The new chancellor Kwasi Kwarteng has gatecrashed the economy with his mini budget last week. In one fell swoop, he deflated confidence from the market, make gilt yields to soar like a ‘meme’ stock and kicked Sterling off a steep cliff. As a result, mortgages are becoming increasingly pricey while import costs are rising due to a weakening currency. The Bank of England has been forced to intervene. All in all, it was a dramatic week for the country.

For investors, however, there are two ways to look at this situation. One, the cheery view. A crisis equals a good time to bargain hunt. Not an easy thing to do though, as we are still in the middle of a crisis.

A more realistic view is that a UK recession looms. Consumer spending falls, cost-of-living crisis deepens and a housing market corrects. Cash is the safest asset. And for good financial reasons too, as interest rates rises to compensate savers.

But weak sterling benefits UK companies with large foreign earnings. Thus, a rotation into large-caps with diversified earnings may see investors overcome the uncertainties originating from the gilt and FX markets.

Moreover, large-cap companies have better credit. Investors simply do not have to worry if these international firms will survive a downturn.

Why should investors buy internationally diversified FTSE stocks when GBP is weak?

- UK economy set for more turbulence

- Sterling’s underperformance makes foreign revenue more attractive

- Internationally diversified large-caps may outperform domestic-focussed stocks

Take Unilever (ULVR). The consumer group sells hundreds of products in 190+ countries. It derives most of its earnings overseas. While it may not boom like a start-up crypto company, low growth suits most investors. With free-cash flow of more than 2billion euros this year, the company will likely survive a deep recession in the UK. A dividend yield of 3.6% is generous.

Others like Diageo (DGE), the drinks company, British American Tobacco (BATS) and Imperial Tobacco (IMB) are too looking attractive in terms of their defensive qualities, although the latter two are in a ESG-negative sector (smoking). Both tobacco stocks fetches a yield of more than 6%.

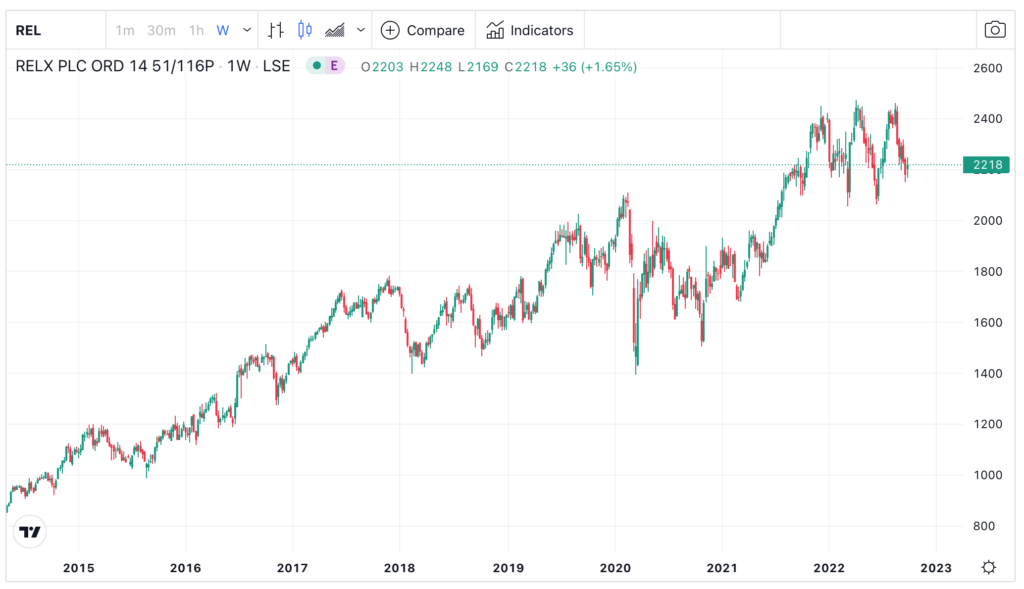

Another contender is RELX (RELX), the knowledge database company that sells copious number of journals to educational institutions around the world. Its share price (in Sterling) has been quite steady due to its large share of foreign revenue.

Of course, there are plenty of other companies in the FTSE 100 universe that derives a significant amount of profits overseas, including miners – BHP (BHP), Rio Tinto (RIO), Antofagasta (ANTO), energy companies – Shell (SHEL), and banking institutions like HSBC (HSBA) and Standard Chartered (STAN).

Having said that, remember that investing in these companies now is not the panacea to the bearish market environment.

For one, it absolutely does not mean shareholders will not lose money. We are in a period of heightened market uncertainty. Perhaps these companies may drop less than a UK-focussed company due to their foreign earnings. But their share price may still drop regardless.

The second point to note is that a few of these companies, such as miners, move according to their own sector cycles. If, for example, the global recession induces a bear market in commodity prices, miners will suffer.

The third point worth noting is about timing. How long should we hold these defensive stocks for? That depends on one’s personal portfolio construction. If a UK manages an economic recovery next year, those beaten-down UK stocks (mid- and small-caps) will provide juicy returns for astute investors. In the end, it is a matter of risk and judgement.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.