.5% +/- SONIA | 3% +/- SONIA | Long -0.01% Short -0.0015% | -0.02341% / -0.00159% DAILY |

| Minimum Deposit | £100 | £250 | £1 | £1 | £500 | $2,000 | £1 | £20 | £1 |

Best DAX Trading Platforms For Added Value

You can use this comparison table of futures brokers that offer DAX trading to see which providers offer the best features for advanced and beginner traders.

| Advanced Features: |  |  |  |

|---|---|---|---|

| Voice Brokerage | ❌ | ✔️ | ❌ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ |

| Level-2 | ✔️ | ✔️ | ✔️ |

| Algo Trading | ✔️ | ✔️ | ✔️ |

| Prime Brokerage | ✔️ | ✔️ | ❌ |

Best Dax Trading Platforms For Beginners

| Beginner Features: |  |  |  |

|---|---|---|---|

| Trading Signals | ✔️ | ✔️ | ❌ |

| Webinars | ✔️ | ✔️ | ✔️ |

| Seminars | ❌ | ✔️ | ✔️ |

| Leverage Control | ❌ | ❌ | ❌ |

| Low-Risk Products | ✔️ | ✔️ | ❌ |

| Investment Account | ✔️ | ✔️ | ❌ |

| Mini Contracts | ✔️ | ✔️ | ✔️ |

| Micro Contracts | ✔️ | ✔️ | ✔️ |

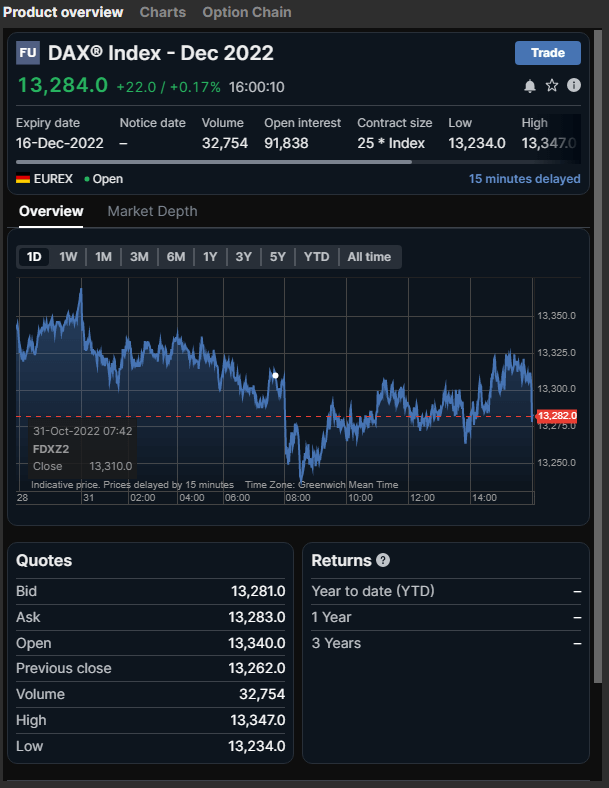

Best DAX Trading Platform For Futures

We currently rank Saxo Markets as the best broker for trading the DAX based on our trading platform matrix.

DAX Futures contracts are a form of derivative through which traders can speculate on the future price of a commodity or financial instrument, in this case, the future value of the DAX40 index.

DAX futures trade quarterly in a December, March, June and September cycle, and each contract reflects the market’s expectations for the value of the Dax out to that point in time.

These contracts are traded on a rolling basis and as the front-month contract expires, so another contract is added to the end of the sequence to replace it.

DAX40 futures are cash-settled meaning that buyers and sellers of the contract pay or receive money depending on the outcome of their trade as such there is no need to undertake or accept delivery of the stocks that make up the index.

Trades are cleared and settled through the clearing house that acts as the counterparty to all DAX futures trades. Futures trades are undertaken on margin. Traders place an initial margin or deposit at the inception of the trade and add variation or maintenance margin, as and when required, throughout the trades lifetime.

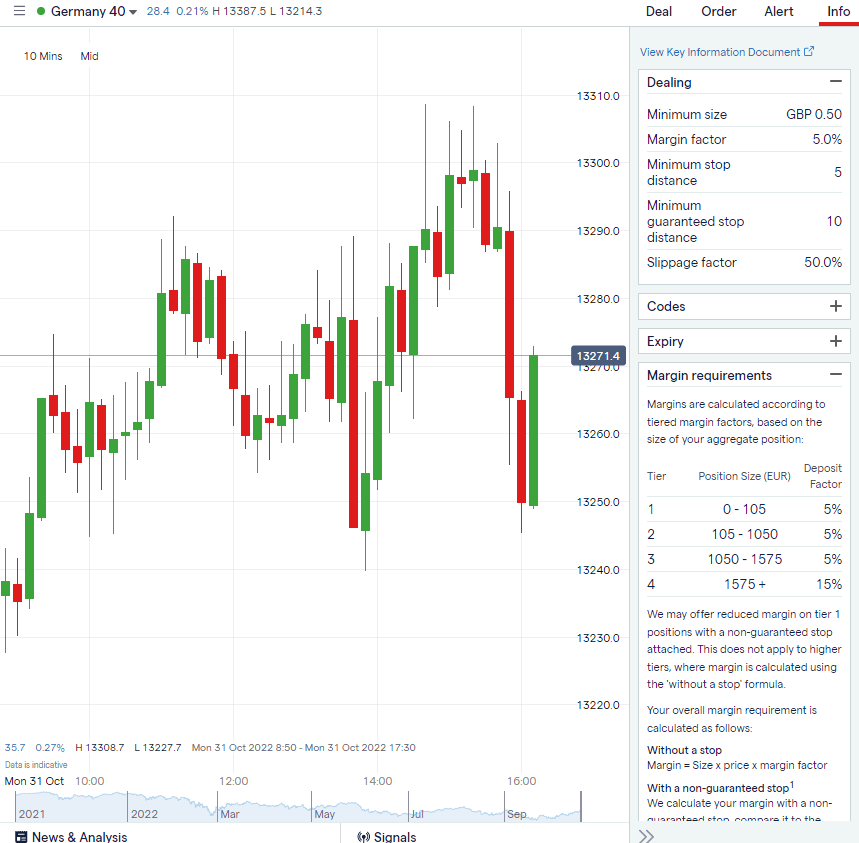

Best DAX Trading Platforms For CFDs

We currently rank CMC Markets as the best broker for trading DAX CFDs based on our matrix and scoring system.

All DAX contracts that are settled in cash are considered to be Contracts For Differences. Under which, the buyer and the seller are either credited or debited, at the settlement of their trade, based on their PnL performance, instead of making or taking delivery of the underlying asset.

A CFD on the Dax index works in precisely the same way, CFDs on the Dax are similar to the futures contracts we discussed above, though there are some key distinctions.

CFD contracts on the DAX trade off-exchange in what is called OTC or Over The Counter trading. Such CFD contracts are not settled through a dedicated clearing-house that means the counterparties to a trade are the customer and their CFD provider or broker.

Trading off-exchange or OTC allows for a higher degree of flexibility, for example, there are no fixed expiry dates for Dax CFDs or indeed fixed contract sizes, though there will be minimum trade sizes.

Futures contracts on the DAX have a contract size of €25 per point so that if the Dax index stands at 10,000 points one full DAX futures contract has an underlying value of €250,000.

DAX CFD traders can usually deal in much smaller sizes, for example, in say €5.00 per index point, which is equivalent to one-fifth of the value of the exchange-traded futures contract.

Best DAX Trading Platforms For Spread Betting

We currently rank IG as the best platform for Dax spread betting based on the data in our broker matrix.

A spread bet on the DAX index shares features with both the futures contract and DAX CFDs. However, there is a difference between the spread bet and the other two, and it’s an important one. The difference is that the spread bet is structured as a bet and not a trade.

When you Spread bet, you bet in pounds or pennies per point (or units of another currency), and you bet on the rise or fall of the DAX index, and your bookmaker is the counterparty to the bet.

Bookmakers offer their clients a range of bets with different life cycles, for example, daily, monthly or quarterly bets.

However, the crucial difference between a spread bet on the DAX and CFD trades on the index is how any profits you make are taxed. Under current UK legislation profits made from betting by individual UK taxpayers are not subject to tax. However, losses arising from spread betting are not able to be offset against capital gains made elsewhere.

Profits arising from CFD trades are subject to tax, though CFD trading losses can be offset against capital gains made elsewhere.

That tax treatment has made spread betting very popular among UK retail traders, however, you should note that as opposed to fixed-odds betting the potential losses in spread betting are not limited to your initial stake.

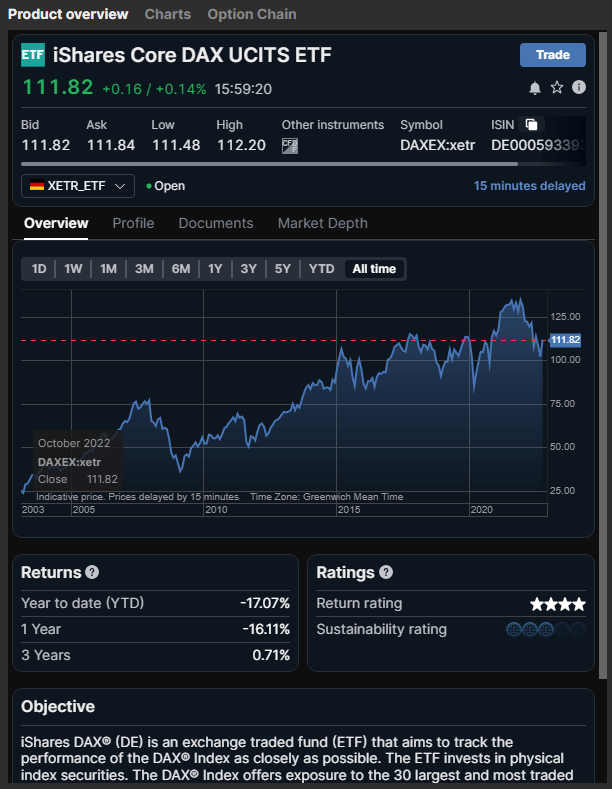

Best Dax Trading Platforms For ETFs

We currently rank Saxo Markets as the best platform for trading and buying DAX ETFs according to our broker data.

DAX ETFs or Exchange Traded Funds are open-ended funds designed to mirror the performance of a given index, a sector or even an investment strategy.

Most ETFs are what are known as passive investments that track a given benchmark rather than attempting to outperform it. ETFs can be traded just like individual shares; they have proved popular among investors as they offer a low-cost replication of an index or sector’s performance. Added to which they allow traders to quickly gain exposure to groups of stocks or asset allocation themes.

The ETFs on the DAX40, aim to mirror its performance and they are likely to own a basket of Dax constituent shares, or a series of derivative contracts over those, or similar assets, to do so.

If you’re optimistic or bullish about the DAX then you would buy a DAX ETF, if you’re are pessimistic or bearish about the prospects for the index then would sell a DAX ETF.

ETFs can be shorted, that is selling something without owning it first, in the hopes of repurchasing the position, at a lower price, to make a profit at a later stage. It would be wise to check with your broker to find out if there are any restrictions on this before doing so, however.

There are many ETFs tracking the DAX index, one of the largest is the Core DAX UCITS ETF, managed by Blackrock, through its iShares division. This ETF was established back in December 2000, and according to recent data from the manager, it has captured cumulative returns of more than +85% since then.

DAX Trading Platform FAQ:

There are multiple financial products derived from the underlying DAX Index that you can trade with, including:

- Index Futures (EUREX)

- Index Options (EUREX)

- Exchange-Traded Funds (GMG Guide on ETFs)

- Investment Funds

- Spread trading

- CFDs

Read the GMG Guide on Index Trading.

To trade the DAX 40 profitably requires a good trading strategy. The following tips may help you to maximise your chances of trading the DAX 40 successfully over the long term.

- Understand your requirements for trading the DAX 40. Are you an intra-day or positional trader? Do you invest for the long term? Are dividends important?

- Research various technical (or fundamental) indicators to support the trading objective. There are many technical indicators that you can use, including

- Trend indicators like moving average

- Oscillators

- Support & resistance levels (see GMG Guide on Support/Resistance)

- Patterns like breakout and reversals

- Backtest these indicators if they are profitable over time. Select a few that you can understand. Check their pitfalls and signal variations over time. Put these indicators into a trading software and backtest. Is it profitable? Can you withstand the drawdown?

- Select the indicators that best suit the objectives. Once the initial backtest research is completed, setup a mock testing period of, say, six weeks. Assess the results. Are they good? Which type of indicators works better?

- Include risk management factors in your assessment. Important factors like position sizing, leverage levels, stop loss levels and risk-reward ratios must be specified. Trading without risk management is like driving without brakes and safety belts.

- Select trading platforms that support your operations. Capital requirements, platform fees, and trading capability are all important factors to look for. See the comparison table above.

- Commit capital and go live. Make sure that you drip feed capital into new strategies because there may be many things to iron out before you’re comfortable with it.

The DAX effectively trades around the clock through a combination of index futures and prices that are derived from them and the moves in other significant indices. Many OTC brokers quote 24 hours prices in the DAX. However, spreads may widen and volumes traded be lower, the further we move away from German market hours, simply because there are fewer active participants in the market at these times.

The DAX is one of the most actively traded equity indices in the world, representing as it does both Germany and the broader export-led Eurozone economy. The front-month futures contract often trades in well in excess of 100,000 lots per day and has open interest in the tens of thousands of contracts.

Being actively traded, with only 40 constituents, the DAX index moves around and often does so more quickly than broader equity indices, which is why it is so popular with traders. However, the average level of volatility in the index since October 2017 is just 16.54 percent on a scale that runs between zero and one hundred. So while that’s a higher level of volatility than some peers, it’s still relatively low over the longer term.

The DAX Index is Euro-denominated. If you are trading in the UK with a GBP-denominated account make sure that you cover any currency deficit from trading losses.

The index is maintained by the Deutsche Börse Group.

The German DAX40 index (Deutscher Aktienindex) is an equity index launched in 1988 that tracks the performance of 40 of Germany’s leading stocks. Launched in 1988 with an initial base value of 1000, the index has risen substantially since then and touched an all-time high of 13,596 in 2018.

Current DAX constituents are:

- Adidas AG ADS

- Airbus SE AIR

- Allianz SE ALV

- Basf SE BAS

- Bayer AG BAYN

- Bayerische Motoren Werke AG BMW

- Beiersdorf AG BEI

- Brenntag SE BNR

- Continental AG CON

- Covestro AG 1COV

- Deutsche Bank AG DBK

- Deutsche Boerse AG DB1

- Deutsche Post AG DPW

- Deutsche Telekom AG DTE

- Deutsche Wohnen SE DWNI

- E. On SE EOAN

- Fresenius Medical Care AG & Co. KGaA FME

- Fresenius SE & Co. KGaA FRE

- HeidelbergCement AG HEI

- HelloFresh SE HFG

- Henkel AG & Co. KGAA HEN

- Infineon Technologies AG IFX

- Linde Plc LIN

- Mercedes-Benz Group AG MBG

- Merck KGAA MRK

- MTU Aero Engines AG MTX

- Muenchener Rueckversicherungs-Gesellschaft AG MUV2

- Porsche Automobil Holding SE – PRF PERPETUAL EUR 1 PAH3

- Puma SE PUM

- Qiagen NV QGEN

40. Remember that this index only contains 40 stocks, so it is not a wholly representative index of the entire German economy.

The top three stocks in the index, by market capitalisation, are SAP, Linde, and Siemens.

The biggest ETF based on the DAX Index is the DAX 40 ETF (ticker: DAXEX). This ETF is gaining popularity because of the ease of trading, unlike futures or options where there are rollover costs and expiry dates.

DAX index futures, they usually expire on March, June, September, and December.

To invest in the DAX, you can either buy an ETF or mutual fund that specifically tracks the DAX or a range of large-cap German equities. ETFs will try to replicate the performance of the Dax, both on the upside and downside. Investing in this way should provide you with the index return. The mutual fund may try to do the same, but it could also try to outperform the benchmark, through active stock selection, though this is becoming harder to achieve as passive investments grow in popularity.

Alternatively, you could invest directly into a basket of German equities selecting from the constituents of the DAX, for example owning the five stocks highlighted in the graphic above, would expose you to approximately 42% of the DAX by market cap. However, it’s always best to seek professional advice to make sure that any investment is suitable and matches your particular requirements before you jump in.

The German DAX40 Index is closely watched. The index is attractive to investors and traders alike because:

- DAX stocks are highly international and these companies derived their earnings globally

- DAX 40 offers good liquidity – as some of these stocks are huge (e.g. SAP, Allianz, and Siemens)

- DAX 40 offers a good exposure of leading industrial companies such as BMW and Linde.

Moreover, Germany companies are export oriented and they are hugely beneficial from firm global economic growth.

Remember that, with only 40 constituents, the DAX Index may be more volatile than broader equity index. Hence its popularity with traders.

Stock markets are often driven by a wide variety of factors. For the German stock market, the number one factor global growth. This is because these companies are global in nature and derive their earnings from many markets.

Other important factors include:

- Monetary factors (e.g., Quantitative Easing, rates movements, yield curve etc)

- Technical factors (e.g., new highs or lows)

- Earning factors (e.g., profitability and earnings momentum)

Investing in the DAX implies the long term ownership of assets related to the index. Whereas trading in the DAX, or indeed any other financial instrument or commodity, suggests short term speculation. Perhaps through spread bets or CFDs, that don’t confer ownership of the underlying assets, just an interest in the rise and fall of the index value.

Yes, you can read about the major indices in our guide to the best indices for index trading.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the DAX trading brokers via a non-affiliate link, you can view their DAX40/GER40 trading pages directly here: