Contrary to widely-held performance, achieving good market returns is not dependent on high IQs. Many investors have successfully navigated the market and so can you. But what’s best for investing, timing or time? Here are our five simple tips to improve your investment returns.

Clearly, the first thing you actually need is a good stockbroker. If you use a stockbroker or platform for your investment ISA or SIPP that overcharges you or does not provide the right market access you are immediately at a disadvantage.

Once you’ve done that, you can work through the following tips:

#1 – Objectives

Define What You Want From Your Investments

Start the process by defining what kind of investment performance you want. It is like asking ‘what type of garden’ you would like so that you can plan towards it. So you need to imagine the portfolio and how it would work – for you. How much capital can you start it off, small or big? If small, do you top it up regularly? Can you leave the capital for a long period of time? How much volatility can you handle?

The second key question is how much time and energy and and time you can channel into the activity. It is one thing to start an investment portfolio and another thing to maintain it. Not many people realise this. Maintaining your investment portfolio is like maintaining your garden. You need to look after it regularly, trimming positions here and there, finding new sectors to invest, changing asset mix based on market conditions, check on the platform fees and trade commission etc.

Write down your thoughts into a one-page summary and, after some trials and reviews, commit to the system.

#2 – Portfolio Reviews

Review Your Portfolio Regularly And Rid Losses As Quickly As Possible

It is a myth that there is a ‘forever stock’ that you can buy and hold. There is no such instrument.

Why? Companies change. The industry they are in changes. Sometimes for the better, sometimes for the worse. Market fads come and go. Bubbles develop and collapse.

Even the most ardent long-term investor, Warren Buffett, shifts his portfolio regularly. When he sees a good price for his stock, he will sell. More importantly, if he sees an underperforming stock in his portfolio, he will sell too. Two such examples are IBM and Tesco.

Therefore, it is imperative that you set some time every quarter and just check if the components are still behaving as they should. You can do it via chart analysis. On GoodMoneyGuide, we have a series of easy to understand guides to help you start chart analysis.

#3 – Approach

Discover Some Of Your Psychological Tendencies That May Interfere With Your Portfolio

Once you have devised a system, there are always some mental blocks that prevent you from executing it flawlessly. Some of these psychological tendencies include:

- Overconfident

- Ego

- Distraction

- Hesitation etc…

For example, your portfolio shows five profitable positions out of six. Should you take some profits, double up or do nothing? Will you regret seeing a 50% reduction in paper profits?

Some investors become overconfident by large profits. They then take their eyes off the ball and go on to lose these paper profits entirely. In contrast, if half the positions are in the red, you know you should have gotten out soon – but didn’t. Why? Did you keep coming up with excuses to hold these losing positions? See Joshua Raymond interview.

Many of these answers can only be found by looking inwards. You need to plan ahead and devise solutions, however crude, to deal with these things.

#4 – Time In The Market

Play The Long Game

If you plan to increase your net worth via the stock market, always play the long game. Studies after studies have showed that most of the investment returns come from ‘dividend reinvestment’. This means you put your dividends back into the stock.

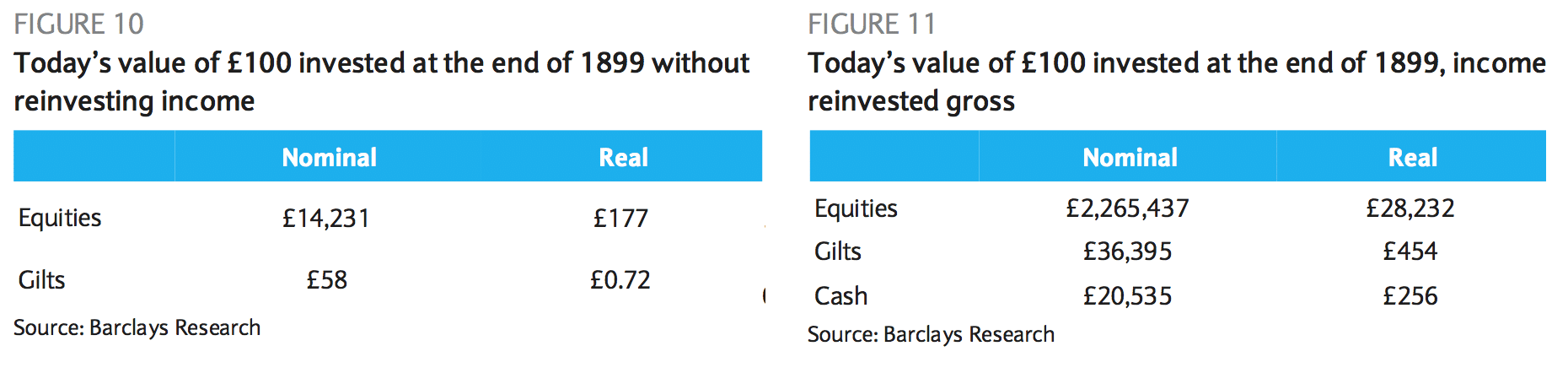

In the 2016 edition of the Barclays Equity Gilt Study, one particular interesting section caught my attention. The analysts compared the impact of reinvestment of income over time. Here is what they found:

“Figures 10 and 11 (see below) show how reinvestment of income affects the performance of the various asset classes. The first table shows £100 invested at the end of 1899 without reinvesting income; the second is with reinvestment. One hundred pounds invested in equities at the end of 1899 would be worth just £184 in real terms without the reinvestment of dividend income, but with reinvestment, the portfolio would have grown to £28,232. The effect upon the gilt portfolio is less in absolute terms, but the ratio of the reinvested to non-reinvested portfolio is over 600 in real terms.”

Source: Barclays 27/10/19

#5 – Timing The Market

If You Are Confused About A Stock’s Outlook, Look At Its Price Chart

The stock market is driven by a crosscurrent of opinions, bullish and bearish. Sometimes it is difficult to know which camp is right. Perhaps on some occasions, none is.

Thus a general rule is, if you are confused about a stock, look at its price chart. After all, it is the ‘collective wisdom’ of the crowd.

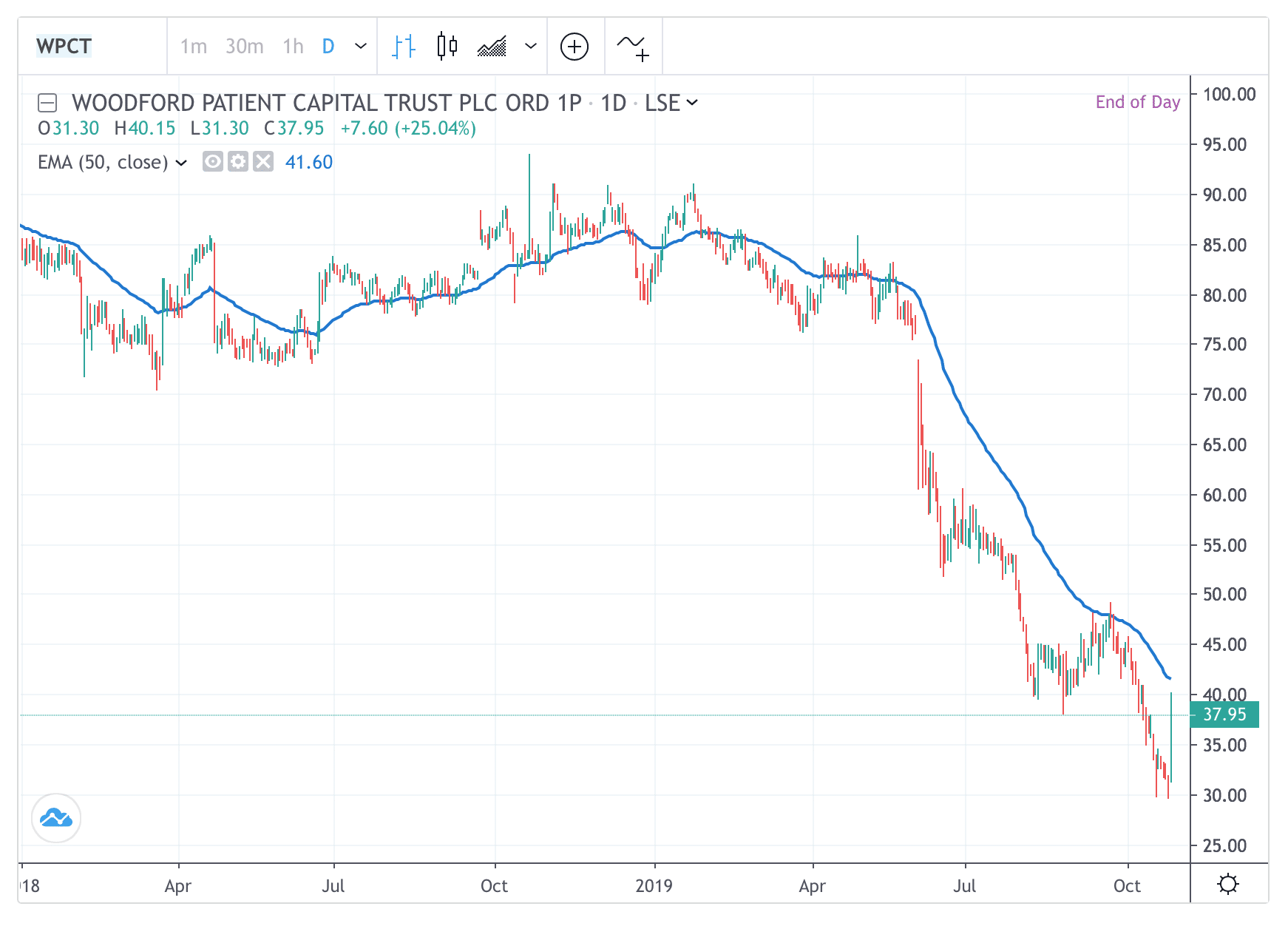

For example, if everyone is bullish about a stock but prices keep dropping, you need to move cautiously. If a stock in which you are holding has broken downwards emphatically, run away as fast as you can.

For example, did you spot the breakdown in Woodford Patient Capital Trust‘s (WPCT) chart in June 2019? It tells you volumes about what is happening to the company. Most corporate disasters have displayed these eye-catching downward dynamics on their way down. The Woodford Equity Income Fund is dissolved.

Therefore it is crucial for investors to review their investments regularly to spot such important market signals.

..and that’s a wrap! We hope these tips get you feeling positive about what you can achieve with your investments.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.