To buy shares in Bank of America (NYSE:BAC), you need a US stock trading or share dealing account that will let you buy US-listed stocks. Follow these three steps if you want to buy shares in Bank of America from the UK:

- Decide if you want to buy Bank of America shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Bank of America shares (NYSE:BAC)?

Buying one NYSE:BAC share costs $34.68. However, as well as the $34.68 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

What is the live Bank of America (NYSE:BAC) share price?

The current NYSE:BAC share price is $34.68 which is a change of -1.27 or -3.53% from the last closing price of 34.68 with 95,566,094 shares traded giving NYSE:BAC a market capitalisation of $273,647,362,928. The most recent daily high has been 36.17 and daily low 34.15. The NYSE:BAC share price 52 week high has been 38.35 and the 52 week low 24.96. Based on the most recent NYSE:BAC share price opening of 34.68, the current NYSE:BAC EPS (earnings per share) are 3.08 and the PE (price earnings ratio) is 11.27.

Pricing data automatically updates every 15 minutes

You can use our table to compare the best brokers for trading Bank of America shares. All brokers in this list are authorised and regulated by the FCA.

If you want to buy shares in Bank of America from the UK, you need an FCA-regulated stock broker that provides access to US stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

Should you buy Bank of America shares (NYSE:BAC) now or wait for the next dip to buy and hold?

Bank of America (NYSE:BAC) is a great survivor on Wall Street. It is one of the few banks to have escaped from the 2008 financial crisis with more entities under its belt (Countrywide, Merrill Lynch). But these bolt-on additions came at a huge cost. Litigations and fines totalled tens of billions. In 2014 alone, BAC settled a SEC mortgage case for $16.6 billion, the largest settlement fine ever imposed on a company.

The bank’s chequered past, however, appears to be over. BAC’s share price has rebounded strongly from the 2009-12 lows of $5. More importantly, the bank is churning out profits once again. No massive credit impairment or loan losses lurk in its balance sheet. At $295 billion in market cap, the Charlotte-based bank is now the 25th most valuable company on the planet.

Is Bank of America (NYSE:BAC) a good investment in the long term?

So attractive is Bank of America that Warren Buffett even bought a 12% stake in recent years – a stake is now worth a massive $45 billion.

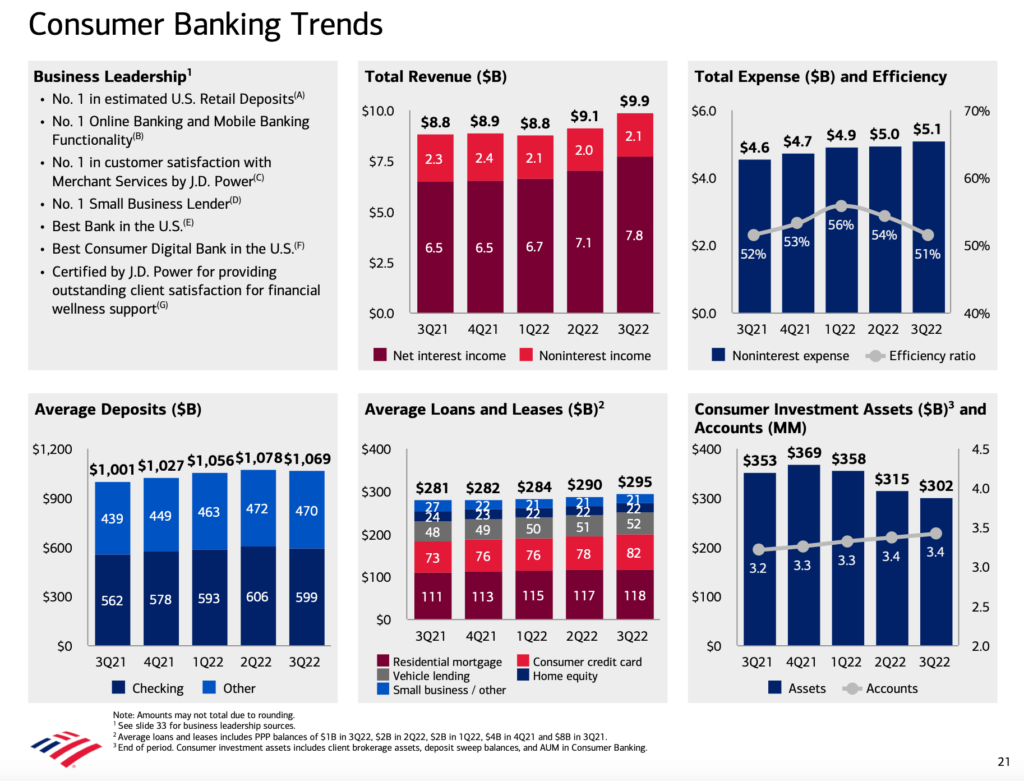

Arguably, if a bank is good enough for the legendary investor Buffett, it should be good enough us common investors. Let’s run through some of the positive points. Financial stocks tend to benefit from a period of rising rates. According to BAC’s latest presentation slides, its 3Q consumer banking department increased earnings by more than a billion over the same quarter from 2021. In fact, the bank is currently in a *sweet spot* – because it is benefitting from a widening in interest spreads while the labour market is still fairly tight (no material increase in default). The US property market remains steady.

Source: Bank of America

For long-term investors, Bank of America is an interesting stock pick due to its profitability, strong franchise and multi-faceted banking operations. And BAC shares are not terribly expensive (the yield is 2.3%). So there is a strong case for buying Bank of America shares.

However, pessimists will point out that the current bear market is not over yet. The economy has yet to slip into a recession and NYSE:BAC shares are not ‘cheap’. Buying BAC now is like buying the market in early 2008 just before the crisis hit.

Whatever the case, Bank of America seems in a better position financially than it was back in 2007/8. Therefore investors should be on alert when BAC’s share price slumps – as that’s the time to buy. I’m pretty sure Warren Buffett will deploy part of Berkshire’s $149 billion cash pile to BAC if a golden opportunity – ie, a market crash – happens.

When is the best time to buy NYSE:BAC shares?

Next time BAC prices drop steeply – be prepared to buy and hold.

Banking is cyclical. The sector profits enormously when the economy does well. Occasionally, a banking crisis hit the sector. Earnings will be decimated and some over-leveraged entities will go to the wall. This is part and parcel of an economic cycle.

Accordingly, one should watch to buy bank stocks during a downturn because that’s when the outlook is most pessimistic. Valuations are low; the price advantage is to the buyer.

For example, in 2011 investors had more than 6 months to buy BAC when its share price was trading below $8. That’s more than two years after the end of financial crisis. And investors were given another opportunity to do so the very next year (2012). Those who bought and sat on these shares would show gains of more than 300 percent (excluding any dividends or buybacks).

Is the Bank of America share price (NYSE:BAC) overvalued or undervalued at the moment?

The market is probably valuing the stock right at this moment. Remember that the market valuation of a company is derived from a combination of many factors – sentiment, macro fundamentals, sector issues, and micro data.

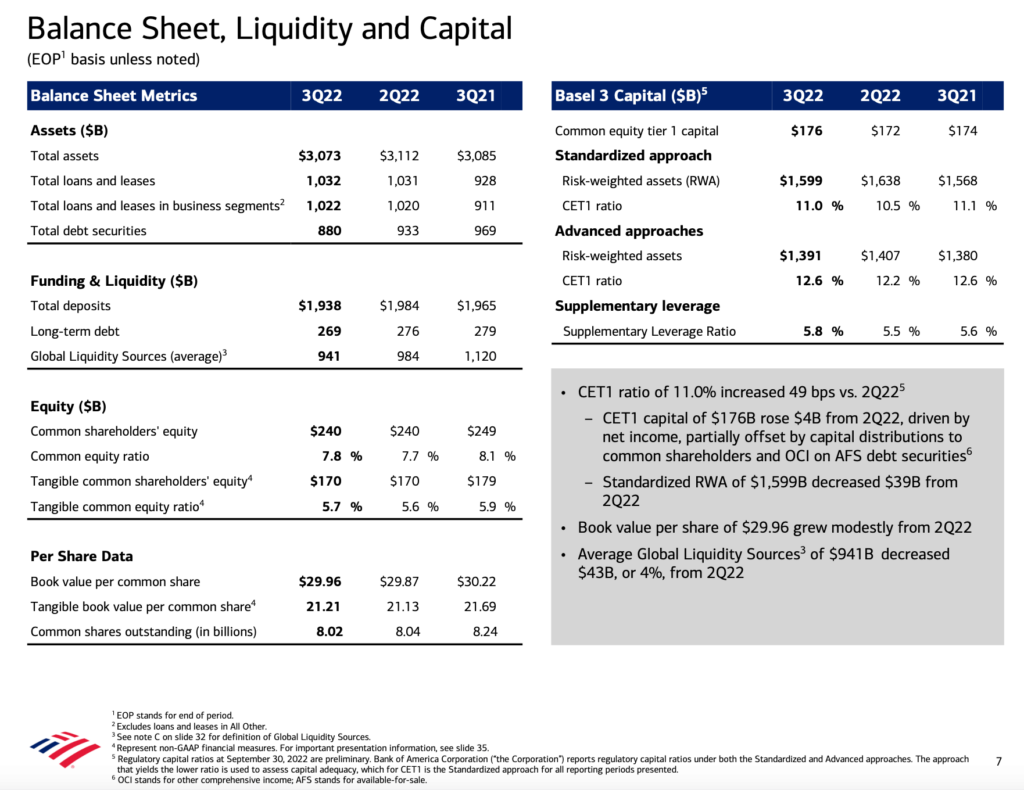

For a bank with $3 trillion assets, you have to place a valuation zone, rather than a number, on the stock.

For now, BAC appears fully valued by the market given its profitability and outlook. It is trading about 1.0-1.2x book value. In comparison, JP Morgan appears to command a higher price-to-book value (book value $88; share price $130).

BAC’s valuation will only rise if market sentiment turns more bullish.

Source: Bank of America

Why has BAC’s share price risen recently?

The post-pandemic boom saw the Bank of America share price rise from $20 to $50. This year, however, was not a bullish one for the bank due to a softening of the market sentiment. After prices corrected to $29, BAC has rebounded on three factors:

- Oversold rebound – markets were pretty much oversold back in autumn and this led to a technical rally in many shares.

- Continuing profitability – BAC’s 3Q report revealed billions in profits and this is not slowing down (yet). This smoothed investor nerves somewhat.

- A potential slowdown in rate hikes – following a series of 75bps raises by the Fed.

Overall, BAC has rebound nearly 30% from its $29 lows. Prices may trade in this range ($30-38) for a while.

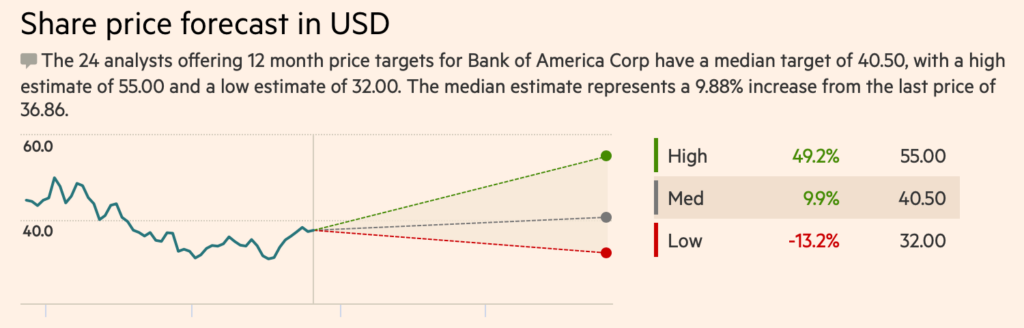

What is the Bank of America share price prediction (NYSE:BAC)?

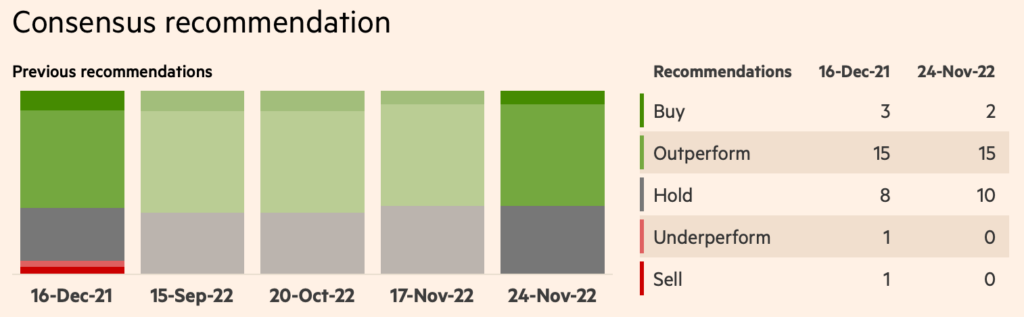

Wall Street is moderately bullish on bank of America.

Out of a group of 27 analysts, 17 are recommending ‘Buy/Outperform’ and 10 say ‘Hold’. Perhaps Wall Street are waiting to see if the bank will be able to weather the looming economic slowdown.

Remember, in the last major crisis BAC re-tested its 2009 lows two years after the crisis ended. It took the bank much longer to get out of the morass. Perhaps investors are waiting to see if this will happen again.

Source: Financial Times

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.